When the Means Undermine the Ends: The Leviathan of Securities Law and Enforcement in Digital-Asset Markets

Posted:

Time to read:

The famous quote from Machiavelli’s The Prince states that ‘in the actions of all men, and especially of princes [i.e., the regulators], one judges by the result’. In short, the end justifies the means. In my article, I address a situation where the means undermine the regulatory ends. This dilemma between the ends and the means materializes when large bureaucratic institutions with sprawling divisions in charge of various aspects of their statutory missions enforce the law without ensuring that enforcement comports with the missions.

The focus of my analysis is the US Securities and Exchange Commission (SEC or Commission). Created in the wake of the Great Depression, the SEC pursues a ternary set of regulatory objectives of protecting investors, maintaining fair and efficient markets, and facilitating capital formation. My article examines a crucial disconnect between enforcement efforts of the SEC and its statutory objectives in the digital-asset (also ‘cryptoasset’) markets. This disconnect between the ends and the means is profoundly detrimental to investors and innovators.

In contrast to many countries, the United States has yet to provide a regulation tailored to cryptoasset markets. Instead, its main financial market regulators rely on, and enforce, the existing pre-crypto securities and commodity regulations. The SEC in particular has become a global leader in terms of the magnitude and scope of enforcement against firms engaged in cryptoasset markets. Since mid-2017, the SEC has essentially been regulating digital-asset markets via enforcement (see here and here). A research paper that I am co-authoring with Irena Hutton and Hang Miao also suggests that digital-asset markets react negatively to SEC enforcement.

My article underscores that the SEC has a strong position in enforcement. The Commission has not lost a single case against crypto-firms, and most enforcement actions resulted in settlements, demonstrating the strength of the Commission vis-a-vis individual defendants and respondents. The SEC has targeted domestic and foreign cryptoasset issuers, crypto exchanges, and other market actors.

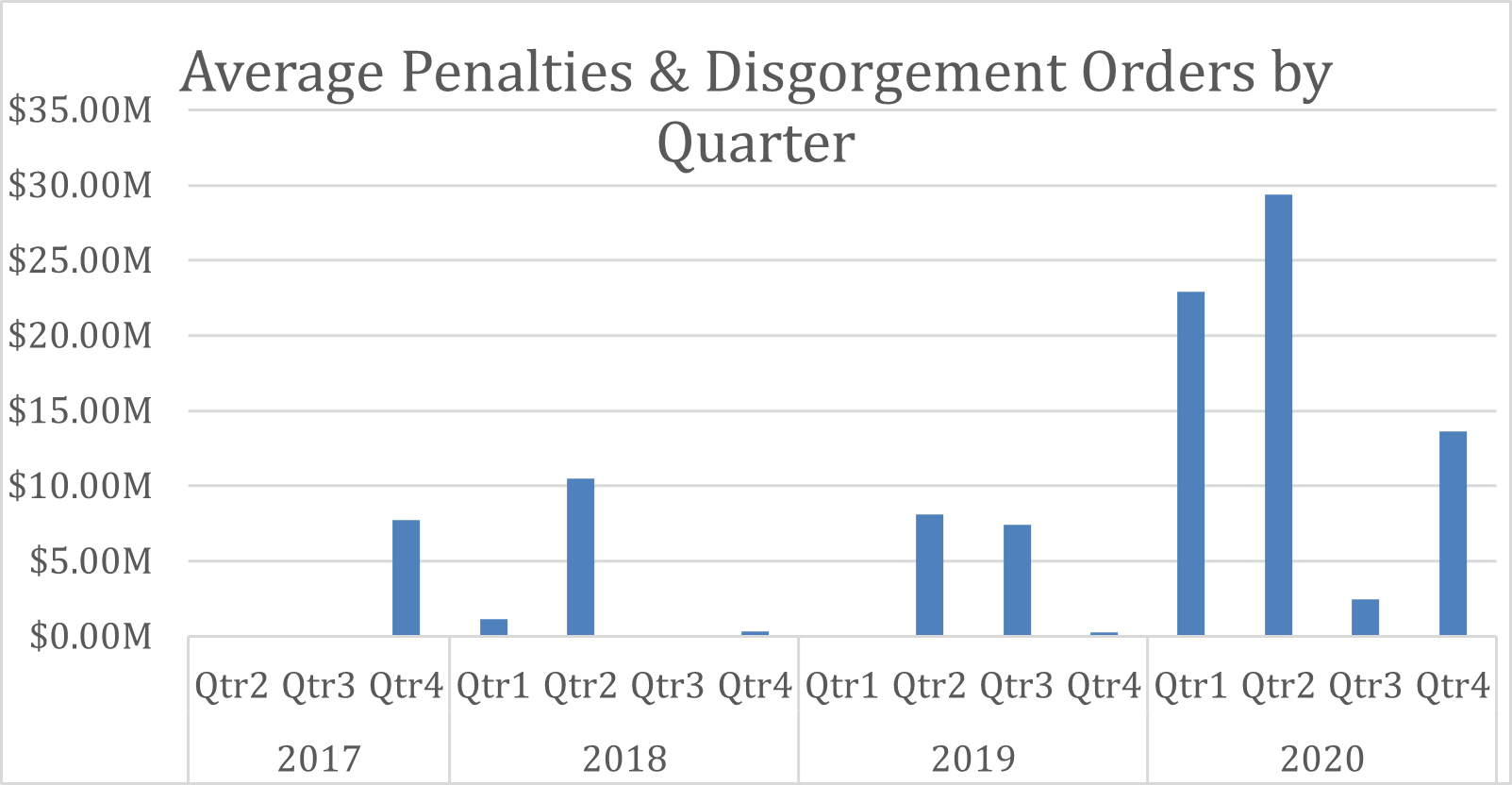

Figure 1 measures enforcement intensity by using the proxy of average civil penalties, disgorgement orders, and prejudgment interest, as well as settlements where issuers agreed to pay rescissory damages and return funds to investors. For simplicity, I refer to these payments as the ‘losses’ of defendants and respondents. The average enforcement ‘losses’ were considerable and increased sharply in the last quarter of 2017, after the first crypto-related enforcement actions.

Although the largest increase in ‘losses’ falls on 2020, a careful reading of the 2020 enforcement actions indicates that those cases mostly concerned events that occurred in 2017-2019 or earlier. The first increase in ‘losses’ was in 2017.

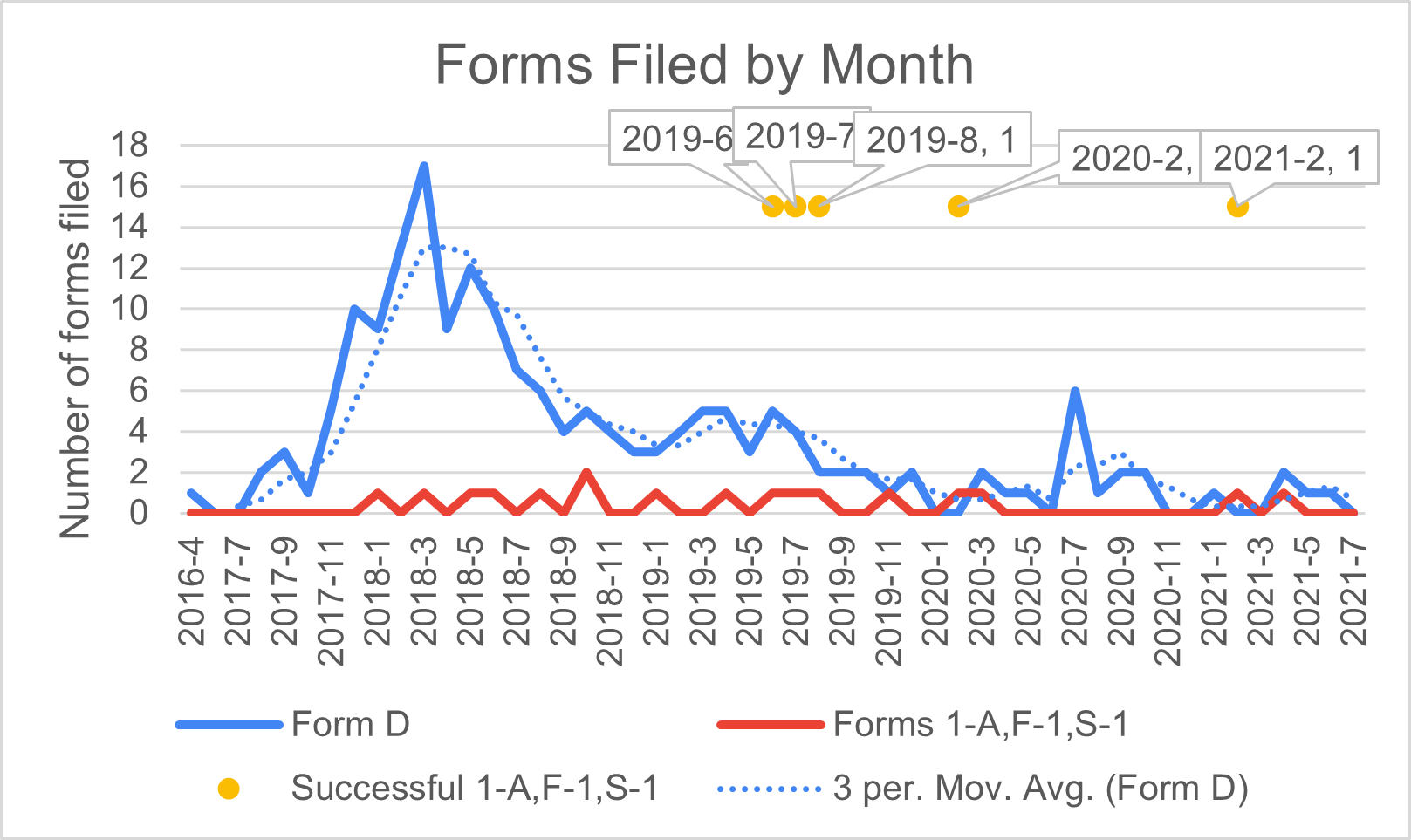

Enforcement has changed the behavior of cryptoasset issuers, nudging them toward compliance with exemptions from the registration provisions of the federal securities laws. Specifically, there was a significant increase in private placement filings following the 2017 enforcement events, which became potent policy signals. A clear spike in private placement filings (on Form D) occurred in 2018. The average number of filings increased 3.3 times the average for the whole sample and 2.1 standard deviations from the mean.

| Period | Average Form D | St Dev |

|---|---|---|

| 2017 H2 | 3.5 | 3.6 |

| 2018 H1 | 11.7 | 3.1 |

| 2018 H2 | 4.8 | 1.5 |

| 2019 H1 | 4.2 | 1.0 |

| 2019 | 2.2 | 1.0 |

Table 3: 2017 and a Significant Increase in Filings

Even though the doctrinal questions about whether cryptoassets were securities and whether the SEC had jurisdiction remained unsettled at the time, cryptoasset issuers preferred to ‘hide’ from the SEC in the light-touch private placements regime of Regulation D instead of having to face off with the Commission. Figure 3 substantiates this point and shows that cryptoasset issuers were reluctant to pursue public offerings (Form S-1 and Form F-1 filings), as well as offerings under Regulation A (Form 1-A filings). There were only one successful registration statement on Form F-1 and four qualified Regulation A offerings.

These data suggest that private placements began to dominate the capital-raising landscape in crypto in the wake of SEC enforcement. Alas, in private placements, investors receive less information compared with the disclosure in registered public offerings. My article examines the main regulatory regimes applicable to public and private securities offerings in the US and discusses why issuers of cryptoassets: 1) resort to private placement exemptions and 2) may disclose less rather than more information. This inadequate disclosure is harmful to investors (particularly the less sophisticated ones), future issuers of cryptoassets, and the market as a whole.

Is it thus possible that active enforcement of pre-crypto securities law has created a status quo that is antithetical to the Commission’s core missions of protecting investors and promoting efficient markets? If so, there is a profound disconnect between the ends and the regulatory means.

To resolve these issues, the article suggests, a formal rule is needed. Although in April 2021 one of the SEC Commissioners—Commissioner Hester Peirce—proposed a new rule on digital assets, the Commission has not engaged in rulemaking to date. Former Chairman Clayton seemed satisfied with a regulation-via-enforcement approach. In August 2021, Chairman Gensler staked out his position grounded in the need for strong investor protection and an expanded statutory authority of the SEC over cryptoasset markets. Recent bills, such as the Digital Asset Market Structure and Investor Protection Act, pursue similar goals. In light of this agenda, it is paramount for the regulators to mitigate the fundamental disconnect between the typical means of investor protection (ie, enforcement of pre-crypto regulations) and actually protecting investors in cryptoassets. Regulatory routes that are contrary to the lofty ideas of protecting consumers, facilitating capital formation, and promoting market efficiency and transparency benefit neither the consumers nor technological and financial innovation.

Yuliya Guseva is a professor of law at Rutgers Law School.

OBLB categories:

OBLB types:

Share: