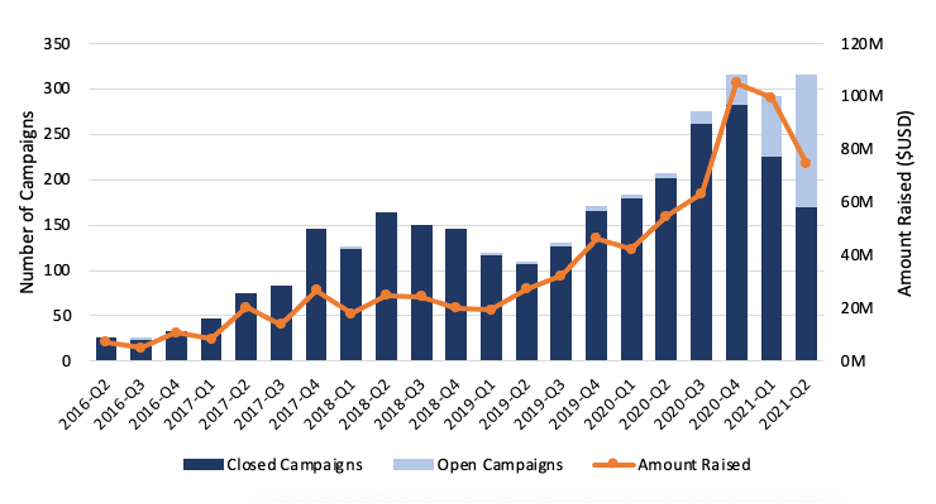

The securities-based regulation crowdfunding market in the United States has grown rapidly from $23 million of capital raised in 2016 to $244 million in 2020. Figure 1 below displays the number of new campaigns and the aggregate amount raised in each quarter over time. The growing size of crowdfunding markets has increased the need to assess the governance mechanisms which facilitate successful fundraising. Without proper governance structures, there is potential for agency problems whereby entrepreneurs can take actions to enrich themselves at the expense of the investors.

Figure 1 (Source: https://business.fau.edu/equity-crowdfunding-tracker/)

In a new paper we introduce a dataset covering all of the SEC-regulated securities-based crowdfunding campaigns in the United States since the market’s inception in May 2016 up until June 2021. Our paper focuses on three mechanisms for facilitating success in US securities-based crowdfunding pertaining to Delaware incorporation, security design, and crowdfunding platforms.

Securities-based crowdfunding in the United States began with the approval of the JOBS Act, signed into law by President Barack Obama on April 5th, 2012. The JOBS Act aimed to revitalize small business growth by democratizing start-up financing. The Title III provision expanded regulated securities-based crowdfunding in the United States beyond just accredited investors to all investors and allowed firms to start raising regulated crowdfunding capital beginning May 16th, 2016. The adoption of crowdfunding has led to significant investment into start-up ventures without having to comply with the arguably burdensome and costly rules and regulations governing traditional IPOs.

The first governance mechanism we examine is the incorporation location of a firm. In the US, firms can self-select an incorporation location that differs from the business’s physical location. The cost, taxation, and corporate laws associated with this incorporation status vary between states, therein making incorporating in some states more advantageous than others. Incorporation in the state of Delaware arguably offers the best possible solution for equity crowdfunding. Entrepreneurs appear to be keenly aware of this too. 45.4% of the campaigns in our sample of 4,015 campaigns are incorporated in Delaware. Crowdfunding investors prefer to invest in Delaware incorporated firms because of the relatively superior operational benefits derived from a legal system that operates smoothly and efficiently, well-established corporate laws, a tendency to fast-track business cases through the experienced Court of Chancery, and minority protection. While prior research has found that the effect of Delaware incorporation on IPO success has declined or disappeared over time, we instead find that Delaware incorporation matters considerably for success in securities-based crowdfunding. Delaware incorporation allows crowdfunders to raise 38% more capital and increases the probability of successful fundraising (achieving the desired capital goal) by 4% on average.

Crowdfunders can offer many forms of investment contracts. The most common security types in our sample are SAFEs (Simple Agreement for Future Equity) (26%), Debt (24%), and Common Stock (20%). Less popular security types are Preferred Stock (7%), Convertible (6%), and Membership Units (3%). Prior research on crowdfunding security design suggests that funding platforms provide standard form investment contracts such as the SAFE to minimize transaction costs and also to provide investors with safeguards that angel investors and venture capitalists seek when investing in nascent firms. We find that common and convertible securities increase the probability of a successful offering by 20-25% (and increase the amount raised by 39%). In comparison, debt reduces the probability of a successful offering by 27% (and reduces the amount raised by 21%). These findings are consistent with the view that there are pronounced agency costs associated with debt for start-ups in this marketplace, including risk shifting, underinvestment, adverse selection, and asset stripping.

The last governance mechanism we examine is the role of platforms. Crowdfunding platforms are intermediaries between entrepreneurs and a heterogeneous set of investors. These platforms provide investors with detailed information about each start-up campaign listed on their website, including the management team, business plan, social media, current fundraising totals, and more. Over 70 securities-based crowdfunding platforms have emerged in the US market since 2016. Among the most popular are Wefunder (which has 26% of all campaigns) and StartEngine (20%). Some platforms take ownership of their listed companies, some charge a higher commission for the capital raised, and some do more due diligence than others. We find evidence that success varies greatly across platforms and conclude that platforms likely play an essential role in mitigating and sometimes exacerbating information asymmetries and agency problems.

Equity and other securities-based crowdfunding are still in their infancy. The richness of data available offers many future angles to explore at the intersection of finance, entrepreneurship, management, and law. We provide an up-to-date version of the data online through ‘The Equity Crowdfunding Tracker’ at Florida Atlantic University. The tracker provides interactive graphs on the number of campaigns, amount raised, success rate, a state heat map, and other dynamics.

Douglas Cumming is the DeSantis Distinguished Professor of Finance and Entrepreneurship at the College of Business, Florida Atlantic University.

Sofia Johan is an Associate Professor of Finance at the College of Business, Florida Atlantic University.

Robert Reardon is a PhD Candidate in Finance, and a research and teaching assistant at the College of Business, Florida Atlantic University.

OBLB categories:

OBLB types:

Share: