The Growing Influence of Politics on Finance: What We Know and What's Next

Posted:

Time to read:

Rising government intervention, surging corporate political spending, and intensifying geopolitical tensions underscore the importance of understanding how politics shapes financial markets. In our review article, ‘Politics and Finance’, we synthesize the rapidly expanding literature at this intersection and highlight promising directions for future research.

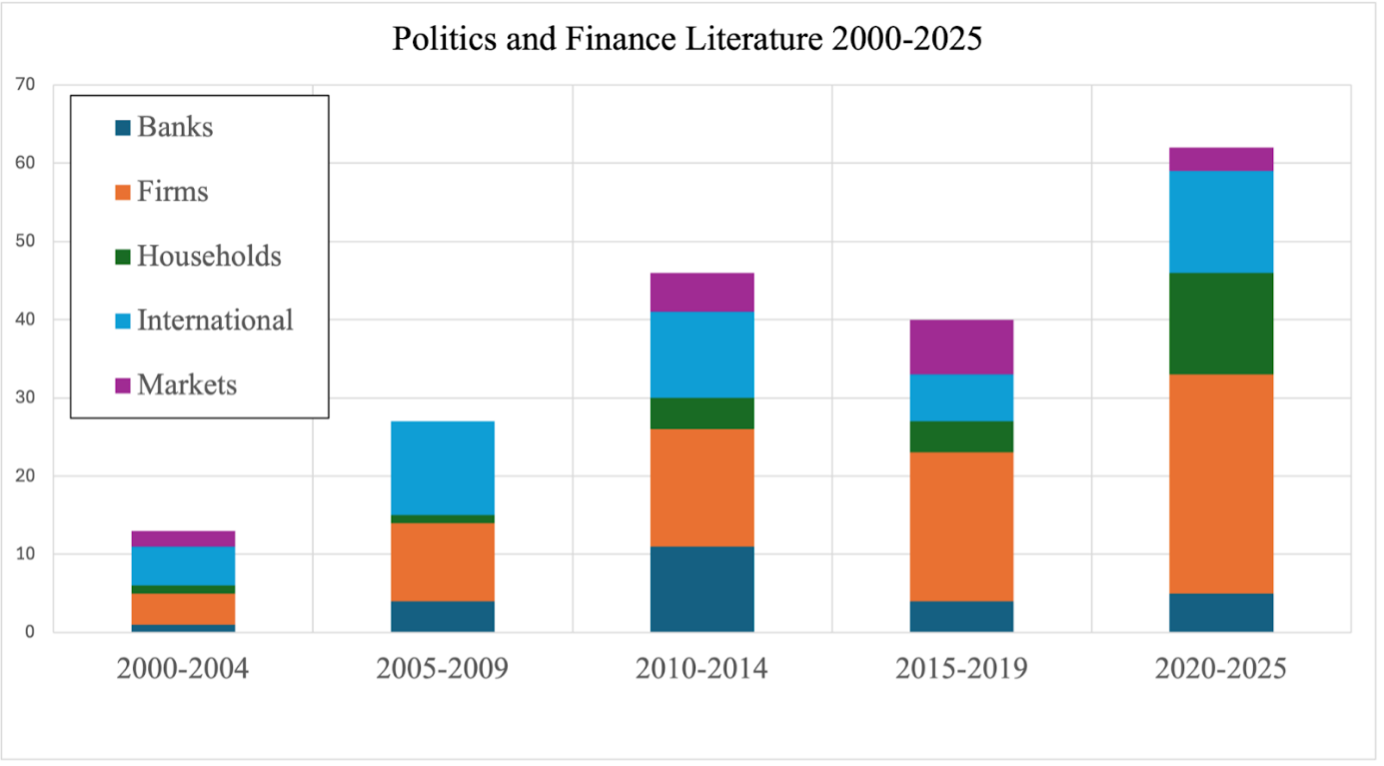

The numbers are striking: federal election spending in the United States rose from $5.6 billion in 2000 to $14.8 billion in 2024, while federal lobbying outlays increased from $2.7 billion to $4.4 billion over the same period. This surge in political spending has coincided with unprecedented government intervention in the market, from the 2008 financial crisis to the COVID-19 pandemic, and a worldwide resurgence of populism and backlash against globalization. These trends have attracted the attention of scholars and have led to an impressive growth in research studying the links between politics and finance. The figure below provides a timeline of research in this fascinating area organized by each paper’s focal group of interest.

How Firms Build Political Capital

Our review shows that firms cultivate political connections through multiple channels, including campaign contributions, lobbying expenditures, politically connected directors, geographic and educational ties to politicians, and revolving-door hiring. The evidence is clear: these connections generally create value for shareholders.

But how exactly do firms benefit? The mechanisms are diverse. Politically connected firms secure more procurement contracts, obtain financing on more favorable terms, receive preferential regulatory treatment, and gain access to policy-relevant information. There's even evidence that political connections can shift legislators' voting behavior on issues affecting connected firms.

The Dark Side of Political Connections

Political connections aren't without costs. During periods of political upheaval or intense electoral competition, ties to incumbents can destroy value. Connected firms may reduce employment less than their peers during downturns, a political favor that comes at the expense of shareholders. Political connections also appear to reduce innovation and distort capital allocation, as politically connected banks often favor connected borrowers despite higher default risks.

Politics and Asset Markets

Political factors also play a prominent role in asset prices. Firms facing higher policy uncertainty or greater exposure to political risk earn higher stock returns, evidence of a political risk premium. At the macro level, US stock returns have been systematically higher during Democratic presidencies than Republican ones, a puzzling empirical regularity that recent theory attributes to the timing of when each party tends to win office.

There's also evidence of politically informed trading. Hedge funds with connections to lobbyists outperform their benchmarks when trading connected stocks, and politically connected corporate insiders made unusually profitable trades during the 2007-2009 financial crisis. However, evidence on whether politicians themselves profit from their policy knowledge remains mixed.

Politics and Household Finance

A growing body of literature documents how partisan identity influences individuals' economic expectations and financial decisions. Americans who align with the president's party express more optimistic expectations about the economy and the stock market, and this partisan gap has widened over time. These beliefs influence real decisions: partisan identity affects stock market participation, portfolio allocation, entrepreneurship rates, and even residential location choices.

Interestingly, while partisans disagree sharply about economic prospects, this doesn't translate systematically into different consumption behavior. The disconnect between expectations and actions remains an open puzzle.

Geopolitics and Global Capital Flows

Recent geopolitical events, such as the US-China trade war, the war in Ukraine, and the widespread imposition of tariffs, have highlighted how political relations between countries shape international capital flows. Research indicates that bilateral political distance has a significant impact on foreign direct investment, portfolio flows, cross-border mergers and acquisitions, syndicated lending, and global supply chains.

Since the start of the war in Ukraine, capital flows between geopolitically distant blocs have declined significantly relative to flows within the same bloc. Whether this trend toward ‘friend-shoring’ and geoeconomic fragmentation will persist and at what cost to economic efficiency remains an important question.

Where Do We Go From Here?

Despite rapid growth in this literature, many important questions remain unanswered:

Which money matters? With multiple forms of political activity available, we still don't fully understand which types are complements or substitutes, or which deliver the best returns. This question has become more pressing since the Citizens United decision fundamentally reshaped campaign finance.

What about relational contracts? Emerging evidence shows that partisan identity influences supply chain relationships and global sourcing decisions. How does political polarization affect trust-based business relationships more broadly?

When do politicians benefit? While we know political connections benefit firms, there's surprisingly little direct evidence of what politicians gain from these relationships, beyond limited evidence on legislative voting.

What theories explain equilibrium behavior? Most political economy theories focus on abstract interest groups and legislators, not firms. We need better theoretical frameworks for understanding firm-politician interactions, particularly how political factors get priced in asset markets.

The intersection of politics and finance has never been more relevant. As government intervention in markets intensifies, corporate political engagement grows, and geopolitical tensions reshape global capital flows, understanding these dynamics becomes essential, not just for investors and managers, but for policymakers and citizens concerned about the functioning of democratic capitalism.

The authors’ full article can be found here.

Pat Akey is an Associate Professor of Finance at ESSEC Business School.

Nandini Gupta is a Professor of Finance at Indiana University's Kelley School of Business.

Stefan Lewellen is an Assistant Professor of Finance at Penn State's Smeal College of Business.

OBLB types:

OBLB keywords:

Jurisdiction:

Share: