Insolvency law plays an essential role in the real economy. On the one hand, an attractive insolvency framework for debtors can promote entrepreneurship, innovation, responsible risk-taking and the preservation of viable businesses facing financial trouble. On the other hand, an attractive insolvency framework for creditors can help them maximise their recoveries if their debtors eventually become insolvent. Thus, from an ex ante perspective, insolvency law can encourage lenders to extend credit, facilitating firms’ access to finance and the promotion of economic growth.

Additionally, adopting an attractive insolvency framework for debtors and creditors can bring many other benefits for a local economy. For instance, a jurisdiction with an attractive insolvency framework for creditors will provide a more attractive forum for lenders and financial services. Similarly, an attractive insolvency framework for debtors may strengthen the position of a jurisdiction as a restructuring hub. In both cases, countries can benefit from the job opportunities created in the legal and financial industries, as well as other sources of income generated by increased levels of trade, foreign investments, consumption, and tax revenues.

However, in jurisdictions traditionally having creditor-oriented insolvency systems, such as the United Kingdom, Hong Kong and Singapore, one of the primary challenges faced when improving the restructuring framework for debtors consists of making sure that the insolvency system remains protective of the interests of the creditors. If an insolvency reform makes creditors worse off, lenders may respond with an increase in the cost of debt, harming firms’ access to finance and thereby the ability of companies to pursue value-creating projects that can ultimately generate jobs, wealth and growth. As a result, a reform seeking to support the real economy may end up doing more harm than good. Moreover, in the context of global financial centres, such as the United States, the United Kingdom, Hong Kong and Singapore, an undesirable reform for creditors can also undermine the leadership of these jurisdictions as international hubs for legal and financial services.

In my new article, ‘Building a Restructuring Hub: Lessons from Singapore’, I analyse the steps that Singapore has taken to become an international hub for debt restructuring. Namely, it is argued that the Singapore strategy has been based on three primary pillars: (i) the development of an attractive business and institutional environment; (ii) the modernisation of Singapore’s insolvency and restructuring laws; and (iii) the strengthening of the restructuring ecosystem while enhancing Singapore’s leadership in the international insolvency debate.

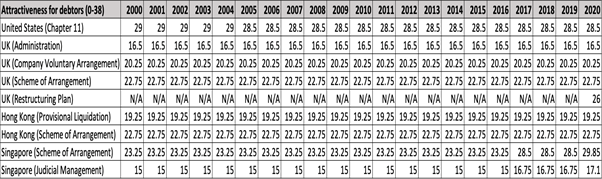

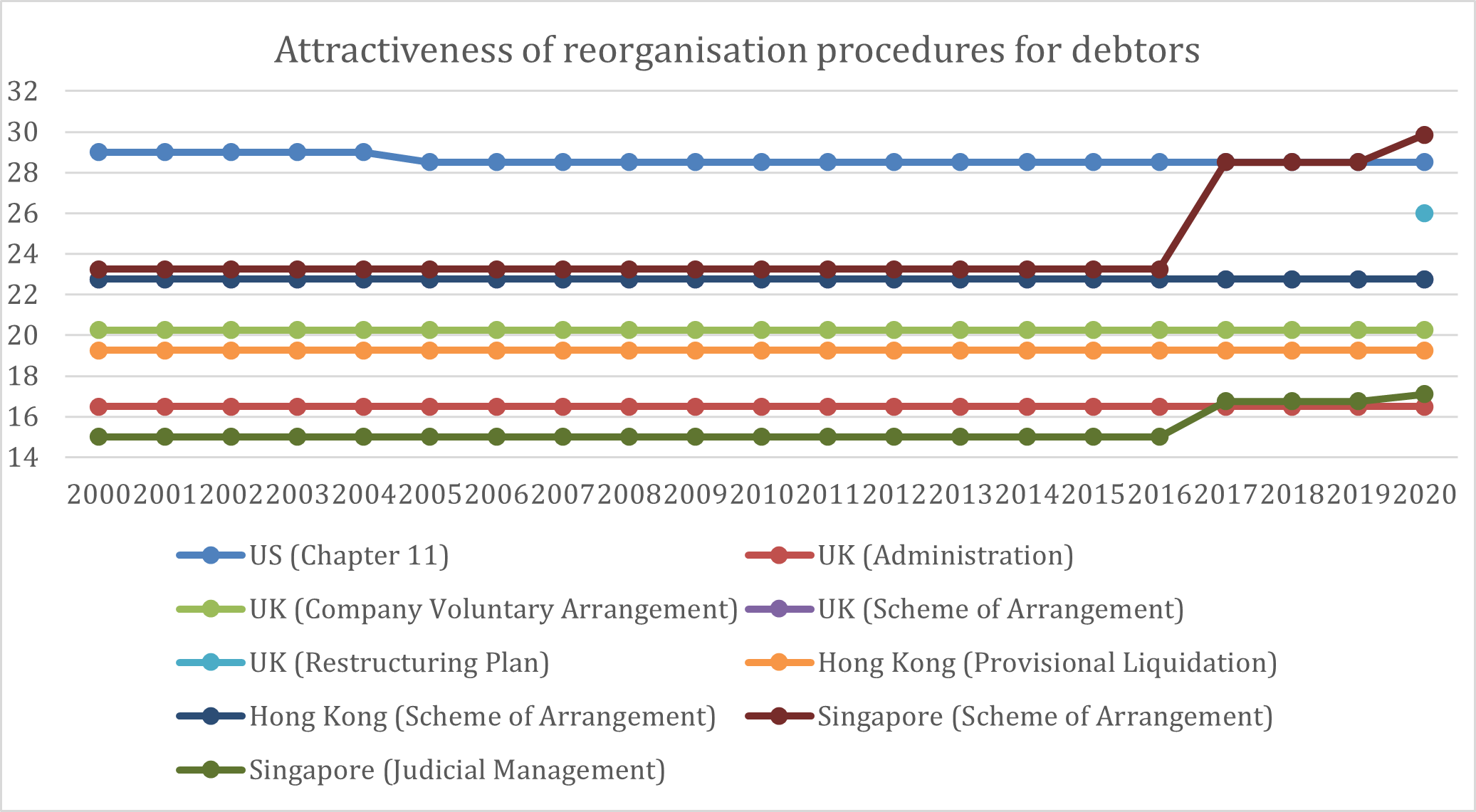

Then, by using a novel index measuring the attractiveness of reorganisation procedures from the perspective of debtors, secured creditors and general unsecured creditors, my paper analyses how the Singapore insolvency reforms have affected debtors and creditors, and how the attractiveness of reorganisation procedures in the United States, the United Kingdom, Hong Kong and Singapore has evolved from 2000 to 2020.

As shown in the table and graph below included, the US Chapter 11 has traditionally been the most attractive reorganisation procedure for debtors among those existing in the financial centres analysed in my paper. However, the recent insolvency reforms adopted in Singapore have made the city-state’s Scheme of Arrangement replace the US Chapter 11 as the most attractive reorganisation procedure for debtors.

My paper then assesses the attractiveness of reorganisation procedures from the perspective of secured creditors and general unsecured creditors. Against the classification of pro-debtor or pro-creditor insolvency jurisdictions often provided in the literature, my index shows that countries like the United States have managed to design an insolvency system that is both pro-debtor and pro-creditor, and the recent insolvency reforms adopted in Singapore and the United Kingdom have significantly improved the attractiveness of their restructuring framework for debtors while continuing to be attractive jurisdictions for lenders. Therefore, these reforms can provide valuable lessons for jurisdictions interested in improving the attractiveness of their restructuring frameworks for debtors without undermining the position of creditors. Moreover, it also shows that, within a particular jurisdiction, some procedures can be more pro-debtor or pro-creditor. Therefore, classifying a country as a pro-debtor or a pro-creditor insolvency jurisdiction can be misleading.

Based on the experience of Singapore and the steps that the country has taken to become an international hub for debt restructuring, the paper concludes by arguing that enhancing the insolvency framework and solving the debtor-creditor dilemma is just the first step to become a restructuring hub. The sophistication of the judiciary, the development of the restructuring ecosystem, and other external factors mainly related to the international recognition of reorganisation procedures will also play an essential role in the success of a jurisdiction seeking to become an international hub for debt restructuring.

Aurelio Gurrea-Martínez is an Assistant Professor of Law and Head of the Singapore Global Restructuring Initiative at Singapore Management University Yong Pung How School of Law.

OBLB categories:

Jurisdiction:

Share: