In a paper published in the July 2021 edition of the Law Quarterly Review, we argue that cases concerning the conflict of laws can provide very useful broader lessons as to the nature and operation of trusts. A recent example of just this point is provided by Fancourt J’s judgment in Byers v Samba Financial Group. It is the latest milestone in the long running Akers v Samba saga; it is unlikely to be the last, as an appeal is pending. Here, we explain why the judgment has important consequences even for purely domestic cases and why we think Fancourt J was right about the nature of a knowing receipt claim.

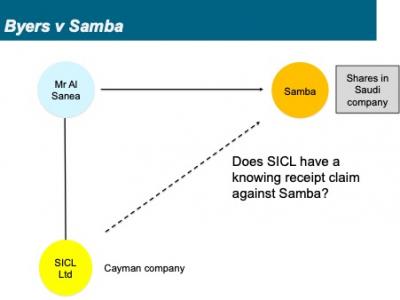

The initial claim in Akers v Samba arose out of a number of transactions that took place between 2002 and 2009, by which Mr Al Sanea effectively declared himself trustee of shares for SICL, a company with which he was closely associated. The trust was governed by Cayman law but as the shares were in various Saudi companies the law generally governing transactions in the shares was Saudi law. Subsequently, and in breach of trust, Mr Al Sanea caused the shares to be transferred to Samba (a company of which he was a director). The liquidators of SICL sought to set aside the transfer under the Insolvency Act 1986, s 127 on the basis that it was a disposition of SICL’s property after the company had gone into liquidation. The Supreme Court recognised that SICL’s rights under the trust counted as ‘property’ for the purposes of s 127 (with Lord Sumption noting that, under s 436 of that Act, the definition of ‘property’ is ‘exceptionally wide’) but concluded that there had been no ‘disposition’ of SICL’s property. This was the case even if, as was assumed, it was not possible for SICL to assert its equitable interest against Samba – the mere absence of such a claim by SICL did not make Al Sanea’s transfer a ‘disposition’ of SICL’s interest. As Lord Sumption put it: ‘

The liquidators of SICL then made a claim against Samba in knowing receipt, which was heard and rejected by Fancourt J in Byers. The knowing receipt claim was governed by English or Cayman law, and SICL had conceded that Saudi Arabian law governed the transfer of the shares from SICL to Samba. SICL argued however that an English court could nonetheless recognise a personal liability of Samba in knowing receipt. Fancourt J expressed the view that a ‘continuing proprietary base’ was necessary for the purposes of a claim in knowing receipt, which could not arise if from the moment of receipt the defendant had unassailable title to the trust assets. As Saudi Arabian law governed the transfer of the shares, and it did not recognise SICL’s pre-existing equitable right to them, at the moment of receipt Samba took good title to the shares, and so SICL’s claim failed.

First, Byers sheds light on the general nature of knowing receipt. Fancourt J held that knowing receipt and the equitable proprietary claim are inextricably connected. He described knowing receipt as ‘a claim on behalf of an equitable owner to recover its property or compensation for the failure to restore it’ and held that SICL’s claim depended on its continuing equitable interest in the shares. Although Samba’s liability in knowing receipt may have been a personal liability to make good the value of the lost shares, crucially that personal liability depended on receipt of trust assets in which SICL could assert an equitable interest. It followed that if SICL’s interest in the shares was extinguished by the lex situs, so was the knowing receipt claim.

Second, this analysis has an important domestic consequence. Just as the lex situs may give a defendant unassailable title, regardless of notice of a prior equitable interest, so may a land registration scheme. Indeed, referring in particular to the analysis of Conaglen and Goymour, Fancourt J considered that where the Land Registration Act 2002 prevents the assertion of an equitable interest, no knowing receipt claim is available. Byers thus demonstrates that a recipient may be protected in certain circumstances even if her conscience is affected by knowledge, such that she would otherwise be under an equitable duty to the claimant.

In our view, this understanding of a knowing receipt claim, seeing it as inextricably linked with the equitable proprietary claim, has much to commend it (in passing, it also raises a question mark as to the application of knowing receipt in cases where there is a breach of fiduciary duty but no pre-existing trust). However, care is needed as references to a ‘continuing proprietary base’ and ‘continuing equitable ownership’ tend to suggest that equitable rights under trusts are ownership rights. That causes two problems. First, remember that in Akers, the Supreme Court emphatically held that an English court can enforce a trust even if the assets are located in a jurisdiction which does not recognise the trust. The idea is that the English court is not interfering with the trustee’s property rights under the lex situs: it is merely directing the trustee as to how she must exercise those rights so as to comply with her obligations of conscience. If the beneficiary of a trust really has proprietary rights, or a form of ownership, departing from the position under the lex situs in this way would be difficult to defend. Second, in Akers, Lord Sumption emphasised that the beneficiary’s interest is effective against a third party recipient only in so far as the third party’s conscience is affected. But how can a beneficiary’s rights under a trust count as ownership if they are not prima facie enforceable against the world?

The way to resolve these difficulties, we argue, is to see the equitable proprietary claim as relational: in other words, it depends on showing a reason for which the specific defendant has come under a liability or duty to the claimant. A pre-existing equitable interest is important because it opens up a particular reason for finding such a liability or duty or, in other words, a particular reason for which the defendant’s conscience may be affected. That reason requires both the defendant’s acquisition of a specific right, and the defendant’s having or acquiring knowledge of the claimant’s pre-existing interest whilst still holding the right received or its traceable proceeds. As Fancourt J held, if the party has the asset and knows about the breach of trust, she must deal with the asset as a trustee should, by restoring it or, failing that, making good its value. A knowing receipt claim can be seen as simply another way of giving effect to the same relationship that must exist before an equitable proprietary claim can be made.

As Fancourt J noted, a knowing receipt claim is thus different from a dishonest assistance claim. In our view, this is because the latter claim, unlike the former, does not depend on the defendant’s having acquired any specific rights. As a result, the latter claim, unlike the former, is not barred by a rule (whether arising from the lex situs, or from a land registration scheme) which prevents the claimant from asserting a pre-existing interest in the right acquired by the defendant.

Finally, to return to the conflicts perspective, it is worth noting the pragmatic advantages of the outcome reached by Fancourt J. A third party who acquires assets from the legal owner should be protected from having to investigate whether there is anyone else who might have a claim to those assets under a different legal system. As pointed out to us by Professor Robert Stevens, this concern is particularly relevant where the third party acquires rights under a negotiable instrument, as the domestic rule that applies in such cases may protect the third party from any and all pre-existing rights (equitable and legal). This was the position in Macmillan v Bishopsgate Investment Trust Plc (No. 3), but not in Byers, and so the pragmatic reasons for protecting the defendant in Byers may not have been as strong as they were in Macmillan. Even so, in our view the application of the lex situs in Byers is still conceptually justifiable. In a knowing receipt claim, the reason for which the defendant’s conscience is affected includes the fact that she has received a right from a party holding on trust. It follows that the law that governs the transfer of that right should be relevant to the defendant’s liability.

It remains to be seen what view the Court of Appeal will take on any of these issues in the Byers appeal. But the case demonstrates that the intersection of trusts law and the conflicts rules continues to force judges to grapple with the conceptual underpinnings of trusts law in a refreshingly explicit way.

--

How to cite this blogpost (Harvard style):

Agnew, S. and McFarlane, B. (2021). The Nature of Trusts and the Conflict of Laws. Available at: https://www.law.ox.ac.uk/research-and-subject-groups/property-law/blog/2021/07/nature-trusts-and-conflict-laws (Accessed [date])

Share: