Corporate Groups: Corporate Law, Private Contracting and Equal Ownership

Posted:

Time to read:

The median number of subsidiaries of the 50 largest companies in the MSCII World Index is 439, reflecting the prevalence of the corporate group as the most common form of business organization among large corporations.

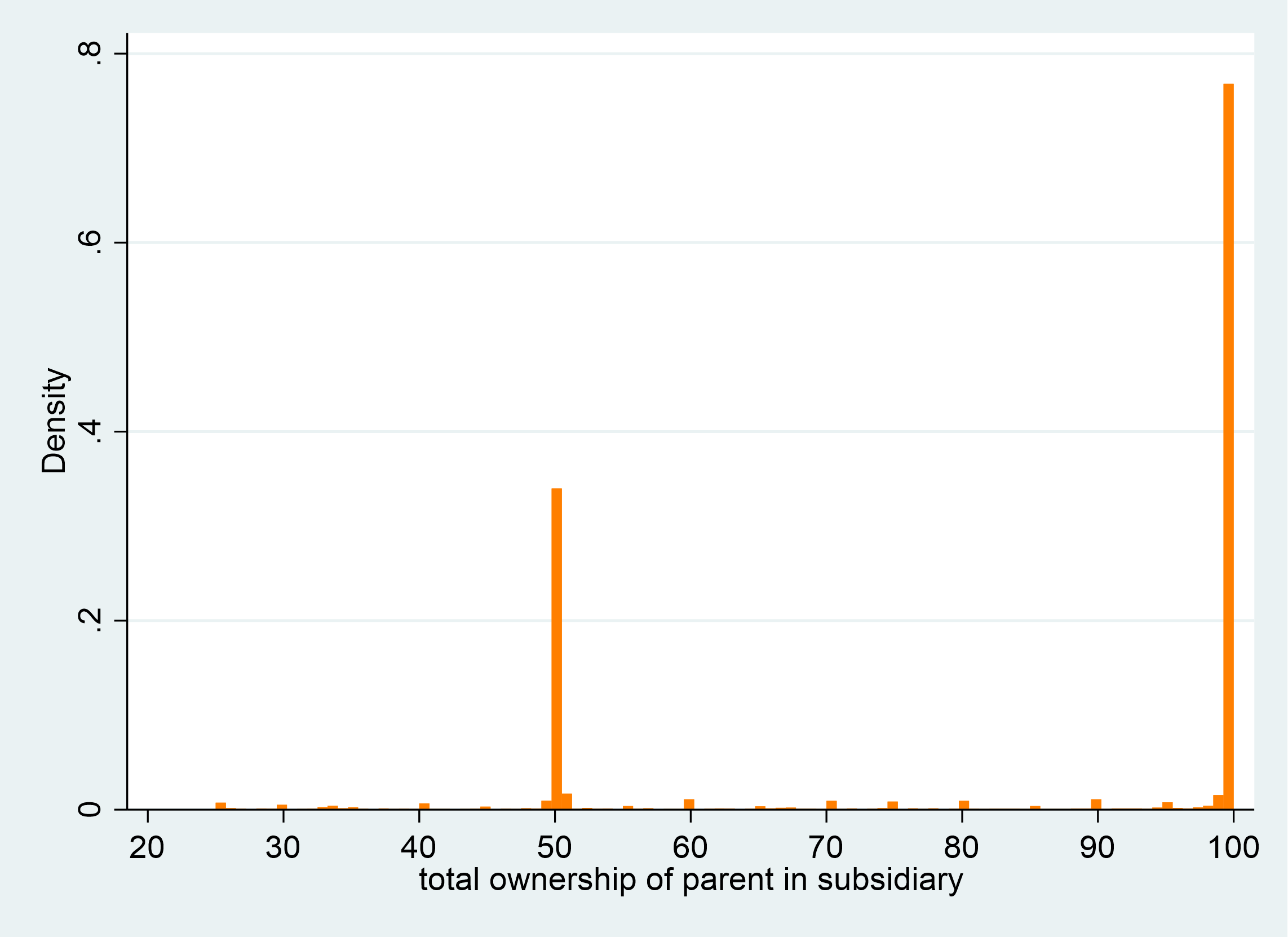

Legal scholars have debated how to best handle corporate group structures for a long time. Typically, unlike the literature in economics or management, legal analysis usually takes the group structure as a given. Thus, it does not usually consider the organizational or strategic reasons behind the choice of ownership structure for the subsidiaries. Legally, the group appears when the parent company is a controlling shareholder of the subsidiary company, irrespective of the size of its stake. We argue that the prevailing legal approach does not capture the whole picture: a closer look at the ownership data shows a very particular ownership distribution, with most subsidiaries being held by the parent with either a 100% or a 50% stake.

We try to make sense of these bimodal ownership distribution taking a broader view of groups that reunites findings from the economic, management, and legal literature on this phenomenon. Specifically, we define a corporate group as the linkage between two or more companies where one of these companies (the parent) is both a shareholder—most commonly, exercising control—and a significant business stakeholder of the other companies (the subsidiaries). The unique problems arising from this dual nature of the parent explain the prevalence of the extreme ownership structures we observe in the real world.

There are important economic rationales behind group formation. The parent places some assets in the subsidiary to benefit from regulatory arbitrage and/or from the cooperation of a minority partner in the subsidiary in managing those assets.

Ownership structures close to 100% are effectively placing part of the parent’s assets in a separate legal entity. This produces regulatory arbitrage gains for the parent by insulating these assets from creditors, tax authorities and other stakeholders. Regulatory arbitrage gives rise to conflicts between shareholders and other stakeholders which have been studied in depth by the legal literature. However, stakes equal to 50% are more difficult to justify and tend to be ignored by the prevailing legal literature on group structures. This is the case of joint ventures, where two shareholders hold each 50% shares, but also, more generally of groups where the parent owns 50% and a group of minority shareholders jointly own another 50%. In our paper we try to explain the prevalence of these ownership arrangements where the parent’s stake is 50%, forcing it to share control with other shareholder(s).

Interestingly, the critical situation from a corporate governance perspective arises precisely when the parent sets up a subsidiary with other shareholders. When we move away from full parent ownership, and leaving aside the small number of listed subsidiaries, the minority and the parent are both shareholders but also business partners. Generating incentives for their joint cooperation is the reason behind the creation of the group. Different ownership stakes will be granted to parent and minority in the subsidiary firm depending on their respective expected contributions to value creation. However, cooperation can be hindered by corporate governance problems. It is in this setting where 50-50% structures can arise as a ‘mechanism of last resort’ against expropriation of one shareholder by the other.

Equal ownership arrangements offer a strong solution to expropriation because they give both parties veto power. However, this is a solution of last resort because it comes with high cost in terms of deadlocks and a very inefficient decision-making process. Moreover, 50-50% structures distort cooperation incentives: both parties are given the same cash flow rights irrespective of their contribution to the joint production process in the subsidiary, which is very unlikely to be equal. Therefore, we argue that these ownership structures are used when alternative cheaper solutions to expropriation—legal protection and shareholders’ agreements—are ineffective.

Why is legal protection surprisingly inefficient in the group context? Corporate law allocates control according to ownership stakes and sets (i) prophylactic ex-ante measures to reassign control power when there is a high risk of expropriation and/or (ii) ex-post sanctions and compensation when the value of the subsidiary has been reduced by the conflicted decisions of the parent. Nevertheless, corporate law typically ignores the stakeholder nature of the parent and, because of this, legal rules that may serve well to curtail expropriation in stand-alone firms may prove ineffective or undesirable when dealing with corporate groups. Strict anti-expropriation rules disincentivize the parent from cooperating and lax anti-expropriation rules disincentivize the minority partner from doing so. Additionally, specific laws and regulations dealing with corporate groups, while acknowledging the stakeholder nature of the parent, commonly also fail to offer a workable legal solution to expropriation through business dealings.

Shareholders’ agreements offer an alternative protection mechanism for the minority partner in the subsidiary. These contractual arrangements provide protection from conflicts of interest by decoupling ownership rights from control rights: the minority can be granted control rights over some specific decisions even with a reduced stake (for instance through veto rights or the appointment of a given number of minority directors). The advantage of this decoupling solution is that it prevents expropriation while preserving both the parent’s and the minority’s incentives for cooperation as determined by the ownership stake that each party holds. Nevertheless, the efficiency of shareholders agreements will be critically determined by the balance between the bargaining power of the shareholders drafting the contract, and, more importantly in terms of policy implications, by the quality of contract enforcement in each jurisdiction.

We test these ideas using a very large international cross-section of parents and subsidiaries. Our results are consistent with our arguments and show that the prevalence of equal ownership structures is largely independent of the quality of minority protection from expropriation in the country where the subsidiary is located, but lower for subsidiaries located in countries where the quality of contract enforcement is high.

Our analysis and empirical results have important policy implications for the legal regulation of corporate groups. In the European context, a number of jurisdictions have opted to break away from the complete application of the anti-expropriation regulation in corporate law, and to develop specific group legislation to deal with their severe corporate governance problems. However, our analysis and empirical findings suggest that they may be fighting a lost cause and that corporate governance of groups with minority presence would benefit much more from efforts directed at ensuring the contractual enforcement of shareholders’ agreements within groups.

Maribel Sáez Lacave is a Professor in the Faculty of Law, Universidad Autonoma de Madrid and a research associate at the European Corporate Governance Institute.

María Gutiérrez-Urtiaga is Associate Professor in the Department of Business and Finance of the Universidad Carlos III, Madrid and a research associate at the European Corporate Governance Institute.

OBLB categories:

OBLB types:

Share: