Gender Quotas: Challenging the Boards, Performance and the Stock Market

Posted:

Time to read:

The glass ceiling - the invisible barrier which prevents women reaching top positions in their professional careers - is still a dominant phenomenon everywhere. Even in countries in which women participate more in the labour market, only a minority make it to the highest positions. There is an urgent need to reduce the absence of women from positions of leadership, as part of the global strategy of exploiting talents to promote business and performance (IMF, 2014).

Gender quotas have been proposed to accelerate the promotion of women's empowerment. Norway pioneered the introduction of gender quotas for boards of directors in 2005, followed by Italy in 2011 and, more recently, by France and Germany.

However gender quotas are controversial. From business to politics and academia, the economic effects of the introduction of gender quotas are under scrutiny. Even in cases in which gender quotas are a useful way to promote a gender-balanced representation at the the top of a profession, they may have costly consequences, as they risk promoting less-qualified individuals, who are likely to perform poorly. In Norway, Ahern and Dittmar (2012) document a reduction of firms’ value (measured by Tobin’s Q) due to the introduction of board gender quotas and a negative stock market reaction.

Are these negative consequences the unavoidable cost of achieving more gender-balanced representation?

Using the Italian experience, our recent working paper provides a new and different answer. In July 2011, Italy introduced gender quotas for boards of directors and statutory auditors of companies listed on the stock market. The law (Law 120/2011) is gradual and temporary: it requires a minimum threshold of 1/5 representation for both genders for the first election after August 2012, which increases up to 1/3 for the following two board elections. After that, the law will expire.

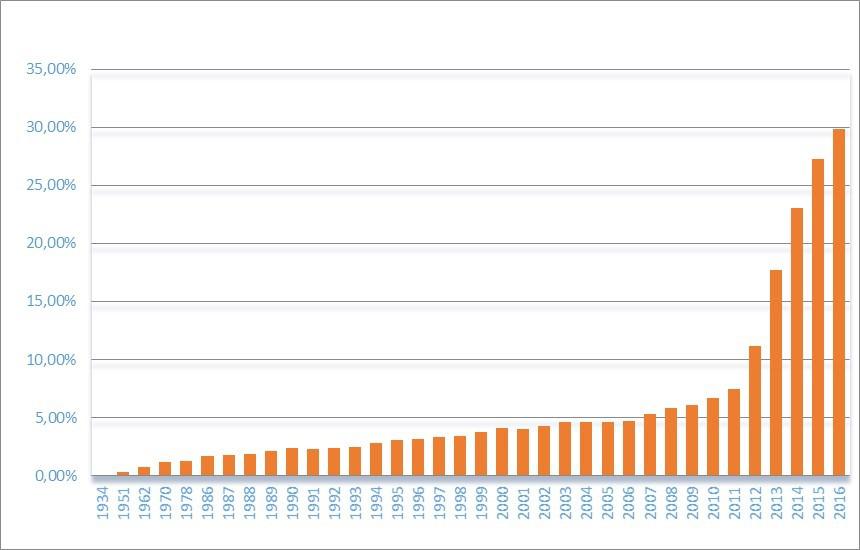

In contrast to the position in Norway, Italy features a very conservative gender culture, and ranks poorly in Europe in almost all gender statistics (see Profeta et al, 2014). Figure 1 shows the slow evolution of the share of women on boards of Italian listed companies in the last decades, which, after the introduction of the quotas, shifts from 6% up to the current 30%.

To evaluate the efficacy of gender quotas in the process of promoting women's empowerment vis-à-vis the costs they may generate, we concentrate on the effects of the introduction of quotas on the characteristics of board members, on firms’ performance and on the stock market.

We first manually collected 4627 CVs of board members (males and females) in the period 2007-2014 of the 245 companies listed on the Italian stock market and subject to the gender quota requirements introduced by Law 120/2011 according to CONSOB (the regulatory body of the Italian stock exchange authority). We compare within firms, before and after the July 2011 reform, changes in board members’ characteristics, such as gender, age, level and field of education. More precisely, we follow the same firm over two consecutive board elections, the first one before the implementation of the quota law and the second one with the quotas in place. Our analysis identifies that, when gender quotas are enforced, firms show a higher share of women directors (well above the required threshold), higher average education levels of all members of the board, and lower ages than before the quotas. We do not find an increase in board members belonging to the same family, nor a clear increase in the average number of positions held by each board member. Moreover, by comparing the characteristics of new, retained and exiting members, we show that gender quotas trigger a process of better selection of the entire board: after the quotas, new members are more qualified than exiting ones.

Second, we collected firm-level data for the period 2010-2014 on several standard measures which capture the performance of each company, including the number of employees, production, profits, share of short-term and long-term debts, ROA, Tobin's Q, and assets. The sources of information are Orbis-AIDA, Bankscope, Datastream and, in the case of missing data, we hand collected the corporate documents available on the website of the Milan Stock Exchange or on the official budget balance sheets published on each company's website. We also downloaded from Bloomberg the daily closing price of the FTSE MIB for the years 2009-2014.

To assess the causal effect of women's empowerment on firms' performance, we use the reform period, which is exogenous to firms' decisions, as an instrumental variable for the share of female directors. Although the short time period (two years) after the introduction of gender quotas does not allow us to assess the long-term effects, our analysis shows that so far quotas in Italy have not been associated with different (for instance, worse, as in Norway) firm performance. However, when we consider the stock market performance - a short-term outcome - consistent with the existing evidence that a more gender-balanced team may be more risk-averse than a male dominated one (see review in Bertrand, 2011), we show that gender quotas reduce the variability of companies' stock prices.

Finally, we use data on the stock market prices to run event studies at both the day of announcement of the law and at the date of the board elections. We find that the introduction of gender quotas in Italy is associated with better firm returns.

Overall our results support the idea that gender quotas not only contribute to women's empowerment, but, through the increased competition from the entry of qualified women, they stimulate a beneficial restructuring of the board, which is positively received by the market.

Figure 1: Share of women on boards, Italian listed companies (1934-today)

References

Ahern, K. and Dittmar, A. (2012) The changing of the boards: the impact on firm valuation of female board representation. The Quarterly Journal of Economics 127:137-197.

Bertrand, M. (2011) New Perspectives on gender, in Card D. and Ashenfelter O (eds) handbook of Labor Economics, vol 4b, chapter 17.

Paola Profeta, Livia Amidani Aliberti, Alessandra Casarico, Marilisa D'Amico and Anna Puccio. Women Directors. The Italian Way and Beyond (2014) Palgrave MacMillan.

Giulia Ferrari is a researcher at INED.

Valeria Ferraro is a PhD student in Economics at Boston College.

Chiara Pronzato is an Associate Professor of Demography at the University of Turin.

Paola Profeta is an Associate Professor of Public Economics at Bocconi University.

OBLB categories:

OBLB types:

Share: