The persistent gender gap in corporate leadership has led several European countries to institute board-related policies such as gender quotas, starting with Norway in 2003. Recently, California became the first US state to follow suit, with many more considering similar regulatory measures. Nevertheless, the World Economic Forum estimates that the current pace of reforms is too slow to bridge the gender gap in wages and leadership in the next two centuries. Given the public interest in reducing the gender imbalances at all levels, it is essential to understand both the company level factors that affect the gender pay gap and the regulatory interventions aiming to tackle the top executives’ gender pay inequality.

In our recent paper, we examine the gender gap in executive pay, focusing on company-level factors and regulations. In regulations, we consider not only board gender quotas but also parental leave provisions. While the upper echelons of the corporate world are not the primary target of the parental leave provisions, it is an important public-policy instrument. We analyze pay and demographic information of 15,000 executives of listed companies from eighteen countries between 2002-2015. We follow a comparable cohort of executives appointed within our sample period throughout their tenure within a specific company. With this method, we show a structural gender gap in executive pay across the world. We document that female executives receive 34 per cent less pay than male equivalents with similar education, experience, leadership roles, and other firm-level features. We also find a significant variation in the pay gap across industries; the executive gender pay gap is the highest in the banking and finance industry (57 per cent), and lowest in the consumer goods industry (11 per cent). Unsurprisingly, the gender pay gap is highest for the youngest female executives, who are more likely to be affected by proximate maternity breaks in their corporate careers.

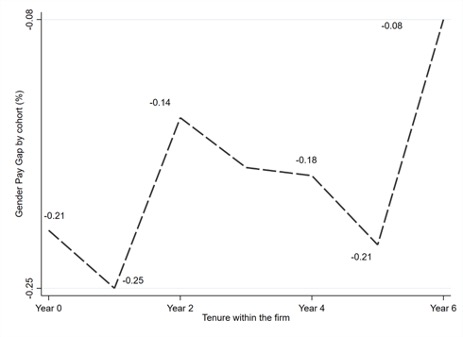

One of the novel findings of our study is that, unlike previously assumed, the gender gap is not a static feature within a company. We document that the gender pay gap diminishes with tenure. It means that once employers learn more about their female executives’ performance, they narrow the pay gap. It suggests that the gender pay gap is a dynamic learning process for employers rather than something that is purely a result of ‘bias’ or ‘prejudice’. Notwithstanding the narrowing, the pay gap is never fully bridged throughout the female executives’ corporate tenure. Figure 1 shows this tenure-led narrowing of the pay gap trend, all things being equal.

Figure 1

This structural nature of the gender pay gap is the primary rationale of why public policies are potentially necessary. Board gender quotas are demand-side policies since it mandates companies to appoint female board members creating additional demand for their services. In contrast, parental leave entitlements are supply-side policies that enable females to stay longer at work to have a better chance of being appointed as executives—and demand better wage—during their child-rearing years. Such policies could also help them return to work sooner, post-maternity. Prior research has shown that maternity’s demands are the greatest on the females. Therefore, it is essential to study how such policies affect highly-educated females in the workplace. Our results show that the pay disadvantage is lower for female executives in countries with board gender quotas and parental leave provisions compared to countries that do not have these provisions.

A central question that regulators grapple with when designing public policies is: who should benefit? Often the answer to that question is that the most disadvantaged group should benefit from public policies. In the corporate setting, the younger females face a considerable disadvantage since they have to juggle home-life and corporate-life while attempting to climb the corporate ladder. Besides, as females, they face additional pressures that come with being ‘token’ appointments. With experience, such disadvantages are likely to recede. It, however, depends on their staying power. Here public policies should help. We document that with quota-types public policies, established and senior females benefit more with not only significantly smaller pay gaps, but sometimes it results in a pay-premium. In contrast, young female executives benefit from the parental leave provision type policies. Therefore, when facing gender quotas, companies react by appointing the senior female executives with more experience. On the other hand, supply-side policies such as parental leave entitlements reduce labour market frictions for younger women, enabling them to overcome their maternity pay discount.

The closure of the representation gap, an essential metric in itself, must be assessed in light of the overall aim of reducing gendered-barriers to corporate leadership. Our results inform the debate on the nature of the executive gender pay gap and the design and effectiveness of public policies that expect to alleviate some institutional hindrances that create gender imbalance in the corporate sector. Gender quota policies’ allure is their rapid effect in the short-term. Nevertheless, in the longer-term, family policies, such as parental leave provisions that compensate the most disadvantaged group of young women directly, can function as a complementary policy channel to address the gender gap.

Swarnodeep Homroy is an Assistant Professor of Finance at the University of Groningen.

Shibashish Mukherjee is an Assistant Professor of Accounting at the University of Groningen.

OBLB categories:

OBLB types:

Share: