There is a widespread belief that the governance of banking supervision affects financial stability. Recent reforms that followed the Great Financial Crisis, as the establishment of the Single Supervisory Mechanism in Europe and the Prudential Regulatory Authority in the UK, reflect this idea. However, while existing research identifies the pros and cons of having either a central bank or a separate agency responsible for microprudential banking supervision, the advantages of having this task shared by both institutions (shared supervision) have received considerably less attention.

In a recent Bank of England Working Paper, I fill this void by comparing empirically the impact of three supervisory governance models—supervision by the central bank, by an agency or by both of them—on bank non‑performing loans (as a share of total gross loans). To do so, I introduce a new database on the governance of banking supervision in 116 countries from 1970 to 2016. The findings of this work lead to two considerations. First, shared supervision can improve financial stability as it deters supervisory capture. Second, supervisory governance per se does not affect financial stability, but is effective only depending on the country-specific context. This short article summarises how I reach these conclusions.

There are at least three reasons for which we should care about shared supervision. First, existing comparisons between supervision by a central bank and an agency, which overlook the case of shared supervision, led to mixed empirical results (eg Goodhart and Schoenmaker 1995; Dincer and Eichengreen 2013), leaving unclear which supervisory model works best for financial stability (Koetter et al 2014). Second, even if the majority of countries has a central bank as sole supervisor (see page 10 of the paper), in other important economies, such as Germany and China, banking supervision is shared between the central bank and an agency. Third, the theoretical literature argues that shared supervision prevents against the risk of capture of regulators and supervisors from the private sector. With two supervisors, banks would need to double their effort to take control over supervision (Laffont and Martimort 1999 and Boyer and Ponce 2012) compared to the costs of capturing a single institution, be it the central bank or another agency. If this is true, the debate should not focus on whether supervision should be given to the central bank or an agency, but whether it should be given to the central bank and an agency.

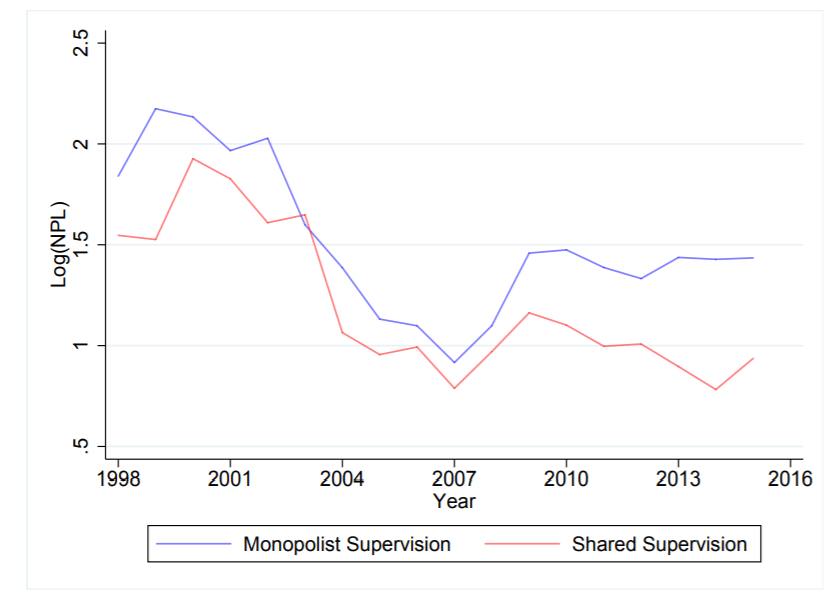

A captured supervisor can be detrimental for financial stability, as it incentivises banks to take over more risks for two complementary reasons. First, a captured supervisor is more lenient in evaluating banks’ health. Second, banks may expect the captured supervisor to rescue them in case of distress regardless of their solvency, increasing banks’ moral hazard. We therefore expect non-performing loans (NPLs), which are a proxy for financial instability, to be higher when supervision is not shared. Descriptive evidence suggests that this might be the case. Figure 1 shows that NPLs are lower when supervision is shared rather than when it is in the hands of a single supervisor. Panel data regressions support this hypothesis: across the three governance models, the coefficient of shared supervision is the only one negative and significant, indicating that NPLs are lower under this arrangement.

Figure 1: Median NPLs under shared supervision (red line) and under non-shared (‘monopolist’, blue line) supervision (ie supervision by the central bank or an agency only).

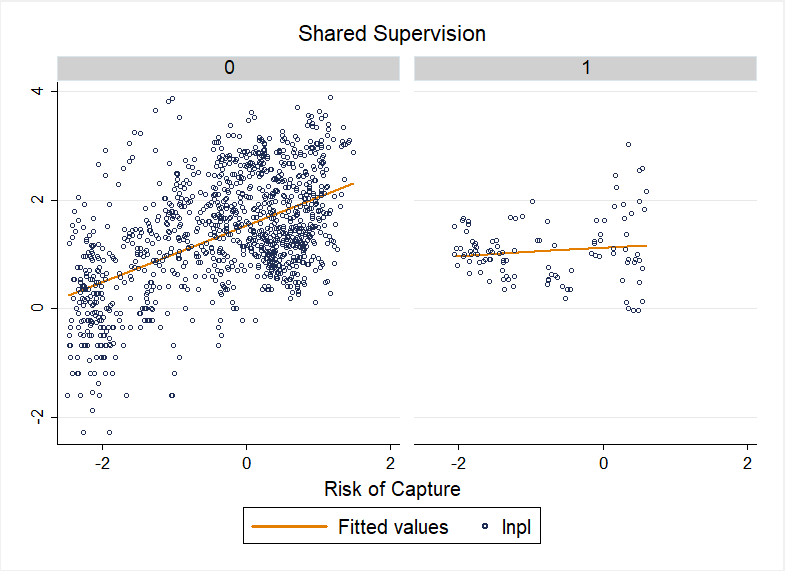

There is however a second element that the theory on governance and supervisory capture highlights. Supervisory governance is not effective per se, but depending on the context to which it is applied. In other words, shared supervision should be associated with better financial stability outcomes only in those countries where there is a risk of supervisory capture. This means that in those countries where corruption is lower, shared supervision may have no any impact on financial stability. Figure 2 summarises this idea, showing that NPLs increase with the risk of capture in countries where supervision is not shared (left panel), whereas this relationship is weaker where supervision is shared (right panel).

Figure 2: The relationship between NPLs and shared supervision under different degrees of risk of supervisory capture

Note: The figure plots log NPLs (y-axis) against risk of capture (x-axis) in countries with non-shared (left-panel) and shared (right-panel) supervision. The fitting lines show that, as the risk of capture increases, the level of NPLs is higher in countries where supervision is not shared (positively sloped fitting line); on the other hand, when supervision is shared, the risk of capture does not affect the share of NPLs (horizontal fitting line). Risk of capture is the inverse of the variable ‘Control of Corruption’ of the Worldwide Governance Indicators database.

The results of panel data regressions provide evidence in support of this hypothesis. The interaction between shared supervision and risk of capture (proxied by the variable ‘control of corruption’ from the Worldwide Governance Indicators database) is negatively and significantly correlated with NPLs, even after controlling for a number of macroeconomic and financial factors as well as country- and year-specific fixed effects.

In conclusion, this paper suggests that supervisory governance could have an impact only depending on the institutional setting in which they are implemented. Institutional factors, such as the risk of capture in a country, are able to influence the effectiveness of supervisory governance in keeping the banking system stable. If policy-makers want to address reforms in the governance of banking supervision, they should be aware that the success of their efforts will be conditional on the existing political economy setting in which the reform is undertaken.

Nicolò Fraccaroli is a Postdoctoral Research Associate at Brown University.

A version of this post appeared originally on the Bank of England’s ‘Bank Underground’ blog, and is available here.

OBLB categories:

OBLB types:

Share: