Banning Cassandra from the Market? An Empirical Analysis of Short-Selling Bans during the Covid-19 Crisis

Posted:

Time to read:

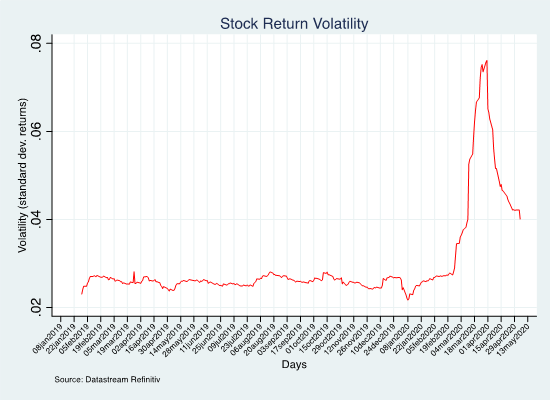

With the recent outbreak of the COVID-19 pandemic, there has been an unprecedented shock in worldwide supply and demand caused by the imposition of various lockdown measures to prevent human-to-human contagion. These measures have led to an extraordinary increase in economic uncertainty, followed by an inevitable capital market crash. In March 2020, stock markets were down 25% compared with January 2020. Volatility was also extremely high: in Europe, the VSTOXX, the implied volatility of EURO STOXX 50 Index options, closed at 86% on March 16, 2020, its second highest daily close ever. Figures 1 and 2 show the average trend in stock market return and volatility, respectively, in the sample countries.

Figure 1: Sample countries’ index returns

Figure 2: Sample countries’ stock return volatility

In this turbulent economic scenario, market regulators have considered whether to restrict or ban short selling or to enhance disclosure requirements. France’s financial market regulator, the Autorité des Marchés Financiers (‘AMF’), banned short selling in 92 specified equities for a one-day period, beginning on March 16, 2020 and ending on March 17, 2020. So did the Commissione Nazionale per le Società e la Borsa (‘CONSOB’), the governmental authority of the Italian stock market, by introducing a temporary ban on taking or increasing net short positions in respect of 85 companies’ shares admitted for trading on the Mercato Telematico Azionario (‘MTA’), the Italian regulated stock market. Similar actions were taken by the relevant authorities in Spain, Belgium, Greece, and Austria. In these countries, short-selling bans have been viewed as a possible tool to curb the adverse consequences on stock market liquidity and investors’ confidence. However, although subject to a similar economic scenario, other European countries, such as Germany and the United Kingdom, did not ban short-selling. All bans expired or were lifted on May 18, 2020. The purpose of our study is to examine whether the temporary short-selling bans in the EU during the COVID-19 crisis have achieved the market supervisors’ goals and, more generally, if similar bans are effective and desirable. Our conclusion is that they have are not.

Methods

Using a sample of listed market securities from 14 EU countries and the United Kingdom during the period from January 24, 2020 (the date of the first confirmed COVID-19 case in the EU) until May 18, 2020 (when bans were lifted), we examine the effects of these short-selling bans on market quality. The table below shows the distribution of daily observations of market securities during this period across countries and short-selling status (ban vs no ban).

We employ several measures to assess the market quality effects of short-selling bans. First, we use abnormal returns, measured as the difference between firm i’s actual stock return and its expected return—estimated based on the return of the entire market—on day t. Abnormal returns measure the unusual performance of a stock compared with the overall market performance on a particular day. Consequently, abnormal return captures the idiosyncratic effect of industry- and firm-specific events on a firm’s equity value, beyond a firm’s systematic effect as proxied by overall market performance. We examine the liquidity effects of short-selling bans using two additional measures: (1) bid-ask spreads and (2) the Amihud illiquidity measure. Bid-ask spread is defined as the difference between the highest price a buyer is willing to pay for a security and the lowest price a seller is willing to accept. The larger the difference between price bid and price ask, due to information gaps between sellers and buyers on the transaction date, the larger the information asymmetry. Amihud measures the price response associated with one euro of trading volume. To exemplify, the smaller the trading volume required to change the price by one cent, the more illiquid the stock.

Results

Using a staggered differences-in-differences (diff-in-diff) research design and controlling for the stringency of country daily lockdowns, volatility and firm fixed effects, we find that banned securities significantly underperform non-banned stocks. We also find that information asymmetry was significantly higher during the banning period. Finally, we find that the liquidity of banned stocks decreased as compared with the same banned stocks in the non-banning period and to stocks in countries that did not impose bans. Collectively, the findings suggest that banned securities are: (1) not performing better, (2) exhibit wider spreads and (3) are less liquid than those in comparable jurisdictions that are not subject to short-selling restrictions. These results hold after matching for stocks in the same industry, of similar size and governance structure. The overall evidence indicates that over the longer term short-selling bans may undermine the confidence in European financial markets, something that will be vital to European recovery from the profound economic shock caused by COVID-19.

Our paper is available here.

Professor Marco Ventoruzzo is head of the Department of Legal Studies ‘Angelo Sraffa’ at Bocconi University

Gianfranco Siciliano is Assistant Professor of Accounting at the China Europe International Business School (CEIBS)

OBLB types:

Jurisdiction:

Share: