The Investment Choices of Households. Evidence from the Italian Markets

Posted:

Time to read:

The annual Report of the Italian financial regulator (CONSOB) on investment choices is aimed at gaining insights as to how Italian households manage their investment decisions, given their financial literacy and behavioural attitudes, and supporting policies and initiatives promoting investor education and protection. In detail, the Report gathers evidence on the multifaceted drivers of financial decision making, such as education, experience, behavioural biases, socio-demographic characteristics, and investment behaviours such as portfolio choices and advice seeking.

Financial knowledge

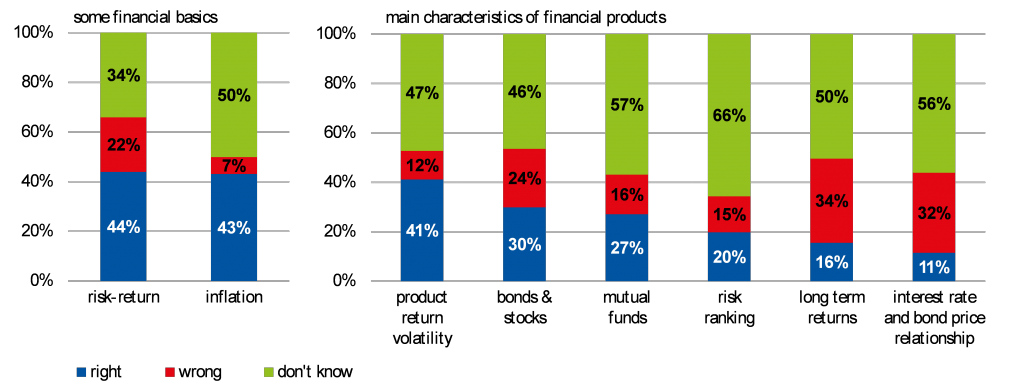

The 2016 Report confirms alarmingly low levels of financial knowledge among Italian households. Questions on basic notions sitting at the heart of financial choices, such as inflation and risk-return relationship, record slightly more than 40% of correct answers. As for advanced questions, addressing knowledge of the characteristics of the most common products, the percentage of correct responses ranges from 41% to 11% (Figure 1).

Figure 1. Financial knowledge  Source Consob, 2016 |

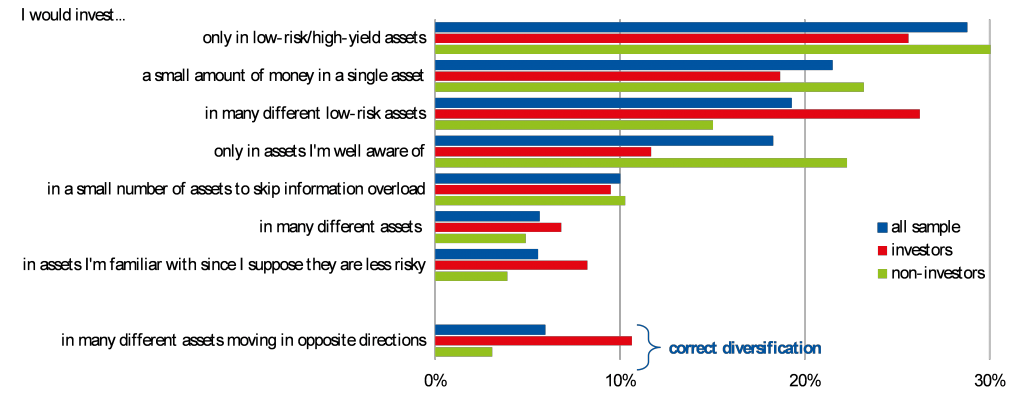

Beyond low financial knowledge, investment choices may be hindered by individuals’ attitude towards under-diversification. Portfolio diversification is correctly understood only by 6% of respondents, while the remaining reveal either misunderstanding of risk/return relationship or attitudes potentially ascribable to a number of biases (Figure 2). Although misunderstandings of diversification are more frequently detected among low-literate respondents, financial knowledge is not always associated to the correct behaviour.

Figure 2. Attitudes towards portfolio diversification  Source Consob, 2016 |

Investment habits

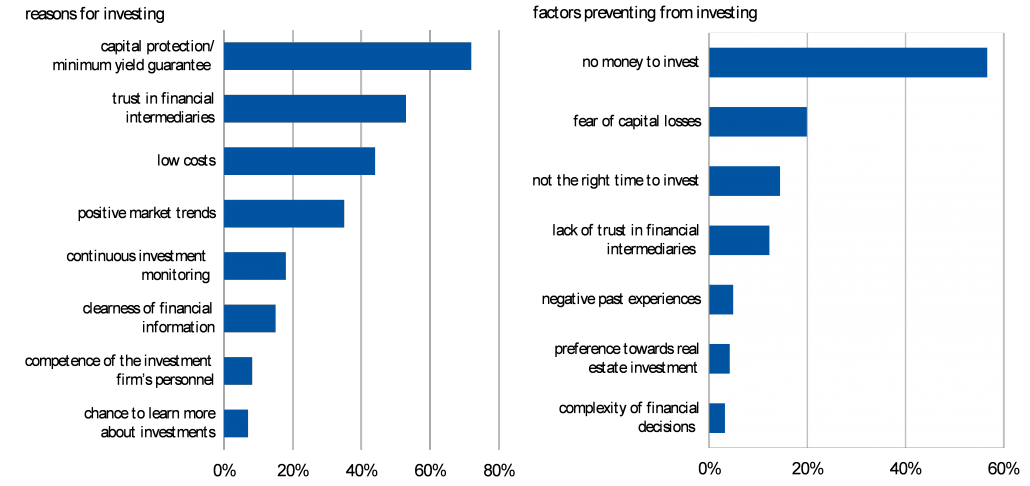

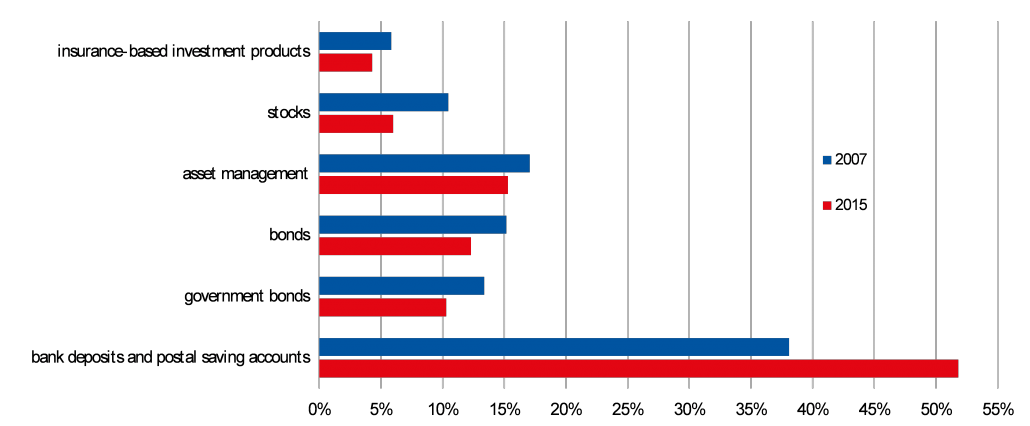

As for the drivers of investment, the main triggers of financial markets participation are the availability of capital protected/minimum yield guaranteed products and trust in financial intermediaries (Figure 3). Reported data on financial wealth composition consistently witness the increasing preference for liquid products, with the share of bank deposits and postal saving accounts rising from 38% in 2007 to 52% in 2015, at the expense of stocks, government bonds and bonds, recording the most significant contraction (respectively, -43%, -23% and -19%; Figure 4).

Figure 3. Reasons and deterrents for investing  Source: Consob, 2016 |

Figure 4. Breakdown of Italian household financial wealth by type of asset  Source: Consob, 2016 |

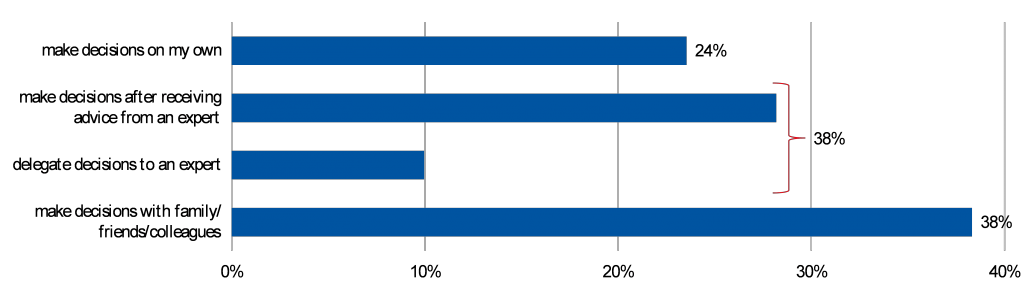

Coming to investment habits, 24% of interviewees make decisions on their own, while the remaining are equally split among those either seeking for professional support (28%) or delegating to an expert (10%) and those relying on the so-called informal advice, ie, family and colleagues’ recommendations (38%; Figure 5). Informal advice is more likely to be preferred by men, less educated, self-employed and wealthy individuals, while reliance on professional advice is more common among high-literate, and less overconfident investors. This evidence is consistent with previous findings showing that financial advice might act as a complement rather than as a substitute of financial capability, thus confirming the concerns about regulation of financial advice being not enough to protect less sophisticated investors needing it most (Consob, 2016).

Figure 5. Household investment habits  Source: Consob, 2016 |

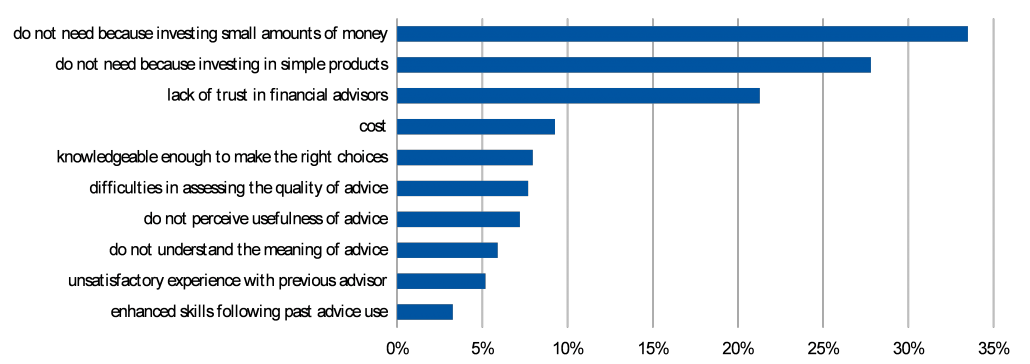

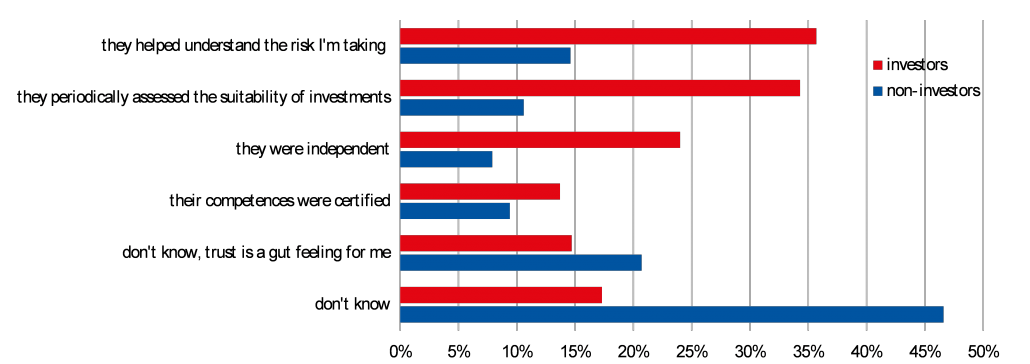

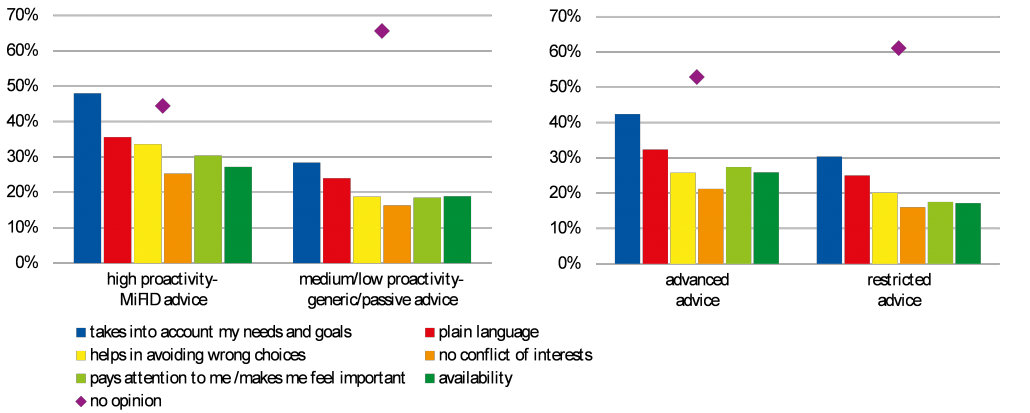

The main reasons preventing investors from seeking for advice are investing small amounts of money, investing in simple products, and distrust in intermediaries (Figure 6). In this respect, moreover, the persistently low willingness to pay for the service along with the low capability to judge the quality of the advisor do play a role (Figure 7).

Figure 6. Deterrents for seeking for financial advice and drivers of trust in financial advisors deterrents for seeking for financial advice  I would trust more in financial advisors if...  Source: Consob, 2016 |

Figure 7. Most valued features in financial advisors  Source: Consob, 2016 |

Focus: robo-advice and crowdfunding

Digitalisation is expected to quickly change the provision of financial services. Disruptive innovations are already reshaping the way products and services are designed, distributed and consumed. Automation in financial advice (so-called ‘robo-advice’) and capital raising through crowdfunding platforms are of particular interest for their prospective impact on retail investors. Along with potential risks, which are increasingly investigated by domestic and international regulators, these phenomena might deliver a number of benefits. Automated financial advice is forecast to improve availability of wealth management services for a larger range of consumers. Equity crowdfunding is anticipated to broaden the opportunities for businesses to access funding options other than the traditional bank lending, which following the changed economic environment has been experiencing a progressive contraction.

The development of robo-advice and crowdfunding postulates that consumers have appropriate digital skills, are aware of the new options available (and the corresponding risks) and are willing to engage with them. As for digital skills (defined over five areas including information, communication, content-creation, safety, problem-solving), at the end of 2015, Internet users (accounting for about 65% of the population) can be classified as high-digital-literate only in 30% of the cases; not surprisingly, skills decline with age.

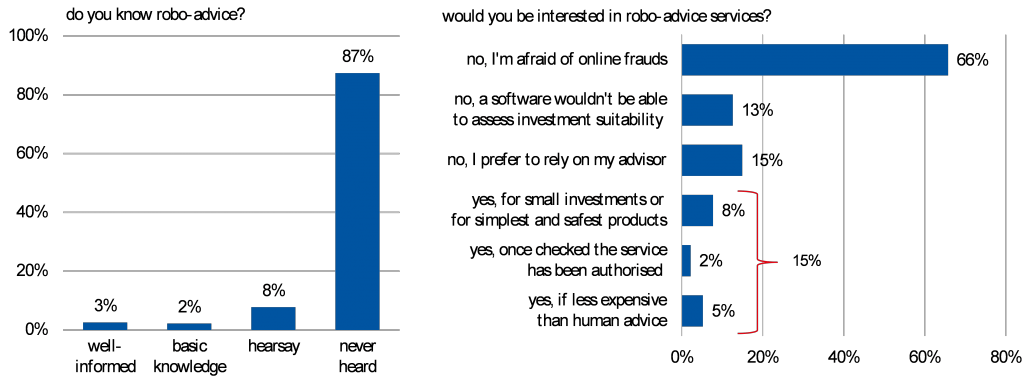

Robo-advice is neither known nor attractive to the vast majority of the interviewees, whose lack of interest in the service is mainly due to concerns about online financial frauds (66% of the sample; Figure 8).

Figure 8. Knowledge and propensity to seek for robo-advice services  Source: Consob, 2016 |

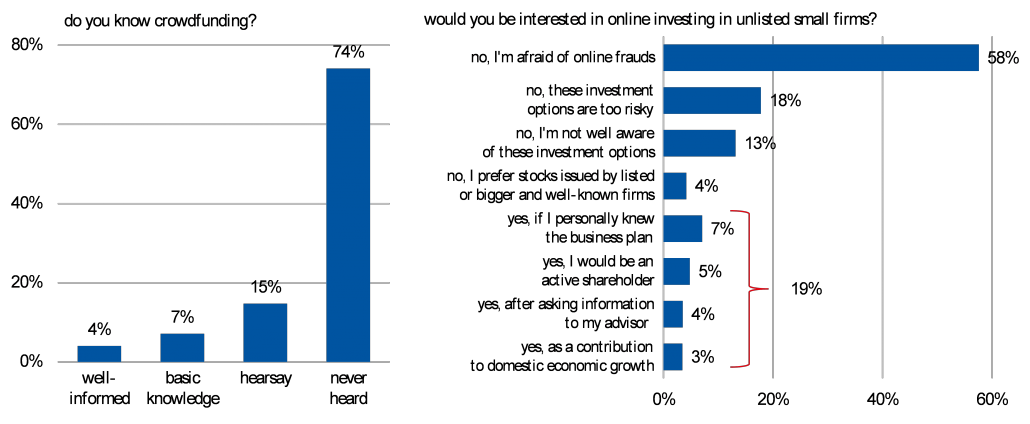

Crowdfunding is still largely unknown too, given that 74% of the respondents never heard about it. Again predominantly because of the worry of scams, online investing via a crowdfunding platform is attractive to only 19% of interviewees (Figure 9).

Figure 9. Knowledge of crowdfunding and interest in online investing in unlisted small firms  Source: Consob, 2016 |

Conclusions

The Consob Report addresses the need to understand the actual behaviour of Italian financial decision makers in order to best assess the potential efficacy of policy measures. For instance, rules aimed at boosting high quality advice service and independent advice may not deliver the expected results given that the vast majority of consumers are not aware of the main features of the advice service, nor are able to appreciate it or to pay for it. This claims for investor education initiatives well-grounded in observed choices and attitudes, which Consob is currently developing also by relying on behavioural finance insights.

Nadia Linciano, Monica Gentile, and Paola Soccorso are researchers at the Commissione Nazionale per le Società e la Borsa (CONSOB).

The opinions expressed in this post are the authors’ personal views and are in no way binding on Consob.

OBLB categories:

OBLB types:

Share: