The Architecture of Decentralised Finance Platforms in the Post COVID-19 Era — A New Open Finance Paradigm

Posted:

Time to read:

During the COVID-19 pandemic a new consensus has emerged which castigates modern finance for its preponderance towards creation of excessive leverage and asset bubbles due to excessive borrowing, monoculture investments, intermediaries’ rent-seeking, and short-termism. As all this activity took place against a background of disappearing disposable incomes, it is not surprising that it also boosted inequality, especially between the asset rich and the asset light who have to borrow ever higher amounts of money to acquire those assets. A number of respected global fora have dedicated time and energy to discuss how the global economy can be reset and re-oriented. Yet, so far none of these valuable initiatives have tried to tackle the serious underlying weaknesses of global finance and the social costs they create.

The challenge is enormous. In its present state, global finance is broken and cannot be rebuilt by merely using the same tools that were used in the post-2008 era. In addition, it hardly contributes to the funding of the real economy especially when it comes to long-term infrastructure, socially responsible investing, the social market economy (eg, consumer credit and social housing), or the acceleration of divestment from fossil fuels. Therefore, as the issues the COVID-19 crisis raises are truly existential and not just related to the script of financial sector greed, the remedies should be structural, systemic and far-flung.

Agency costs are at the heart of the investment chain today and thus stand as a formidable obstacle to such transformation. Namely, while investors’ investment horizon is normally medium to long-term, intermediaries have a very strong preference to take a short-term view in order to both maximise commission income and boost short-term performance against their peers—the latter being the prevailing performance and compensation benchmark in the investment industry.

Accordingly, we see repatriation of investor control and market democratisation as ways to alleviate the disparity of interests between investors and intermediaries. At the same time, decentralisation is the only way to avoid the total domination of financial technology by today’s very large financial institutions that offer cutting edge infrastructure and the pending entry of gigantic technology firms (BigTech) into the space.

For investments other than cryptocurrencies and infrastructure other than decentralised payment systems, decentralised finance has been a blackbox so far. Therefore, our recent interdisciplinary paper ‘The Architecture of Decentralised Finance Platforms: A New Open Finance Paradigm’ attempts to supply a holistic model of decentralised finance on which integrated financial platforms based on the cooperate-and-compete model can be built and operate.

Arguably, given the rapid entry of large financial institutions and BigTech into the space (see eg, the HSBC-IBM partnership to create a proprietary AI-built set of equity indices), most of today’s financial technology firms (fintechs) may only survive the fee reductions and the huge size of distribution networks of their bigger rivals through co-existence on decentralised platforms utilising the cooperate-and-compete model. The platforms would offer them the distribution networks, liquidity, and drive to innovate that will be necessary for them to stay in the market.

We see decentralised platforms as capable to deliver three far-flung structural changes: democratisation, broadening of the tradeable assets’ base, and diversification of investment. In our research paper we argue that the evolving merger of payments technology with technology underpinning investment markets’ infrastructure will have a great impact on the supply mode of financial services.

Decentralised Open Finance Platforms – A New Market Paradigm

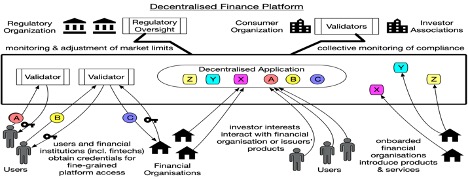

One-stop-shop multi-purpose and multi-asset platforms based on Distributed Ledger Technology (DLT) are bound to become a key characteristic of post-COVID-19 finance. Decentralised finance platforms can allow most appropriately licensed business to business (B2B) and business to customers (B2C) fintech firms and credit and investment markets to share operating costs and flourish through the platform’s market fora and distribution channels. The central idea is that smaller fintech firms would have a reliable framework to compete for business and cooperate in terms of platform governance and regulation. Network externalities might attract to the platform larger financial services providers but still these will supply their services on the basis of the same compete and co-operate model.

Decentralised open finance platforms can bring a radical transformation of the marketplace in three respects:

- markets will become less centralised;

- investment will become democratised since broader access and reduction of agency costs will bring a greater re-alignment between investors’ medium and long-term horizons with financial intermediary asset allocation strategies, consequently altering the composition of investment portfolios;

- finance will serve better socio-economic goals allowing the emergence of tradeable social market products.

To facilitate this transformation in this paper we offer a model of decentralised finance that goes far beyond the so-called ‘autonomous’ finance.

Decentralised finance can allow new types of asset markets, such as markets for social housing and other forms of social market investment, to emerge and thrive. For example, in our paper we offer a characteristic consumer credit use case which shows how decentralised platform-based open finance can both introduce competition in the market for low-grade consumer lending while maintaining their privacy. In addition, multi-asset platforms could boost liquidity in previously illiquid assets facilitating long-term/committed investment at the expense of today’s investment short-termism. At the same time, the platform’s lower admission fees and advantageous disclosure regimes for SMEs can facilitate small issuers’ access to equity capital.

Yet, the challenges brought about by increasing automation and integration in the supply of investment services are considerable, both at the regulatory and the technical level. A proactive approach is required to resolve the technical and regulatory tensions. Nonetheless, subject to some simplification, certain parts of regulatory rulebooks can be coded for the purposes of automating compliance. We explain how platforms can automate compliance with rules such as counterparty position limits, order and price limits for short-sellers and front-running prohibitions. Implementation of such automated controls would diminish the cost of regulatory monitoring and augment ex ante compliance.

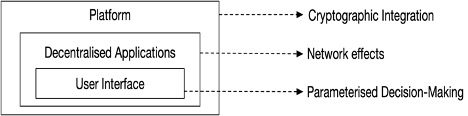

We identify three fundamental properties that will define decentralised finance systems. First, we utilise cryptographic integration as the foundation for the applications that will create a more open and competitive financial system. Secondly, we suggest that decentralised applications will give rise to positive network externalities removing the need for investment intermediation by large institutions, even at the investment origination level. Broadened access will lead to more pluralistic investment choices. In this context, we offer use case examples which underscore the potential of multi-purpose and multi-asset platforms to further socio-economic goals. Third, we use parametrisation to account for the pluralism of investor preferences that may go beyond risk and return to encompass social and ethical preferences.

Fig. 1 Architecture/Logic of Decentralised Finance Platforms

The integration of infrastructure and client interface into an accessible single multi-asset platform is not just the realm of financial and information technology. It will also require advancements in regulatory technology as well as the adaptation of private law, especially property law and the willingness of different jurisdictions to mutually recognise the licensing and operation of these platforms. Standardisation of consumer contracts will be another prerequisite to enabling decentralised platforms to operate on a cross-border or even global basis.

Automation of regulatory compliance and detection of wrong-doing on multi-purpose and cross-asset platforms based on effective ex ante operating algorithms and thorough ex post audit systems would be essential in order to stem fraud, front-running and other forms of abusive and illegal conduct. Thus, research should not just be directed into building up the next generation of blockchain algorithms, but also of multi-sensor systems that go beyond current artificial intelligence and machine learning methods and allow for real-time compliance as well as smart detection of compliance breaches.

The model of decentralised finance platforms we propose takes the concept of open banking a decisive step forward to achieve the above objectives. We suggest that policy-makers’ support for integrated decentralised platforms is the only realistic alternative to the present domination of the fintech space by gigantic financial institutions and the widely expected entry of BigTech which might choke competition. Similarly, we argue that integrated decentralised platforms are the most promising route to alter the investment industry’s narrow asset allocation practices whose fragility has been badly exposed by the COVID-19 pandemic.

Emilios Avgouleas is the Chair in International Banking Law and Finance, University of Edinburgh.

Aggelos Kiayias is the Chair in Cyber Security and Privacy, University of Edinburgh.

OBLB categories:

OBLB types:

Share: