Holding USS Directors Accountable, and the Start of the End for Foss v Harbottle?

Posted:

Time to read:

In McGaughey and Davies v Universities Superannuation Scheme Ltd [2022] EWHC 1233, the High Court held that beneficiaries of a pension trust corporation can bring a derivative claim against its directors for breach of duty. However, it also held the claimants’ claims did not fall within the exceptions to the rule in Foss v Harbottle. My name is on this claim, but it is really an action that Dr Neil Davies, certain esteemed legal scholars, and I organised with over 5500 donors, and we’re doing it for every university staff member, who holds the economic interest in USS Ltd. The donors reject the directors’ conduct of the UK’s biggest pension fund. We say they breached their statutory duties with a nonsense valuation method, cuts that have a discriminatory impact, failure to contain costs, and failure to divest fossil fuels. We were able to directly access barristers David Grant QC and Gus Baker, and so mitigate the incredible financial obstacles that deter derivative enforcement of directors’ duties. We are seeking leave to appeal because the High Court’s judgment makes any remedy for statutory rights impossible. It could be the start of the end for Foss v Harbottle, and it is significant for company lawyers worldwide.

1. The key claims

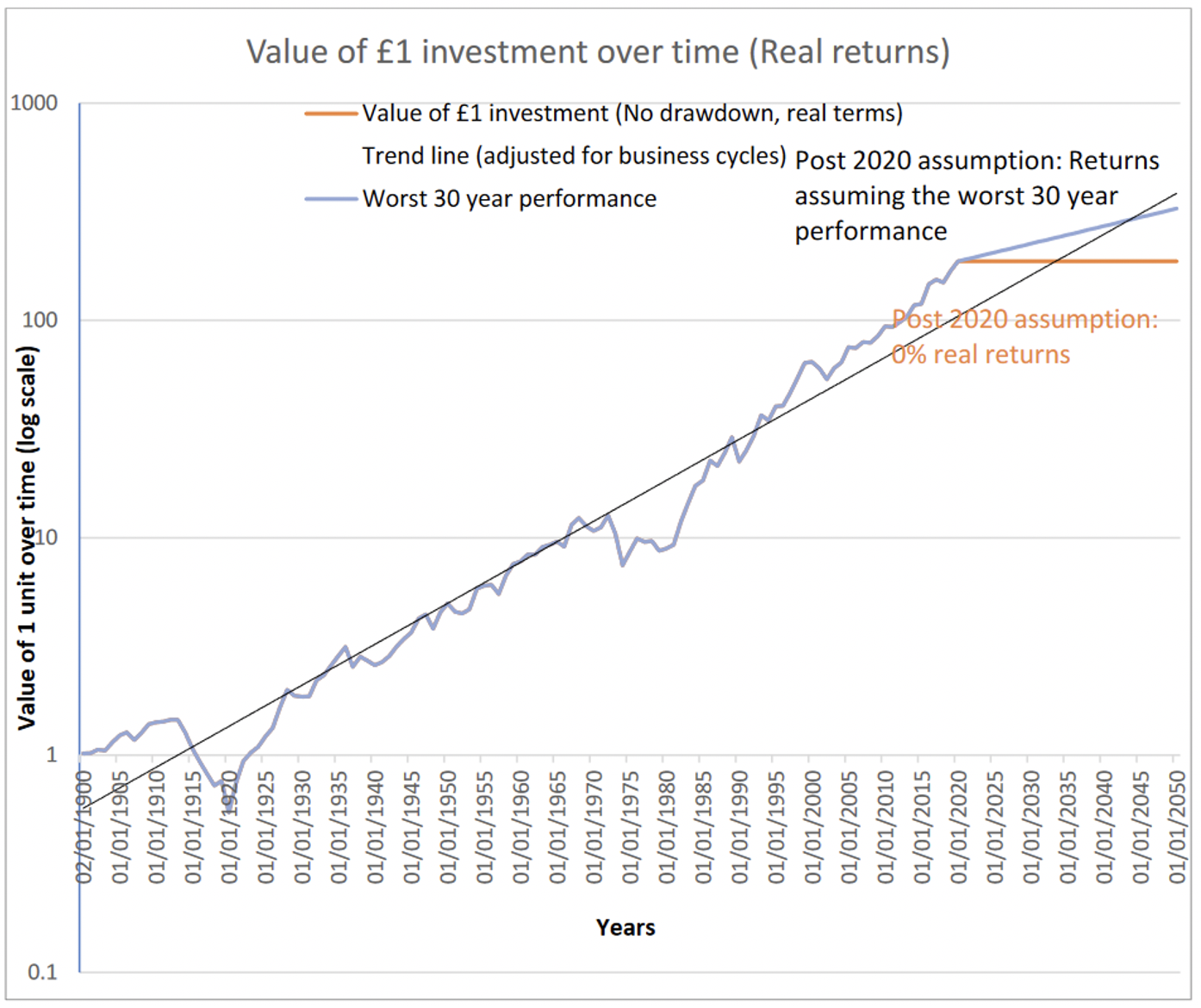

(1) The valuation ‘deficit’ was nonsense, and an abuse of power

The claimants first submitted that the directors breached the duty to act for proper purposes under CA 2006 section 171 by valuing the pension in the Covid-19 crash on 30 March 2020, predicting a £17.9 billion deficit, and then cutting benefits. The valuation method assumed there would be ‘0.0%’ asset growth above CPI inflation for 30 years, when there was in fact 30% growth in the next 2 years. The objects of USS Ltd are to provide benefits ‘solely or primarily for the benefit of university teachers or other staff of comparable status’ (article 71), while the Pensions Act 2004 section 222 requires there are sufficient assets to cover future liabilities (the statutory funding objective), and the Occupational Pension Schemes (Scheme Funding) Regulations 2005 regulation 5 require valuations are done with ‘an appropriate margin for adverse deviation’. Compared to the £17.9bn predicted “deficit”, by March 2022 there was £22.1bn more (assets from £66.5bn to £88.6bn). The claimants submitted that USS had acted improperly, and Prof Raghavendra Rau’s research was to be preferred, that even if USS went through the worst era of depression and war (an improperly pessimistic assumption), there would still be over a £30 billion surplus:

Thus, the directors had used their powers in setting valuation assumptions, and driving through cuts averaging one-third to benefits, improperly, violating section 171(b). They ignored the fact that their assumptions were never historically true, the better evidence of what is likely, and the actual facts that they had been using were wrong. This is not directors using their powers ‘for the benefit of university teachers’.

The claimants submitted evidence of an ulterior motive (s 171) and bad faith (violating CA 2006 s 172) from the USS Ltd ‘CEO’ Bill Galvin. He told a board meeting in 2019 ‘DB pensions in the UK have failed. This is not controversial.’ Galvin sits on a subsidiary board, yet ‘pulls the strings’, so the claimants submit he is a ‘shadow director’. In 2018 he tried to close the defined benefit plan completely, only stopped by huge strikes, which included the threat to remove the Oxford Vice Chancellor. But this time the directors changed the constitution so that they are irremovable except by the existing board. They drove through a cut to defined benefits (from £60k to £40k) on 1 April 2022, with an inflation cap on benefits of 2.5%, and a slash to the accrual rate from 1/75th to 1/85th of salary each year. By the USS constitution and section 172(2), the interests of beneficiaries are the interests of the company. The directors pursued an agenda that damaged both.

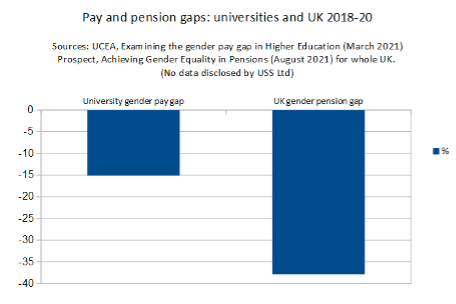

(2) Discriminatory impact on women, young people and minorities

Second, the claimants argued the directors breached CA 2006 section 171 because the cuts indirectly discriminate against women, minorities, and young people, violating the Equality Act 2010 sections 19 and 61, and expose USS to a litany of discrimination claims. Women tend to live longer than men on average, so cuts to guaranteed income pensions put women at a ‘particular disadvantage’. They make the gender pay gap and ‘gender pension gap’ even worse: we do not yet have data from USS on how much worse.

Moreover, the cuts are to future benefits, not accrued rights. This particularly disadvantages young people, and younger staff are more often from minority backgrounds: this is indirect age and race discrimination. Durham University itself concluded there could be indirect discrimination. USS has ignored this. It bought, but did not publish, legal advice. It has released no equality data. It has published no equality impact assessment.

Could the cuts be objectively justified to pursue the statutory funding objective? USS must show its action is proportionate, a threefold test. Its action must (1) be suitable to achieve the aim, (2) go no further than necessary, using the least discriminatory means, and (3) strike a reasonable balance. Even if there were a deficit, USS could simply cut its super-inflated costs, not the pension.

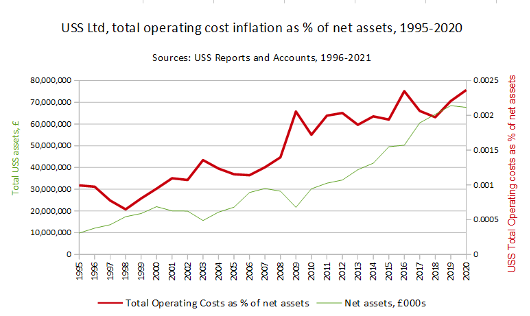

(3) USS cost super-inflation

Third, the claimants submitted the USS directors breached the duty to avoid conflicts of interest in CA 2006 section 175, by super-inflating costs. Cutting costs, not the pension, is a non-discriminatory means of achieving the legitimate aim of the statutory funding objective, as is required by the Equality Act 2010 section 19. Total operating costs have risen from £40m a year to £160m since 2010, and as a percentage of assets from 0.125% of assets to 0.236% in 2020. The pay of the failed CEO, Bill Galvin, inflated from £291,000 to £756,000.

Conjuring deficits, and driving cuts, is apparently a very expensive business, and rewarding for some. Section 175 clearly applies to any ‘exploitation of property’, such as directors inflating bureaucracy at others’ expense.

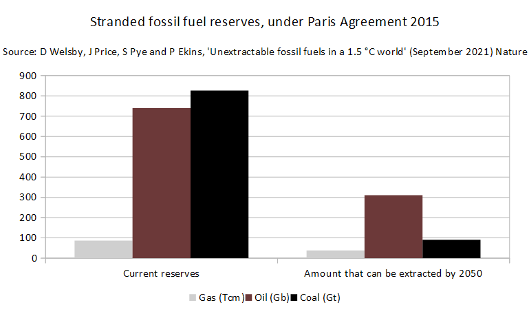

(4) Failure to divest fossil fuels

The claimants’ fourth claim is that the directors are causing ‘significant risk of financial detriment’, violating section 171, by failing to divest fossil fuels (see [2020] UKSC 16, [25], [43]). Fossil fuels have been the worst performing assets since 2017. The claimants submitted an Imperial College Business School empirical study showing across a range of portfolios, ‘renewable power generated higher total returns relative to fossil fuel’ for over 10 years (p.3). In future, these risks of loss will accelerate. Fossil fuel companies have billions in ‘stranded assets’ that simply cannot be drilled, mined or burned if the world stays within the Paris Agreement 2015, and protects the right to life. Gas, oil and coal already cost too much, and risk massive financial detriment. This violates section 171.

The claimants highlighted the conflicted careers of USS directors: Dame Kate Barker worked for the coal industry. Other directors worked at JP Morgan, Citi, and HSBC, institutions that still bankroll fossil fuel projects. In November 2020, USS members were surveyed and said they wanted to divest. The directors hid the results. Then in March 2022, USS lost £450m in Russian fossil fuel investments. The directors have a status quo bias, leading them to ignore the financial risk of fossil fuels to the beneficiaries, and what beneficiaries want.

2. Leech J’s decision, grounds of appeal, and Foss v Harbottle’s end

Before trial on the substance, the claimants needed permission to sue the directors in the company’s name through a derivative claim. The Companies Act 2006 sections 260-263 codified a derivative claim for members of companies. However, in USS Ltd, the directors are the members. They will not sue themselves. There must be some other means to enforce statutory directors’ duties. As beneficiaries of the pension corporation, the claimants relied on the principles in Re Fort Gilkicker [2013] EWHC 348, [24] and [51] and McDonald v Horn [1995] 1 All ER 961, that they had standing. The beneficiaries of a pension corporation hold the economic interest in the company, and are suitably qualified stakeholders. The judge accepted this. But the claimants then had to argue that, at common law, they fulfilled the ‘fraud on the minority’ exception to the rule in Foss v Harbottle (1843) 2 Hare 461, a case decided 10 years before Charles Dickens’ Bleak House. The judge rejected the claims based on at least four flawed understandings of the law.

(1) Consistency with statute

The claimants submitted that derivative claim procedure at common law should be viewed consistently with statute, to ensure directors duties are enforceable. Statute requires a prima facie case to be shown (s 261), and then the court asks (among other things) whether permission to continue the claim would be in the interests of the company (s 263). In the case of USS Ltd, this means whether the claim is in the interests of beneficiaries (s 172(2) and USS Ltd, art 71). The USS directors’ lawyers and Leech J simply did not engage with this fundamental issue. At one point, Leech J noted he would not explain the directors’ duties at all: his judgment was already ‘lengthy’ [151]. This is central to appeal because it is fundamental that ‘if a statute gives a right, the common law will give remedy to maintain it’: Holt CJ, Ashby v White (1703) 92 ER 126. Common law ‘developments must be consistent with legislative policy as expressed in statutes’, not undermine them: Johnson v Unisys Ltd [2001] UKHL 13, [37] per Lord Hoffmann, and [80] per Lord Millett.

(2) A new statute-defeating ‘reflective loss’ hurdle

Flowing from the common law undermining statute, a second problem is that Leech J held there was a new requirement of ‘reflective loss’. The claims were rejected ‘because [the company] has suffered no loss which is reflective of the loss suffered by the Claimants themselves’ [130], and [159]-[160], [191] and [30]. The ‘reality is’, wrote Leech J, that the claimants ‘are seeking to prevent USSL from implementing the changes’ to the pension fund, not complaining of a breach of director’s duty. This new hurdle was derived from reading Waddington Ltd v Chan Chun Hoo Thomas [2009] 2 BCLC 82, where Lord Millett said there is a legitimate interest to sue a company director where any ‘depletion of a [company’s] assets causes indirect loss’ to a claimant.

This misunderstands the reflective loss rule. That prevents double recovery by claimants in personal actions. Lord Millett was explaining where a derivative claim may be legitimate, not saying there should be an additional hurdle. It makes impossible the enforcement of any directors’ duty that does not require proof of loss, such as the duty to act for proper purposes (s 171), to act in good faith (s 172), or cases where directors take conflicted opportunities and make a gain, but cause no ‘depletion’ of a company’s assets (s 175). It would even make a case like Cook v Deeks [1916] UKPC 10 impossible.

(3) A statute-defeating ‘financial benefit’ requirement

A third problem is that Leech J accepted the USS directors’ argument ‘that [directors must] have improperly benefitted themselves at the expense of the company (although the nature of that benefit need not be exclusively financial).’: [43], applied at [145], [162]-[163], [178] and [192]. This came from Harris v Microsfusion LLP [2016] EWCA Civ 1212 where McCombe LJ states at paragraph [31] there may be a need to show dishonest or deliberate conduct, or a personal benefit from a directors’ breach. However, at [29] McCombe LJ also accepted that action to ‘to further [one’s] own ends and in that sense to gain a personal benefit’ was sufficient to begin a derivative claim.

The claimants submitted there could be no requirement of financial benefit if that made statutory duties impossible to enforce. Harris should be read broadly so that ‘furthering one’s own ends’ was merely the opposite of ‘not acting in the interests of the company’ as in section 172. In McDonald v Horn another Court of Appeal held ‘lack of conformity with interim deeds’ could enable a derivative claim by analogy. In Re Fort Gilkicker Ltd, [18], Briggs J said a derivative claim is available for any breach of fiduciary duty except ‘mere negligence’. In Estmanco v Greater London Council, Megarry VC said a derivative claim is available to stop ‘abuse of power’. Again, there was no engagement with the principle that ‘if a statute gives a right, the common law will give remedy to maintain it’.

A considerable problem is that Harris drew upon Abouraya v Sigmund [2014] EWHC 277 (Ch), which said ‘all the authorities on direct derivative actions’ require ‘that the alleged wrongdoing should result in a … reflective loss to the shareholders and also that the alleged wrongdoers should have personally gained from their breaches of duty.’ This is staggeringly wrong. Consistent authority, like Edwards v Halliwell [1950] 2 All ER 1064 (CA), shows that derivative claims are available for simple breaches of constitutional rules, or when actions are ultra vires, with zero requirement for reflective loss or personal benefits. Common law cannot destroy statute.

(4) Failures to engage with evidence and the law

On the ‘merits’ of each claim, Leech J’s new requirements of reflective loss and financial benefit foreclosed any chance of remedy for breach of section 171, 172 or 175—anything except self-dealing, secret profits, or theft. Ahead of any data or disclosure from USS, Leech J still went onto reject the claims, but missed key issues:

- on the valuation, Leech J said there was no need for a trial because USS directors paid for ‘expert advisers’, their decisions did not fall ‘outside the ambit of the discretion of a pension fund trustee’, and the directors could not be said to have influenced the decision of the Joint Negotiation Committee to cut the pension: [150]. He accepted the USS directors could prefer accrued members’ rights over future benefits [141], despite the submission that this went against the pension corporation’s very objects. He did not engage with the key point that the USS directors invented a growth assumption of 0.0% above inflation for 30 years, and ignored the fact that assets grew by 30% in under 2 years. He failed to cite the actual statutory duty—section 171—instead citing sections 172-176 ([151]);

- on discrimination, Leech J accepted the USS directors’ submission that ‘the need for more money than your comparators... does not establish the disadvantage required for indirect discrimination’, and ‘comparison between future pension accrual and past pension accrual is not a permissible comparison’: [167]. Yet the question is whether there is a ‘particular disadvantage’ of any kind: Homer v Chief Constable of West Yorkshire Police [2012] UKSC 15, [12]-[13]. Once shown (and here it is, eg at [96]) objective justification is up to the defendant;

- on costs, Leech J said the claimants failed to provide ‘particulars of the individual breaches of duty which they allege the Directors have committed’ [184], but missed that reducing costs is a proportionate means of pursuing a statutory funding objective, which has no discriminatory impact;

- on fossil fuels, Leech J accepted it was enough for USS to have ‘adopted an ambition of Net Zero by 2050’, and (ostensibly) Cowan v Scargill was the applicable case. Yet, the test is whether there is a ‘risk of significant financial detriment’ from fossil fuels, approved by the Supreme Court, from Harries v Church Commissioners and the Law Commission. Cowan v Scargill has been significantly updated, or is no longer good law. Evidence from Imperial College London that renewables already consistently outperform fossil fuels was ignored, as was evidence of future risks.

3. Conclusions: one step forward, three cartwheels back

The judgment of Leech J takes one big step forward in recognising the standing of beneficiaries of a pension trust corporation to bring a derivative claim. But it takes three steps—if not cartwheels—back. First, it construes the exceptions to the rule in Foss v Harbottle to have a new requirement of reflective loss. Second, it asserts that only breaches of duty that financially benefit a director can be remedied. Third, it enabled the directors to effectively conduct a mini-trial at the company’s expense to defend themselves with thousands of pages of documents. The judge was swamped, and missed central parts of the claimants’ case. The problems all begin with a statute-defeating construction of the arcane rule of Foss v Harbottle. On appeal, this should assimilated to the statutory procedure, or Foss v Harbottle should end.

Ewan McGaughey is Reader at the School of Law, King's College London, and Research Associate at the Centre for Business Research, University of Cambridge.

Share: