Transparency in Voting: Why and When Institutional Investors Explain Their Votes

Posted:

Time to read:

Proxy voting is a central channel through which institutional investors influence corporate governance. Although US regulation has required mutual funds to disclose how they vote since 2003, these disclosures are limited to binary outcomes that reveal little about the reasoning behind a vote. As a result, firms, investors, and other stakeholders often observe what investors do, but not why they do it, particularly in controversial cases.

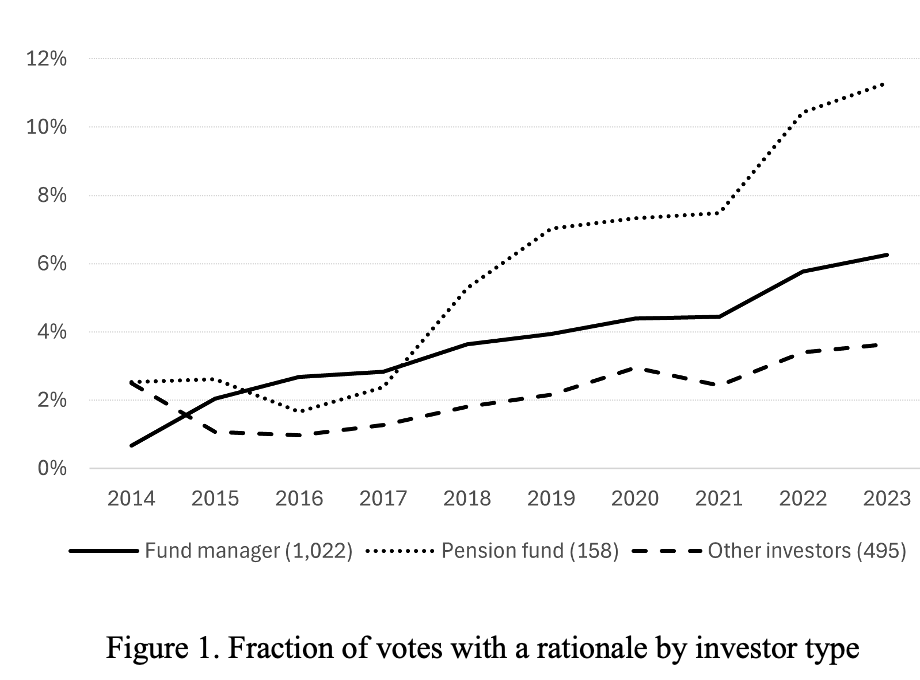

Over the past decade, a notable change has occurred. A growing number of institutional investors now voluntarily disclose voting rationales, explanations accompanying specific proxy votes. These statements, such as ‘The magnitude of CEO pay exceeds the 75th percentile of the company's peer group’ or ‘We are not supportive of this shareholder proposal, as it is overly prescriptive,’ offer a unique window into the motives underlying investors’ voting behavior. Despite the rapid growth of this practice by all types of investors (see Figure 1), little is known about why investors choose to provide voting rationales and under what circumstances they do so.

In a recent paper, Transparency in Voting: Institutional Investors’ Disclosure of Voting Rationales, we study this emerging form of transparency using a novel dataset covering more than 33 million proxy votes cast at US firms by institutional investors worldwide between 2013 and 2023. We investigate the drivers of this transparency, examining both why investors choose to disclose and when they feel compelled to explain their votes.

Disclosure as a Persistent Investor Choice

A first key finding is that the decision to disclose voting rationales is primarily driven by persistent investor behavior, rather than by the characteristics of portfolio firms or proposals. Some institutional investors never provide explanations, while others adopt a stable policy of selectively explaining their votes. Once an investor begins disclosing rationales, it is highly likely to continue doing so in subsequent proxy seasons.

This persistence suggests that voting rationales function as a commitment to transparency, akin to other stewardship practices. At the same time, disclosure is far from universal. Only 18% of institutional investors in our sample ever provide voting rationales, and even among disclosers, rationales accompany 23% of votes.

Why Do Investors Disclose Voting Rationales?

We interpret the decision to disclose voting rationales through three complementary channels.

First, stewardship incentives play an important role. Larger institutions, which typically have greater internal resources devoted to governance and monitoring, are more likely to provide voting rationales. By contrast, institutions that invest less in stewardship, like those that rely heavily on proxy advisors or that systematically side with management, are significantly less likely to disclose voting rationales.

Second, client demand and fiduciary considerations matter. Pension funds and mutual funds, which act as fiduciaries for beneficiaries, are more likely to disclose voting rationales than other types of institutions, such as banks and insurance companies. In this sense, rationales allow investors to demonstrate diligence and accountability to current and prospective clients.

Third, institutional norms and stewardship frameworks shape disclosure behavior. Investors that are signatories to the United Nations Principles for Responsible Investment (UN PRI), or that operate in countries with formal stewardship codes, are more likely to disclose voting rationales. These patterns suggest that rationales also function as public signals of responsible ownership.

Consistent with these incentives being economically meaningful, we document that institutions experience growth in assets under management after initiating the disclosure of voting rationales, relative to comparable non-disclosing peers. This evidence suggests that transparency in voting can be rewarded by the market.

When Do Investors Explain Their Votes?

Although disclosure reflects persistent investor choices, investors do not typically explain every vote. Instead, rationales are provided selectively, and primarily in situations characterized by greater scrutiny or uncertainty.

At the firm and meeting level, rationales are more likely when an investor’s ownership stake is economically meaningful, but not so large as to justify intensive private engagement. Disclosure is also more common during the busy proxy season, when rationales can serve as a cost-effective substitute for direct dialogue with firms.

At the most granular level, institutional investors are substantially more likely to provide a rationale when voting against management, when deviating from proxy advisor recommendations, or when voting on shareholder-sponsored proposals. These are precisely the settings in which stakeholders may find a voting decision less predictable and more difficult to interpret without additional explanations.

Do Voting Rationales Add Information?

Finally, we ask whether voting rationales provide information beyond what is already conveyed by investors’ general voting policies. Using machine learning to recover each investor’s de facto voting policy (as revealed by their actual voting behavior), we show that investors are more likely to disclose a rationale precisely when their vote deviates from what their usual policy would predict. In other words, rationales are used to explain exceptions, not to restate the obvious.

This finding highlights the informational value of voting rationales: they provide a layer of nuance that general policies cannot capture, helping stakeholders understand the judgments investors make when departing from their usual stances.

Conclusion

In conclusion, the disclosure of voting rationales marks a fundamental shift in shareholder voice, transforming proxy voting from a binary choice into a deliberate channel of communication. Our evidence shows that this transparency is context-driven rather than routine: investors provide rationales when explanations matter most, precisely to explain discretionary judgments that standard policies cannot capture. As expectations for transparent stewardship continue to rise, voting rationales serve as a powerful tool for accountability, contributing to a more informative and accountable governance environment.

The authors’ article can be found here.

Daniele Macciocchi is an Associate Professor at the University of Miami Herbert Business School.

Roni Michaely is a Professor of Finance at the HKU Business School.

Silvina Rubio is an Assistant Professor of Finance at NOVA School of Business and Economics.

Irene Yi is an Assistant Professor of Finance at the Rotman School of Management.

OBLB categories:

OBLB types:

Share: