With the global economy stuck in a low growth trap, it is crucial to understand the factors behind the weak recovery in potential output growth, and particularly the barriers to productivity growth. In this new paper, we show that this dynamic can be partly understood in terms of the increasing survival of zombie firms – ie those firms that would typically exit in a competitive market but are being kept alive by creditors or policy weakness. Today, a key risk is that zombie firms may depress creative destruction, crowd-out growth opportunities for healthy firms and underpin a period of macroeconomic stagnation, just as they did in Japan in the 1990s (Caballero et al., 2008). Indeed, our research suggests that within industries over the period 2003-2013, a higher share of industry capital sunk in zombie firms is associated with lower investment and employment growth of the typical non-zombie firm and less productivity-enhancing capital reallocation. Furthermore, we link the rise of zombie firms to the decline in OECD potential output growth through two key channels: business investment and multi-factor productivity growth.

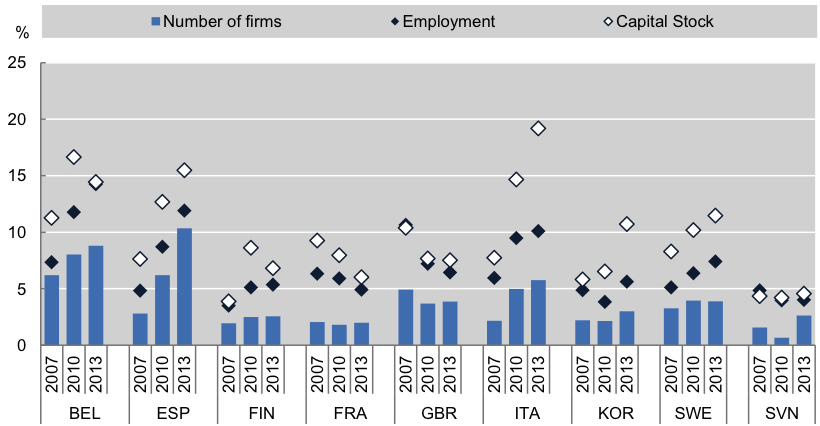

In a number of countries, the prevalence and productive resources sunk in ‘zombie’ firms – defined as old firms that have persistent problems meeting their interest payments – has risen since the mid-2000s (Figure 1). In Italy, for example, the share of the industry capital stock sunk in zombie firms rose from 7% to 19% between 2007 and 2013. This is problematic because zombie firms can congest markets and reduce industry profitability – by inflating wages relative to productivity and depressing market prices – which deters the expansion of healthier firms, especially recent entrants.

Note: Firms aged ≥10 years and with an interest coverage ratio<1 over three consecutive years. Capital stock and employment refer to the share of capital and labour sunk in zombie firms. The sample excludes firms that are larger than 100 times the 99th percentile of the size distribution in terms of capital stock or number of employees.

Econometric analysis shows that when more industry capital is sunk in zombie firms, the typical non-zombie firm undertakes less investment than otherwise, with young firms particularly affected (Figure 2). But the story does not end there because zombie congestion disproportionately crowds-out the growth of more productive firms, thus slowing productivity-enhancing capital reallocation and aggregate multi-factor productivity (‘MFP’) growth.

Note: Impact of a one standard deviation increase in the zombie capital share on non-zombie firms according to their age. This figure shows the ceteris paribus impact of an increase of a one standard deviation (15.6%) of the zombie share on employment and MFP of non-zombie firms, differentiating between old and young non-zombies. Zombie shares refer to the share of capital sunk in zombie firms, defined as firms aged >=10 years and with an interest coverage ratio <1 over three consecutive years. The estimates are based on nine OECD countries (BEL, ESP, FIN, FRA, GBR, ITA, KOR, SWE and SVN) over the period 2003-13. The effects on old non-zombie firms and the differential effects on young non-zombie firms are all significant at the 5% level.

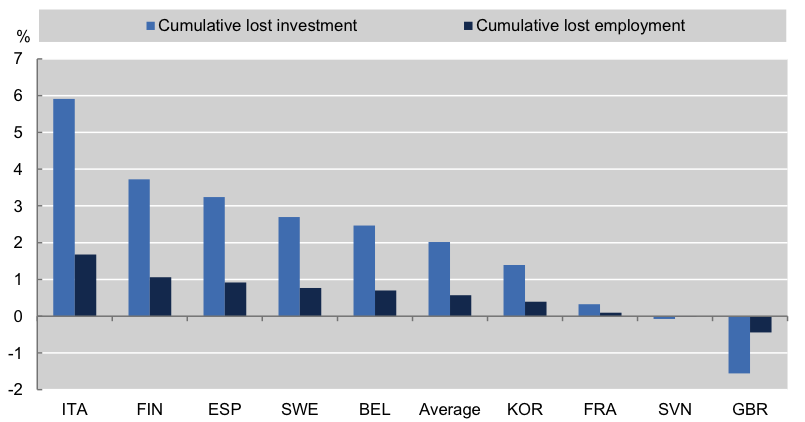

The rise of zombie congestion can be connected to the collapse in OECD potential output via two key channels: weaker business investment and MFP growth. For example, simulations show that had the zombie capital share not risen from its pre-crisis levels:

- Investment of a typical non-zombie firm in Italy could have been around 6% higher in 2013. This can account for one-quarter of the actual decline in aggregate private non-residential business investment in Italy between 2008 and 2013 (Figure 3).

- Aggregate MFP could have been 0.7% to 1% higher in Italy and Spain respectively, owing to more efficient capital reallocation. This is significant given that in both countries, MFP subtracted significantly from potential growth over the past decade.

Note: This figure shows the cumulative lost investment and employment between 2008 and 2013 due to the presence of zombie firms. The counterfactual is to keep the zombie shares at their 2007 level for the period 2008 to 2013. The average refers to the unweighted average of the 9 countries in the sample.

In some countries, these problems are likely to be symptomatic of weak insolvency regimes and a slowdown in the pace of product market reforms. But zombie firms may also be kept alive by bank forbearance and the persistence of crisis-induced SME support policy initiatives. While reforms in these areas may help revive productivity growth, it is crucial that they are flanked by well-designed active labour market policies, which have been shown to be effective at returning workers displaced by firm exit to work (Andrews and Saia, 2016).

Müge Adalet McGowan, Dan Andrews and Valentine Millot are members of the Structural Policy Analysis Division of the Economics Department at the OECD.

OBLB categories:

OBLB types:

Share: