Macroeconomic Relevance of Insolvency Frameworks in a High-debt Context: An EU Perspective

Posted:

Time to read:

Insolvency frameworks are increasingly attracting the attention of European policy makers. The need to overcome the current problem of debt overhang, and to ensure a rapid work out of bad loans in banks' balance sheets, has prompted recent insolvency reforms at national level, and recommendations by European institutions. A recent study carried out by the Directorate General of Economic and Financial Affairs facilitates anunderstanding of the macroeconomic relevance of insolvency frameworks, discusses the elements that characterise effective frameworks from a macroeconomic perspective, and provides a review of recent reforms across EU countries.

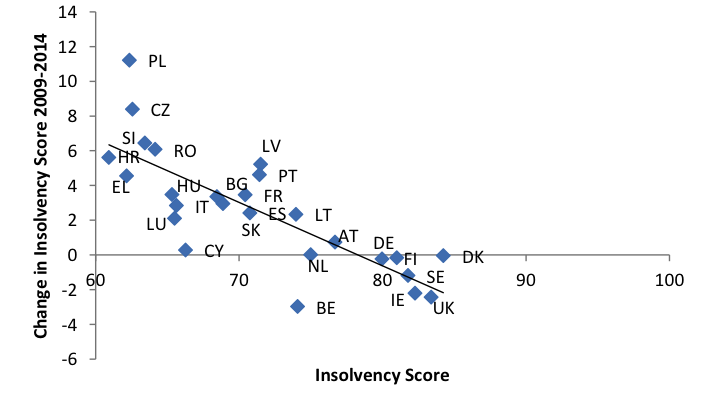

In general, in the post-crisis period, NPLs have been falling faster in EU countries characterised by relatively more efficient insolvency frameworks. The European Commission and the EU Council have recently issued recommendations to selected countries to reform their insolvency frameworks to address the debt overhang problem.

A review of insolvency frameworks across EU countries reveals that substantial cross-country differences remain, most notably regardingthe handling of personal insolvency and the extent to which national legislation enables early and swift handling of debt distress of firms and individuals. While almost all Member States recognise the need for a mix of informal and formal procedures, only some have an explicit requirement to use them sequentially. Informal procedures are often subject to relatively stringent requirements, or are constrained in scope. Moreover, differences remain regarding debtors' obligations in the process. In particular, insolvencies for small companies and entrepreneurs fall under the corporate insolvency framework in some countries, while in others they are dealt with together with insolvencies for individuals. Also, there are differences in countries' emphasis on restructuring versus liquidation, or in how individual debtors’ future income is committed to rescuing value.

There is no single optimal model for insolvency frameworks, although consensus has converged on some broad principles. Economic structures, legal traditions, and societal attitudes justify sizeable differences in insolvency frameworks among countries. Although there is no single superior model to organise insolvency, a number of broad principles for efficient insolvency frameworks have been identified in the economic literature.[2] Moreover, general principles guiding insolvency legislation have been developed, especially for corporate insolvency in the context of international fora, comprising a number of elements as follows: the availability and accessibility of insolvency procedures for different types of debtor; a careful balance between informal and formal procedures; the ability for instruments to resolve distressed debt as early as possible; enforcement mechanisms with limited legal and procedural uncertainty; and clear rules for cross border insolvency.[3] A European Commission recommendation of 2014 focused on the availability of early restructuring frameworks to facilitate early resolution of debt distress and on the possibility of granting distressed debtors a fresh start after insolvency. [4] The European Commission is preparing a legislative initiative to harmonise selected elements of insolvency frameworks across EU countries so as to reduce the disadvantages which may flow from cross-border investment.

Alessandro Turrini is currently Head of Macroeconomic Surveillance Unit at the European Commission – Directorate General for Economic and Financial Affairs.

[1] J. C. Bricongne, M. Demertzis, P. Pontuch, and A. Turrini, "Macroeconomic Relevance of Insolvency Frameworks in a High-debt Context: An EU Perspective", European Economy Discussion Paper no. 32, 2016.

[2] E.g., Djankov, S., O. Hart, C. McLiesh, and A. Shleifer, (2008), "Debt Enforcement around the World", Journal of Political Economy, vol. 116, no. 6, 1105-1149; La Porta, R., F. Lopez-de-Silanes, A. Shleifer and R. W. Vishny, 1997. Legal Determinants of External Finance, Journal of Finance, , vol. 52(3), pp 1131-50, July.

[3] For corporate insolvency, e.g., INSOL, 2000. Statement of Principles for a Global Approach to Multi-Creditor Workouts, December; UNCITRAL, 2005. Legislative Guide on Insolvency Law, United Nations Commission on International Trade Law, New York.; World Bank, 2015. Principles for Effective Insolvency and Creditor/Debtor Rights Systems (revised 2015), the World Bank Group. For personal insolvency, common soft law principles are less well established, as the country-specific context plays a more relevant role in this case For instance, in countries where home ownership is less widespread and property is concentrated among corporations or wealthy individuals, exceptions to foreclosures could be less easily accepted than in countries where home ownership is pervasive and rental markets are relatively underdeveloped. See, e.g., Laeven, Luc and Thomas Laryea, 2009. Principles of Household Debt Restructuring, IMF Staff Position Note 09/15, June;

[4] See the Commission Recommendation on a new approach to business failure and insolvency (C(2014) 1500 final).

OBLB categories:

OBLB types:

Share: