Corporate Governance Reform: The End of Shareholder Monopoly with Votes at Work

Posted:

Time to read:

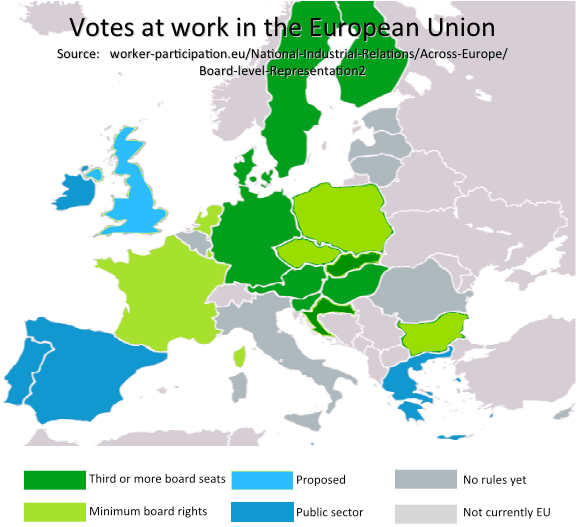

The UK is about to stop shareholders monopolising votes for company boards, with worker voice. Asset managers control most shareholder votes in public companies through ‘other people’s money’. They have systemic conflicts of interest, because shareholder votes may influence companies to buy asset managers’ financial products (eg pension schemes). This enables mass self-dealing. One small step for change is Corporate Governance Reform: The Government response to the green paper consultation (August 2017). The Financial Reporting Council will write ‘comply or explain’ rules in the UK Corporate Governance Code. Listed companies must introduce: (1) ‘a designated non-executive director’ responsible for employee engagement, (2) ‘a formal employee advisory council’ or (3) ‘a director from the workforce’ (page 34, Action 8). A shrinking minority of lawyers and economists still contest the evidence – qualitative, behavioural and quantitative – that votes at work promote good corporate governance. They ignore that a majority of OECD (and EU) countries now have some form of codetermination law. But are votes at work alien to British tradition? No. Summarising my forthcoming Industrial Law Journal article, this post explains why Britain has among the longest, richest histories of codetermination in the world.

It may seem surprising that the UK still has no general codetermination law, because its corporations with the greatest long-term success – universities – incorporated worker voice since the Oxford University Act 1854. The Oxford University Commission of 1852 (hardly a radical body) demanded a reversal of ‘successive interventions by which the government of the University was reduced to a narrow oligarchy’. Today almost all universities – no matter how imperfect, forgotten or opaque – ensure staff have votes at work. Why is there no general plan yet?

Two central reasons have been: (1) an old view that to get votes, people should invest property (not just have a contract of employment) in companies, by buying shares, and (2) uncertainty in the labour movement. Both have now gone. Outside universities, the South Metropolitan Gas Act 1896 and the Port of London Act 1908 enabled worker representatives on boards. The Gas Act required workers invest money in an employee share scheme. This reflected old prejudice, still present then in votes for Parliament, that male ownership of property was key to participation in public life. Yet the Port of London Act enabled worker votes solely by the investment of labour. David Lloyd George wrote it as President of the Board of Trade (but passage was completed by Winston Churchill). After WW1, a Conservative ministry in coalition with Lloyd George attempted to pass codetermination on railways. But, as a previously secret memorandum shows, it failed against management opposition and unions who only wanted nationalisation.

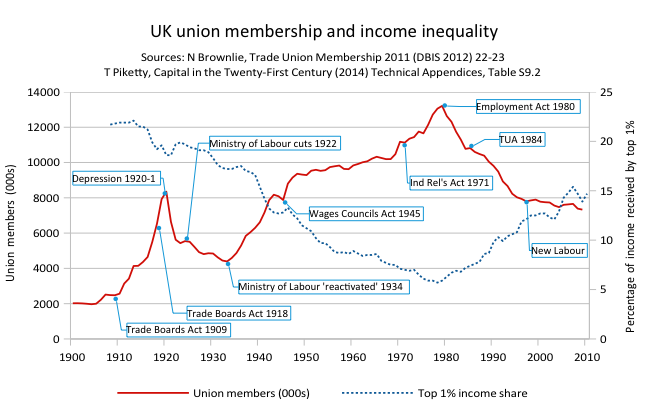

Why didn’t organised labour bargain hard for votes at work, as they did in post-war Germany? First, employee share schemes gave worker representation a bad name: workers were told to save in an Enron-style undiversified portfolio, without meaningful voice. As Sidney and Beatrice Webb said, employee share schemes were advocated ‘by the most reactionary persons’. Second, it was recognised by the Webbs after WW1 that worker representation, purely by investment of labour, could be ‘a real social gain’. But Sidney Webb was also writing the UK Labour Party’s clause IV, committing to ‘nationalisation of the means of production’. Worker voice became conflated with public ownership: socialising ownership, not power. But also, British labour, with government backing, had real influence (if not votes) in collective bargaining and strikes. Voice at work with collective bargaining created genuine prosperity, but it was destroyed from 1979. Unions’ decline and soaring inequality were a mirror image:

Over the mid-20th century, though labour policy documents said trade unions were a ‘single channel’ of voice, there were many codetermination experiments. A low point was 1948: Herbert Morrison’s model for nationalised industry presumed experts from Whitehall (and men like Morrison) should control boards: workers should work. When Hugh Gaitskell piloted the Gas Act 1948 he fired worker representatives there since 1896. But in 1966, the Trades Union Congress pushed back: the Iron and Steel Act 1967, the Industry Act 1975 for aerospace and shipbuilding, and the Post Office Act 1977 for post and telecomms all required worker directors. The Bullock Report of 1977 proposed a general Act, but it divided all sides. Half the board would be worker representatives, half shareholders, and a government representative would break any deadlock. Such detailed plans could not command enough consensus. After the government flipped its proposals to a two-tier board structure, and its White Paper flopped, the 1979 election seemed to be the end.

Or not quite ‘the end’. Universities still had codetermination. Postal ballot papers for Oxford’s congregation remain essential to university governance. Collective agreements guaranteed worker voice in pension plans. The Conservative Pensions Act 1995 codified this: at least one third worker representation in all pensions, unless firms opted out. The Pensions Act 2004 removed the opt-out. The Secretary of State may require one-half by statutory instrument. It is not the world’s best system: Australia, Belgium or Sweden do better. But, surprisingly, British codetermination in pensions supports more worker voice than in Germany. Far from an alien tradition, British codetermination has among the longest, richest histories in the world.

This leads to the essential question: how should companies, employees and unions build votes at work today? It is essential to keep in mind that at the Labour Party conference 2016, policy ‘composite 4’ committed to further corporate governance reform: the Shadow Chancellor adopted the Manifesto for Labour Law, drafted by some of the most distinguished labour lawyers of the UK, EU and Commonwealth. Every ‘board must have worker directors’ and workers ‘should have a minimum percentage of the vote in general meetings of the company’. This is what universities like Oxford, Cambridge, the LSE or Edinburgh have done for centuries. Draft legislation will probably: (1) ‘apply to all enterprises regardless of legal form, size, across corporate groups, and bind foreign entities with their real seat in the UK’, and (2) contain ‘revised Model Articles’ that ‘recognise workers as company members, with a percentage of votes in the general meeting, by default, in every new company startup.’

So, in response to the FRC plans, the best companies will get ahead of the curve. The easiest option is to elect an employee representative on the board: two representatives will bring real diversity, mutual support, and build trust among the workforce. With all major parties committed to reform, the need for votes at work is a new political consensus in Britain. The question is not ‘if’ or ‘when’, but ‘how’.

Dr Ewan McGaughey is a lecturer in private law at King’s College, London and a Research Associate at the Centre for Business Research, University of Cambridge.

OBLB types:

Share: