Between 2008 and 2015 32 countries implemented 42 boardroom gender diversity policies in the form of legal quotas for listed or state-owned firms, governance code amendments, and disclosure requirements. Most policy makers justify their intervention by appealing to the ‘business case’ argument that firms with more women on boards perform better. By extension, policy makers argue that adding more female directors to boards should also increase growth. In my paper, ‘Women on Boards: The Superheroes of Tomorrow?’, I examine whether female directors can help save economies and the firms on whose boards they sit.

There is little doubt that economies can do better when women are fully able to realize their potential in whatever form that may be. But, more research needs to be done to understand the benefits of board diversity. Most studies making the ‘business case’ argument are produced by consulting companies, not academics. Thus, they are not held to the high methodological and peer review standards that academic work is subject to. In my paper, I show that the literature faces three main challenges: data limitations, selection and causal inference.

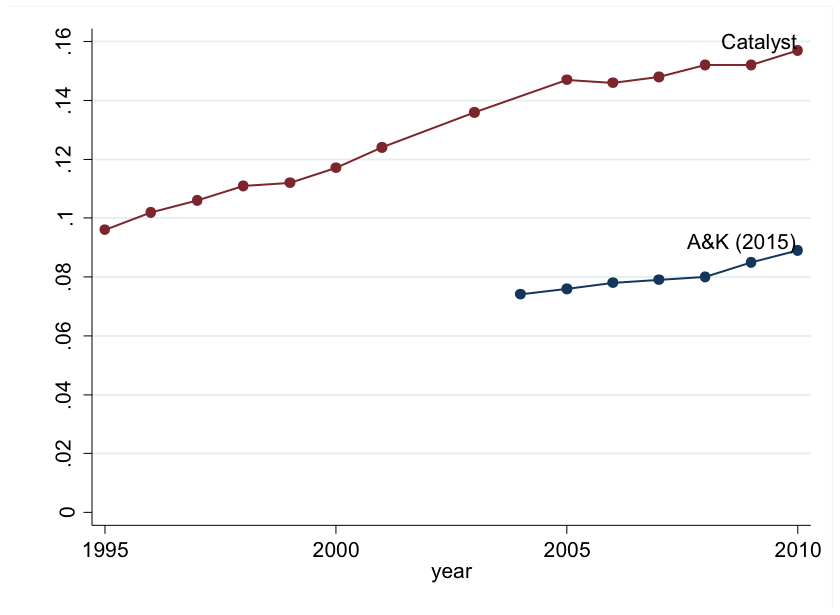

Because of data limitations, most surveys of board diversity focus on large firms. I show that this creates a biased picture of the representation of female directors. Women are much more likely to be on the boards of large firms than small firms. Thus, the representation of women is actually much worse than people argue. Progress towards increasing diversity may also be slower than is commonly argued. The following figure, included in my paper as ‘Figure 4’, illustrates these points by comparing board diversity over time for Fortune 500 firms in the USA from Catalyst (2013) and Adams and Kirchmaier’s (2015) much larger sample containing between 3,298 and 4,566 firms in the USA every year. Because Adams and Kirchmaier’s sample contains many small firms, average firm size in their sample is much smaller than in Catalyst’s sample:

Even with better data, the challenge is to disentangle correlation from causation. I illustrate that correlation does not imply causation by showing that the positive correlation between board gender diversity and firm performance that underlies the ‘business case’ argument is not robust. For example, I show that much of this positive correlation can be attributed to the effect of firm size. In a commonly used sample of data on boards there is no significant correlation between board diversity and performance after controlling for firm size. The reason is simple: large firms tend to perform better and, as I show in the figure above, they also have more women on the board.

Ignoring causality might seem to work in women’s favour. But I argue that if we do not try to identify causal effects, we are in danger of perpetuating further stereotypes about women. These stereotypes can create unrealistic expectations for women. I believe women (and society) are better served if we put wishful thinking aside and try to uncover the facts about boardroom diversity in the most careful and rigorous manner possible. After doing so, it can be easy to make a case for board diversity. For example, I discuss research that shows that female directors are quite different from both women in the population and male directors. Female directors may bring different values to the table and these values may feed into how they, and the board, make decisions. Depending on the circumstances, diversity in values may lead to better decisions. More research is needed to understand how and when the presence of female directors may affect decision-making and corporate outcomes. But it is clear that board diversity can add value.

While female directors may not (always) be superheroes, there is little doubt that they will influence firm and societal outcomes. To characterize this influence we need a better understanding of what women bring to the boardroom table and how diversity affects firm outcomes. We have an even longer way to go towards breaking the boardroom glass ceiling than many would have us believe. Better data and empirical techniques that address selection problems and other sources of endogeneity can help uncover the root causes of low female board representation and allow society to tackle them directly through policies that may or may not target boards of listed firms directly.

Renée B. Adams is a Professor of Finance at the University of New South Wales. She is also the Director of the Finance Research Network (FIRN), a Senior Fellow at the Asian Bureau of Finance and Economic Research (ABFER), and a member of the European Corporate Governance Institute (ECGI).

OBLB categories:

OBLB types:

Share: