The International Centre for Settlement of Investment Disputes (ICSID) Secretariat has published its ICSID Caseload report with a special focus on investor-state arbitration in the EU as of 30 April 2017. The report offers an interesting overview of disputes that involve EU Member States, including the number of cases registered against each Member State, the number of cases brought by EU investors, the type of cases registered, the basis of consent to ICSID jurisdiction, and the economic sectors involved in each instance. In this blog post, we cover a few of the key statistics from the report.

EU Member States featured prominently in Investor-State Disputes

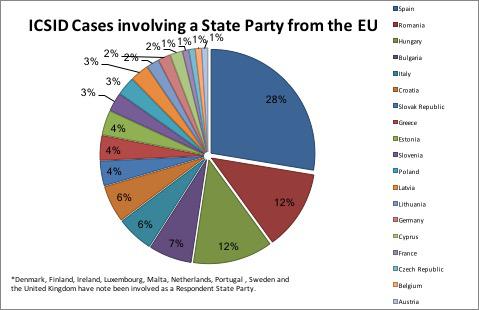

Despite the perception that investor-state disputes tend to happen only in emerging markets, the EU in fact features fairly prominently in the report: 105 of the 608 cases registered (17%) involved a Member State party, in every instance as respondent to the claim. Spain had the highest number of recorded ICSID cases against it (28%), followed by Romania (12%) and Hungary (12%).

When comparing the ICSID Caseload report on investor-state arbitration in the EU as of March 2014, recorded cases against Member states have grown slightly from 12%. However, where there has been a dramatic spike is in cases against Spain in particular, which increased from just over 11% to 28% of total cases registered. The increase in cases against Spain is primarily due to the Spanish government withdrawing the incentives given to new investors in wind energy, solar energy and waste incineration in light of the global recession. Member States such as Spain, the Czech Republic and Italy had strongly promoted policies subsidising investments in renewable energy pursuant to the Energy Charter Treaty (ECT) objectives, but had to scale back those commitments because they could not meet the demand for subsidies after the economic crisis. In response, several groups of investors brought arbitration claims under the ECT challenging those withdrawals.

Most EU-related disputes involved the energy and extractive industries

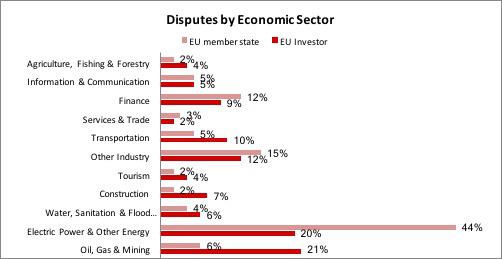

By far, the sector most represented in claims against Member States was the Electric Power and Other Energy sector with 44% of the cases registered involving that sector. The percentage of Electric Power and Other Energy sector disputes against Member States has risen dramatically since 2014 from 24%, again in light of the new ECT claims brought against States such as Spain in response to the withdrawal of renewable energy subsidies.

Similarly, 20% of cases brought by EU investors related to this sector. As ever Oil, Gas and Mining also featured heavily for EU investors (21%), although unsurprisingly not in the EU itself (only 6% of claims against Member States related to this sector).

The majority of claims were brought under bilateral investment treaties or the Energy Charter Treaty

The vast majority of all registered cases (97%) were brought under the ICSID Convention rather than under the Additional Facility Rules. In cases brought against Member State parties, the most common grounds for establishing ICSID jurisdiction were either bilateral investment treaties (56%) or the ECT (43%). Compared to the figures in the March 2014 ICSID report, ECT disputes have risen considerably from 25%. As mentioned above, this spike is attributable to claims being brought as a result of the withdrawal of renewable energy subsidies.

However, for cases brought by EU investors, the basis of consent was predominantly bilateral investment treaties (61%), with the ECT representing a much smaller proportion (15%), followed by investment contracts (14%) and host-State investment laws (10%).

Disputes were more frequently resolved by a final award rather than a settlement

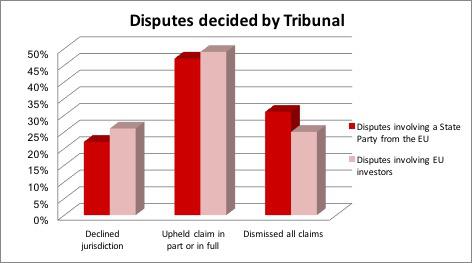

For cases against Member States, 22% were settled by the parties or discontinued before a final determination. This has decreased somewhat from the statistics represented in the March 2014 ICSID report, which showed 36% of cases settling or being discontinued. Of the remaining 78% of cases that were resolved by a final award, 47% of cases were dismissed in full, whereas 31% of cases were upheld in part or full. Jurisdiction was declined in 22% of cases.

In comparison, for those cases brought by EU investors, 35% were settled by the parties or discontinued before a final determination. Of the remaining 65% of cases that fell to be decided by a tribunal, 25% were dismissed in full, whereas 49% of investors’ claims were upheld in part or full. Jurisdiction was declined in a similar number of cases (26%).

Arbitrators from the UK and France were chosen to preside over a significant proportion of cases

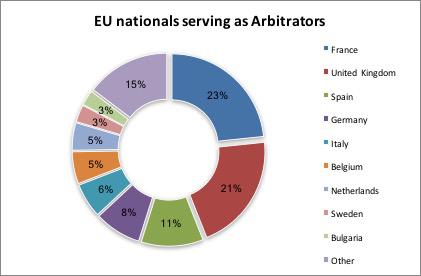

In approximately 72% of appointments made in ICSID cases, the parties selected the appointees, with the remaining 28% of appointments being made by ICSID. In both scenarios, arbitrators from Member States were regularly appointed in a large proportion of investor-state disputes.

43% of all arbitral appointments in ICSID cases involved nationals from a Member State, a level that has been consistent for the last 3 years. Nationals from France and the UK continued to be the most commonly appointed, followed by Spain, Germany, Italy, Belgium and the Netherlands.

This post was written by Holly Stebbing, Partner, and Cara Dowling, Senior Knowledge Lawyer, at Norton Rose Fulbright London. With special thanks to Aimee Denholm, Knowledge Assistant, for her contribution to this blog piece.

OBLB categories:

OBLB types:

Share: