Today I will launch the European Bank for Reconstruction and Development (EBRD) Business Reorganisation Assessment Report on insolvency and bankruptcy systems. Key highlights include:

- comparative research on the EBRD regions and benchmarking against England and Wales, France, Germany and the USA

- 40 jurisdictional bankruptcy and insolvency profiles for 38 emerging markets

- stakeholder perception maps on key issues

The EBRD is a multilateral development bank headquartered in London and established in 1991, following the collapse of the former Soviet Union. Its mission is to develop open and sustainable market economies in countries committed to, and applying, democratic principles. In addition to being a bank and a key investor in many markets, the EBRD is actively involved in policy-making. EBRD economists are very influential in the policy sphere, but lawyers also play an important role through the Bank’s Legal Transition Programme. The programme’s objective is to improve the legal and investment environment in the economies where the EBRD invests. My colleagues and I cover a broad range of commercial law areas from corporate governance to energy efficiency and financial law.

The EBRD Business Reorganisation Assessment Report is the culmination of over 18 months of intensive research and consultations with both the public and private sectors. The report maps all reorganisation-type procedures in insolvency and bankruptcy for the 38 EBRD emerging economies (including 40 jurisdictions). These cover a wide geography across Europe, Asia and Africa and include 12 EU Member States. The assessment ranks each economy according to the relative strength, effectiveness and flexibility of its corporate reorganisation and rescue tools and analyses the results from both an individual economy, as well as a regional perspective. A main comparative report is supported by detailed economy profiles for each of the 40 jurisdictions, with flow charts showing the main procedural steps for each available business reorganisation procedure.

Our assessment methodology is based on a detailed online questionnaire (available in English, French and Russian) and analysis of the local legislation in translation. We consulted throughout the project with at least two partner law firms per jurisdiction to ensure the highest possible accuracy of the data. At times, our analysis was challenging due to the changing legislative landscape. For example, the Federation of Bosnia and Herzegovina, Georgia, Greece and Hungary all introduced new insolvency legislation last year.

We received 457 completed questionnaire in the EBRD regions. A further 18 jurisdictions outside of the EBRD regions in countries including Argentina, Austria, Belgium, Brazil, China, England and Wales, France, Germany, India, Italy, Luxembourg, Netherlands, Portugal, South Africa, Spain, Sweden and the USA all completed the assessment questionnaire for benchmarking purposes.

The EBRD questionnaire includes factual and perception-based questions. Respondents were invited to comment on the general approach to corporate reorganisation in their economy and the technicalities of the initiation and conduct of reorganisation procedures. They were also asked about their views on a range of matters including procedural efficiency and equality of treatment of creditors. Questions in the questionnaire are divided into scoring and data collection questions. We used an automatic scoring system to determine each economy’s overall ranking. We then validated all questionnaire responses of a factual nature with our partner law firms and conducted five virtual country missions with national authorities in Egypt, Poland, Mongolia, Serbia and Ukraine to test our interpretation of the results.

Among all 38 economies, Greece comes first, followed closely by Poland, Lithuania and Romania. In fifth place is Kosovo, propelled forward by the overall quality of its insolvency legislation. Also among the top ten performers are Moldova (in 8th place) and Albania (in 10th place). At the lower end of the spectrum, are many of Central Asian and Southern and Eastern Mediterranean (SEMED) countries, such as Egypt, Lebanon, Morocco, Tunisia and West Bank and Gaza.

With a study of this breadth, there are many interesting findings. Transparency of insolvency data quickly became a central theme of our assessment. We discovered that 11 of the economies where the EBRD invests do not disclose publicly any data on insolvency. Furthermore, in these economies there is no recognisable central authority or regulator. We integrated this into our methodology and ranking through a data transparency bonus of up to 10 points awarded to economies that publish comprehensive and accessible data on insolvency.

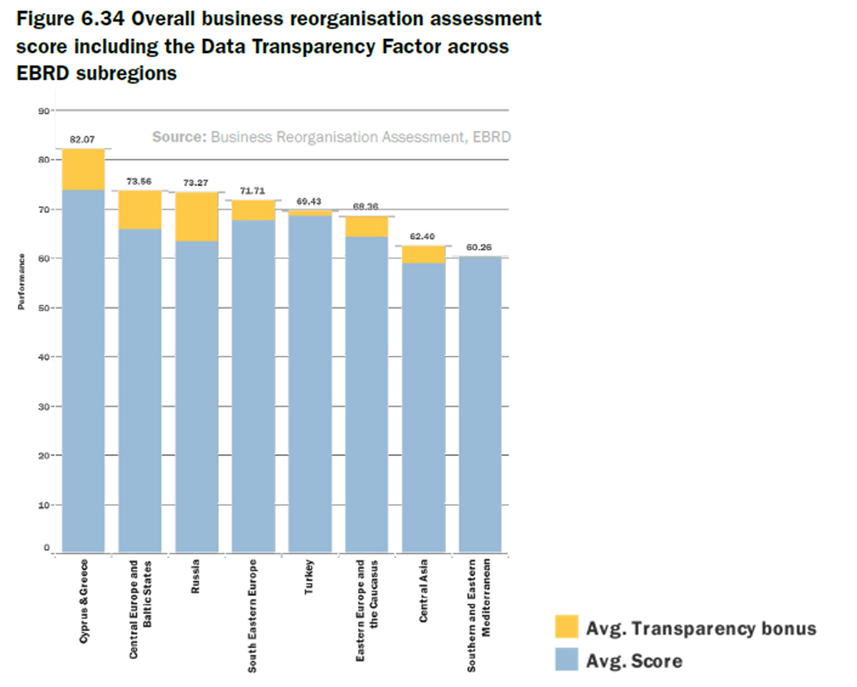

Regional differences can be clearly seen in the below figure from the main assessment report. This illustrates the average performance (in descending order) of each of the EBRD sub-regions on an aggregate basis with respect to the assessment questionnaire and the data transparency bonus. It evidences a significant 22-point gap between Greece and Cyprus and the SEMED region.

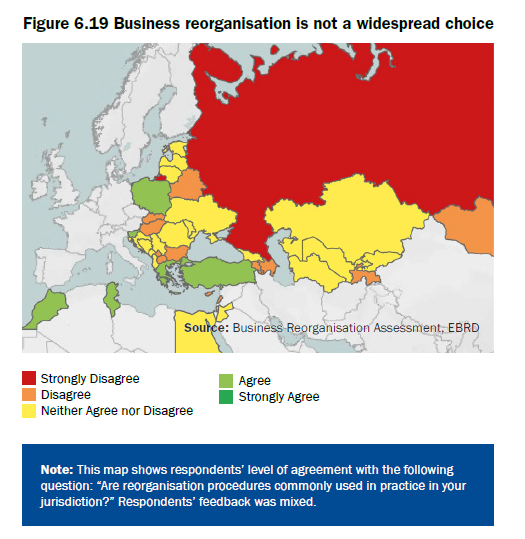

Another important finding from the assessment is the apparent lack of popularity of business reorganisation procedures in many economies where the EBRD invests according to questionnaire respondents, as illustrated by the below stakeholder perception map. Many respondents also believe that private workouts are not widespread. One reason for this may be the lingering negative stigma that affects all aspects of insolvency and bankruptcy, notwithstanding whether the goal of a given procedure is reorganisation of the debtor business.

All the data collected by the assessment questionnaire is available for public consultation and use in anonymised format here.

The EBRD will host a series of events in connection with the report, open to the general public. The first event, ‘Results and Observations’, is held online today at 2pm GMT. Registration links are available here.

Catherine Bridge Zoller is Senior Counsel, Legal Transition Team at the European Bank for Reconstruction and Development (EBRD).

OBLB categories:

OBLB types:

Share: