A Giant Leap for German Restructuring Law? The New Draft Law for Preventive Restructuring Procedures in Germany

Posted:

Time to read:

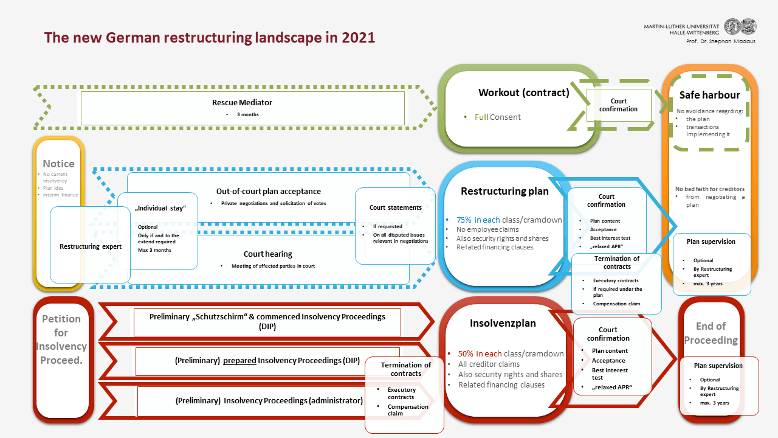

On 19 September 2020 the German Ministry of Justice published the long awaited draft law (the ‘Reform Bill’) transposing the EU Restructuring and Insolvency Directive 2019 (the ‘Directive’). The Reform Bill will not only introduce a preventive restructuring framework, but also a number of relevant changes to the German Insolvency Code following the results of an evaluation in 2018.

The new German preventive restructuring framework

The first part of the Reform Bill implements the Directive by establishing a new Restructuring Code (StaRUG or ‘Stabilisierungs- und Restrukturierungsrahmen für Unternehmen’). The German legislator follows examples set by reform bills in the UK and the Netherlands. The new Restructuring Code provides for a modular set of court-based restructuring support tools available solely to the debtor during the course of crisis management negotiations, provided that she is prospectively cash flow insolvent within the next 24 months. These tools include:

- an individual stay of enforcement actions as well as (contractual or statutory) rights to terminate contracts or accelerate the enforcement of claims for up to 3 months;

- the (optional, in some instances mandatory) involvement of a restructuring expert by court appointment;

- the court confirmation of a restructuring plan that was accepted by 75% of all affected creditor claims/the shareholder capital in each class (not just of the voting creditors/shareholders). The court can impose a cramdown of the plan on a dissenting class if a majority of creditor classes accepted the plan, the best interest test is met and the dissenting class is treated fairly according to a ‘relaxed’ absolute priority rule(meaning that a deviation from the well-known absolute priority rule in favour of a shareholder class is possible provided that the new value exception is met or that preserving the going-concern value requires the shareholder(s) to receive value under the plan (‘sweat equity’));

- the termination of executory contracts with 3 months’ notice by the court when confirming the restructuring plan, if the restructuring plan requires the relief from the contractual burden, previous negotiations have failed and the contract could be terminated by an insolvency practitioner in insolvency proceedings.

None of these tools may affect employment contracts and employees’ claims including from company pension schemes. Redundancies and burdens resulting from such pension schemes can continue to be addressed only in the insolvency law framework.

The restructuring plan would be able to amend the principal creditor claim and any security right granted by the debtor. If the debtor is a holding company, the plan may also amend security rights granted by subsidiaries with their consent. Further, the plan may revise contractual clauses in credit arrangements (covenants, inter-creditor agreements). Shareholder rights may also be affected, in particular with a view to a debt to equity swap. Finally, the plan may protect fresh money (new financing) from avoidance or liability claims in case of a future insolvency (but no super-priority can be established).

The debtor is allowed to negotiate the restructuring plan out of court including soliciting votes on the final version of the plan. Alternatively, the debtor may also approach the court for convening a hearing where the plan would be discussed and where parties would eventually vote. In preparation, the debtor would need to give notice to the competent court that a restructuring has started and court assistance may be required. The court would be allowed to reject the case if the debtor is already (cash flow or balance sheet) insolvent. The new law would also require the management of a corporate debtor to prioritise the interest of creditors over the interest of shareholders as soon as the corporation is prospectively running out of cash within the next 24 months. This is a novel concept to German law where the two year-cash flow forecast has so far only become relevant where debtors considered to take advantage of the insolvency framework voluntarily before actually being insolvent. Whether the same concept would actually work in order to define duties instead of access rights remains to be seen.

The Reform Bill envisions the creation of new restructuring courts to handle these new tools. Here, the federal legislator expects the German federal states to only establish a small number of such courts in order to centralise proceedings and expertise.

Just like the recently adopted ‘Dutch Scheme’, the new German restructuring tools come in two flavours. The debtors get to pick whether they want them public or non-public. If they choose public court assistance, proceedings fall within the scope of the European Insolvency Regulation (the ‘EIR’). With the debtor’s COMI in Germany, confirmed plans would be recognised across the EU. However, Art. 8 EIR would protect security rights on assets outside of Germany and Art. 3(2) EIR would enable parallel proceedings. If debtors instead opt for non-public proceedings, the scope of Art. 1(1) EIR is not met and the proceeding would (probably) be governed by the EU Regulation 1215/2012 (the ‘Judgement Regulation’ or the ‘JR’). Foreign debtors could use the German framework based on an agreement conferring jurisdiction (Art. 25 JR) or a sufficient connection (Art. 8(1) JR) to ensure recognition of the confirmed plans within the EU, provided no part of the plan falls under the exclusive jurisdiction provisions (eg, for matters relating to immovable assets in Art. 24(1) JR).

The German ‘mandat ad hoc’

Independently of the preventive framework, the debtor may also apply for a court-appointed mediator to assist in negotiations with creditors for up to 3 months. If a contract is concluded with such assistance, the debtor may ask the court to confirm the contract with the approval of the mediator in order to protect the contract and any transfer under it from avoidance or liability claims in a possible future insolvency.

The German debtor-in-possession insolvency proceedings

The second part of the law would raise the bar for (near) insolvent debtors to enter insolvency proceedings as a debtor-in-possession and effectively limit this option to well-prepared restructuring cases or pre-pack sales. The current ‘Schutzschirmverfahren’ (umbrella proceedings) would remain available under these new preconditions.

No significant COVID relief

The Reform Bill is set to enter into force on 1 January 2021 in order to absorb the impact of the expiration of COVID relief rules in insolvency law. Businesses suffering significant revenue losses in 2020 compared to 2019 would enjoy a less strict insolvency balance sheet test in 2021. They would also qualify to make use of the preventive restructuring framework or the debtor-in-possession insolvency process despite being cash flow insolvent. The Reform Bill does not provide any additional relief for businesses once they entered proceedings. Regular time limits apply, especially in a restructuring. If businesses continue to suffer from uncertainty in 2021 (such as airlines, travel and tourism), they would be forced to quickly restructure, otherwise to sell or liquidate in 2021 once their financial reserves have been exhausted.

Overall, the Reform Bill brings significant improvements to German law; it is a competitive response to latest reforms in the UK and the Netherlands. Court assisted restructurings would not be limited to insolvency proceedings anymore. Specialised restructuring courts would be established and German businesses would find viable restructuring tools at home in 2021. Exciting new horizons to explore.

Stephan Madaus is Professor of Civil Law and Insolvency Law at the Martin Luther University Halle-Wittenberg.

Share: