The Wirecard Scandal: The High-speed Rise and Fall of a FinTech Company and Its Implications for Developed and Developing Economies

Posted:

Time to read:

Founded in Germany in 1999, Wirecard AG (‘AG’ is a public limited company formed in Germany) operated in the digital payment segment of the FinTech sector. The shares of Wirecard were listed in the DAX, the blue-chip index of Germany, and replaced the shares of Commerzbank AG as of September 24, 2018. Its market capitalisation was around € 24 billion in September 2018.

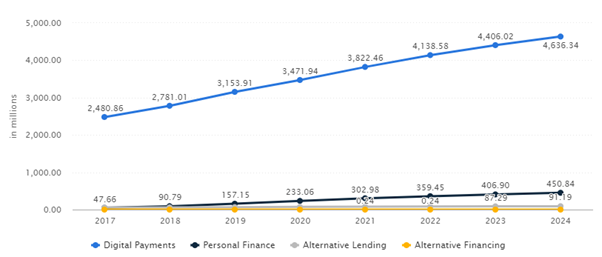

Digital payment companies appear attractive investment targets. As shown by Graph 1 below, the increase in the total amount of users in the digital payments segment is considerably steeper than that of other segments.

Graph 1: Forecast, Digital Payment Segment of FinTech, Number of Expected Users. Source: Statista (2020, Forecast, adjusted for the expected impact of Covid-19).

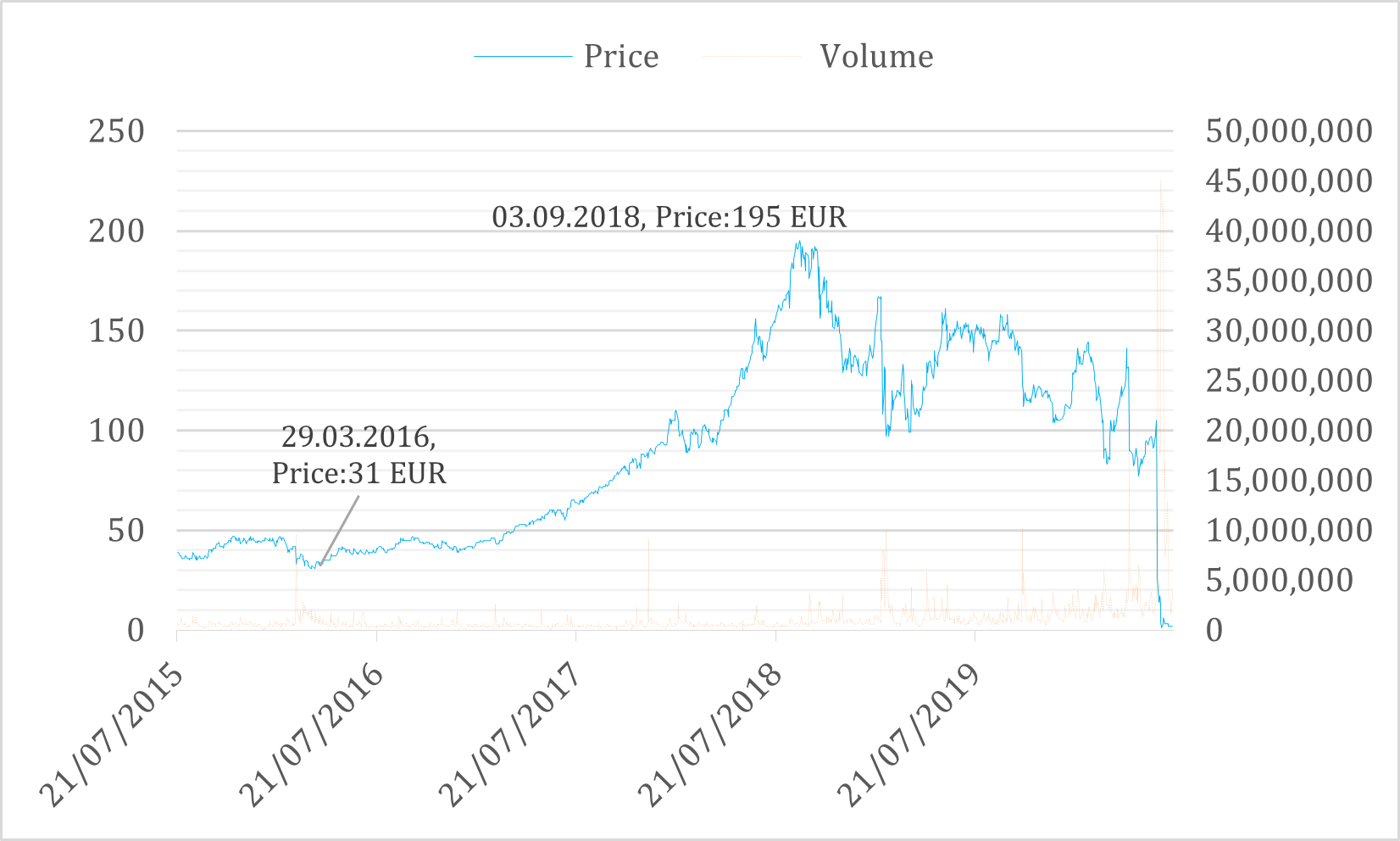

As shown in Graph 2, Wirecard’s share price had an upward trend with a steep slope until September 2018. By the beginning of September 2018, Wirecard’s share price approached € 200.

Wirecard’s share price movements indicate extraordinary performance and signal the need for close attention, particularly after 2017, by financial supervisors. However, being a FinTech company in the digital payment segment, which might be considered as a reasonable explanation for soaring prices, might have been a disregarding point for financial supervisors. This hypothesis addresses a dimension of our ‘white-collar fraud’ analysis below.

On June 25, 2020, the management board of Wirecard decided to apply for the opening of insolvency proceedings at the competent Munich Local Court due to the threat of insolvency and over-indebtedness.

Audit Opinions: Everything was Perfect for the Last Ten Years!

Wirecard had positive audit opinions about its financial statements and management reports until 2020 (for the year 2019). Wirecard, as the sole company, and the Wirecard AG Group submitted audited financial statements and management reports for the fiscal years 2009 up to and including 2018, which were published with an unqualified audit certificate by EY, an auditing firm. None of the audits led to any objections. The auditors neither mentioned nor addressed the issues raised in press reports about possible balance sheet manipulation.

Responses of the Federal Ministry of Finance and the Financial Supervisor, BaFin

According to Germany’s Federal Ministry of Finance (July 16, 2020), the measures taken by BaFin (the regulator) included the ongoing supervision of the subsidiary Wirecard Bank AG across the following areas:

- investigation of probable market manipulation and insider trading by market participants,

- investigation of probable market manipulation by Wirecard AG,

- fine of € 1.52 million imposed on Wirecard AG for the late submission of financial reports in 2019,

- initiation of balance sheet control at Wirecard AG by commissioning the responsible Financial Reporting Enforcement Panel (FREP) in 2019,

- consistent action against Wirecard AG after the detection of balance sheet problems by the KPMG special audit in April 2020.

Behavioral Bias, Corporate Governance and Financial Literacy

Pell (2020) asserts that the Wirecard AG case shows the behavioral biases that can be major drivers of investment missteps, particularly, ‘belief perseverance bias’ when people stick to their previously held beliefs despite contradictory information. FinTech is often spoken about in the context of ‘innovation’ and ‘disruption’, adding allure to FinTech companies (Pell, 2020). FinTech, as a buzz word, might induce financial investors to irrationally invest in FinTech related companies and assume that their performance will always be higher than market returns. Moreover, investors might assume that the country has a well-functioning financial supervisory system, and financial supervisors have perfect supervisory capacity.

As a behavioral finance matter, the FinTech ‘frenzy’ might have also beguiled national financial supervisors and politicians. Financial supervisors might see a rocketing FinTech company as a national economic success and have a bias against recognising ‘warning signs’.

Moreover, some countries impose hefty fines on other countries' companies operating internationally. There are some cases that international companies have been facing aggressive policies in foreign markets under national protectionism policies. These policies might trigger a vicious circle and deepen national protectionism and national bias in other countries. National protectionism policies might also gradually poison national financial supervisors and lead to inconsistent supervisory policies, for example, by disregarding red flags of home country's companies operating internationally.

Additionally, the negative interest rate environment increases the importance of dynamic sectors and fuels the irrational exuberance at capital markets, particularly in stock markets.

The Wirecard case also raises questions about corporate governance, one of the ESG components in sustainable finance. Until early 2019, Wirecard's board did not choose to create dedicated committees for audit, risk, and compliance (Pell, 2020). The size of the compliance team was about 0.4 percent of the workforce in 2019. HSBC, by comparison, had 2.6 percent compliance staff in 2017 (Pell, 2020). This picture was both a corporate governance failure and a red flag for financial supervisors.

The Wirecard case also addresses financial and digital literacy policies. Financial consumers should be aware of the fact that FinTech might be used as an alluring word to induce investors to invest in a company irrationally. In this regard, protective investment rules should always be promoted by governments, financial supervisors, SROs, and universities.

Implications of Digital Transformation for Financial Supervisors and White-Collar Fraudsters

We define asymmetric technology as a technological imbalance between two related groups. For example, in a school, students might be digital ‘natives’, familiar with the use of technological tools and technology such as smartphones, tablets, computers, and virtual reality to study and learn. On the other hand, teachers might not be familiar with technological tools and do not have any idea about how to use technology in teaching activities. In this case, asymmetric technology exists between teachers and students in this school. The rapid advancements in technology raise the problems mainly arising from asymmetric technology. Asymmetric technology between a private sector and a government sector also leads to serious problems in delivering governmental services, including supervisory ones.

Technological imbalance or asymmetric technology between financial markets or institutions and their supervisors is more dangerous than cyber-attack risks since cyberattacks are well-known risk types; hence there is considerable vigilance to develop shields against them (Zeranski & Sancak, July 2020). However, the lack of a well-functioning and holistic supervisory technology (SupTech) leaves many doors wide-open for detrimental technological transactions, financial scandals, FinTech crises, and their ensuing effects on an economy's financial stability. In other words, asymmetric technology is one of the most significant risks today. Therefore, having a digital financial supervisory system with a well-functioning, consistent, and holistic SupTech is one of the best risk management strategies in this regard (Zeranski & Sancak, July 2020).

Financial innovations are also the materials, and transformation periods are the perfect time frames, for potential financial fraudsters. The typical stories of new industries and technologies reveal the importance of innovation as the context for fraud and scandals in a broader sense (Driel, 2019). Outcomes of innovation are highly uncertain, which may indirectly lead to dubious financial practices (Driel, 2019). New financial instruments and products were a major type of innovation that facilitated or triggered dubious business practices (Driel, 2019).

Digital transformations are challenging and take time. The transition periods are perfect time frames for potential white-collar fraudsters since financial supervisors, in general, do not keep pace with market developments.

Since many countries are still struggling to cope with FinTech related risks, in light of our industry experience, we configured an ideal financial supervisory system for the digital world in a new article recently published by the Journal of International Banking Law and Regulation. In this article, utilizing some real-world cases, we configured essential elements of a digital financial supervisory structure, such as real-time and automated data collection, advanced data analytics, and a nation-wide SupTech system.

Conclusion

The relatively low pace of digital transformation by financial supervisors and the high speed of advancements in technology increase the technological gaps between supervisors and their supervisees and result in a new phenomenon named ‘asymmetric technology’. The ‘fog’ of the transition period, where new technologies have entered but regulators are yet to catch up, may be very conducive to potential white-collar fraudsters who plan to abuse their advantages in technology or the FinTech sector. Fueled by inconsistent supervisory approaches, national protectionism in reaction to trade wars, fierce competitions among national economies, and unattractive yields at money markets, potential white-collar fraudsters come up with great opportunities to abuse FinTech-related companies in capital markets. Therefore, the Wirecard AG case has multiple aspects and causes, not only one. Nevertheless, there are many parallels between the Wirecard story and new FinTech crises and FinTech related scandals in every economy, developing or developed ones.

Stefan Zeranski is a Professor in Business Administration with a focus on financial services and financial management at the Brunswick European Law School (BELS) and director of the ZWIRN-Research Center, Ostfalia University of Applied Sciences, Germany.

Ibrahim E. Sancak is a Professor of Finance and an Associate Member of the ZWIRN-Research Center, Ostfalia University of Applied Sciences, Germany, and the former director of the Capital Markets Board of Turkey.

OBLB categories:

OBLB types:

Share: