The increasing use of financial technologies (FinTech) by market participants has fostered a discussion among public authorities on the use of similar technologies for regulatory (RegTech) and supervisory (SupTech) purposes. Innovative technologies could also be applied to crisis resolution, i.e. the use of one or more resolution tools by a public authority to manage the failure of banks and financial firms in an orderly way. However, the features and market dynamics of resolution differ from those of RegTech and SupTech: there is little market incentive for the private sector to foster innovation in the area of crisis resolution. That is mainly due to two reasons: first, crisis management is the duty of public authorities; second, financial firms have little incentive to plan for crises.

Our paper ‘ResTech: innovative technologies for crisis resolution’ defines the concept and the scope of ResTech (‘resolution technology’). ResTech is the application of innovative technologies (i) to support the work of resolution authorities in developing resolution plans and in resolving banks and financial firms and (ii) to allow financial firms to achieve regulatory compliance and better risk management in an effective and automated manner.

There is a case for ResTech. Supervisors generally lag behind innovations developed by market participants. Internal ratings-based models are one tangible example of this phenomenon applied to credit risk management. Counterparties’ creditworthiness assessment is an evergreen challenge in banking. Thus, market participants developed sophisticated internal credit-scoring models, which have subsequently been endorsed by regulators.

We argue that the drivers for developing innovations for supervisory purposes are distinct from those of crisis resolution. Given the lack of private sector incentives to invest in R&D on how to resolve a firm’s crisis, resolution authorities are called on to do it. One example from the early 2010s was the introduction of bail-in, which, as opposed to public bailouts, limited banks’ moral hazard by ensuring that losses are first borne by their shareholders and creditors.

We identify four main areas of ResTech:

- Technology supporting resolution planning activities;

- Technology supporting the execution of resolution actions;

- Technology supporting the cross-border exchange of information to coordinate global resolution actions;

- Technology supporting financial firms’ cooperation with resolution authorities enhancing compliance with resolution regulation, policies and decisions.

The ResTech Framework

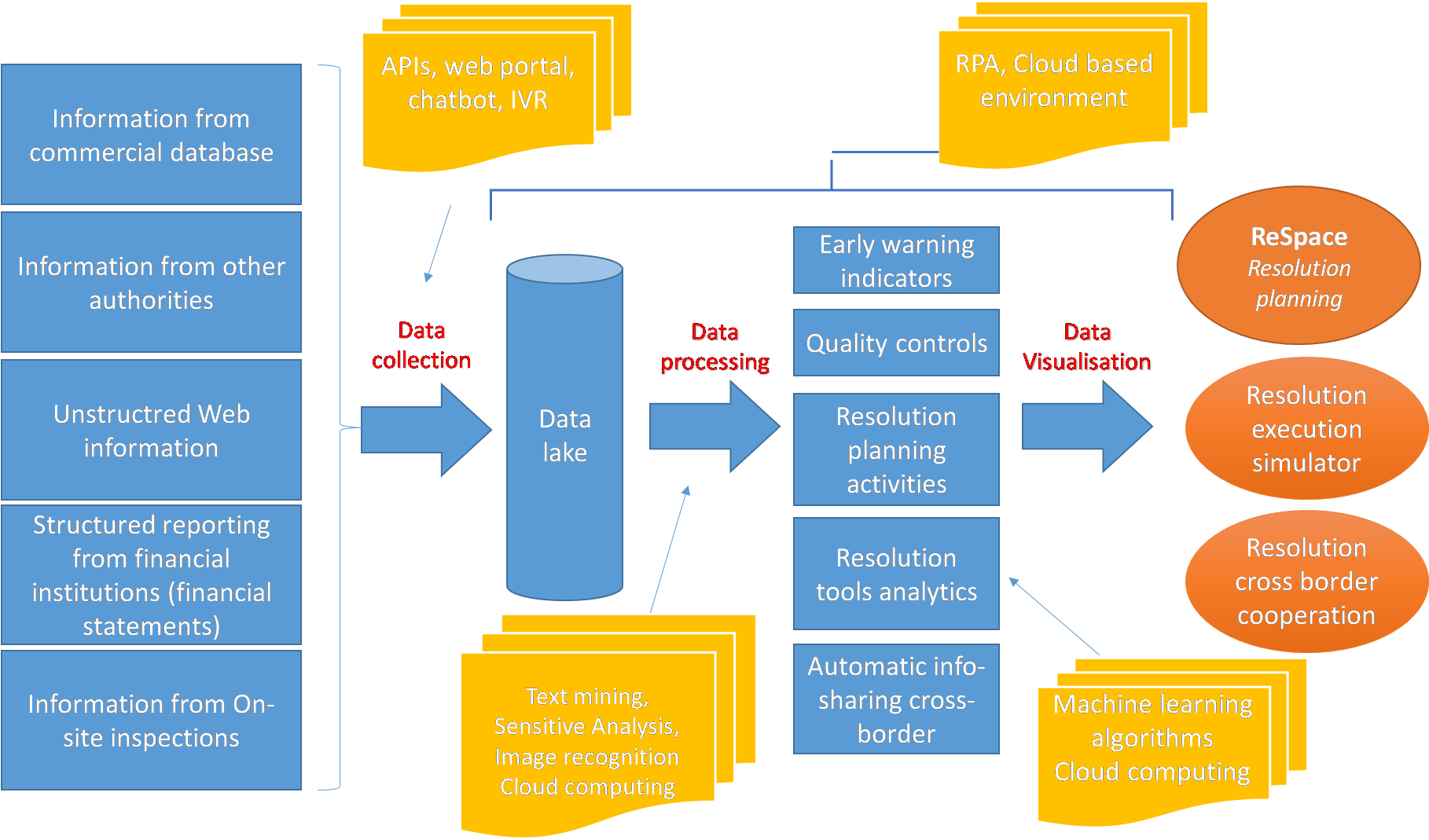

The ResTech toolbox relies on state-of-the-art big data architecture and technologies. Resolution authorities may develop from data warehouses to data lakes, which enable the collection of structured reporting and unstructured web-based information. Collected data are processed in cloud computing environments and robotic process automation systems. Machine learning algorithms support the analytical work underpinning the definition of early warning indicators and the calibration of the resolution strategy that best minimises the negative externalities of a crisis at any given point in time.

ResTech uses a virtual resolution space (ReSpace) and a resolution simulator (ReSimulator). In ReSpace, the resolution plan becomes a cloud-based work environment. Data regularly flow from authorities and from firms to the resolution authority’s data lakes and are consolidated in ReSpace, with automated quality checks. For each planning activity, users can view the underlying input data and any applicable law provisions and policies. In ReSimulator, machine-learning algorithms define the optimal uses of resolution tools at any given point in time, for example by tailoring bail-in execution to the firm’s balance sheet features.

Financial firms may ultimately benefit from the use of ResTech applications for compliance purposes. Machine-readable solutions, such as regulatory radars, automatically scan legislation, official communications and authorities’ websites to capture publicly available regulatory developments.

ResTech achieves better results in a technologically neutral environment. Technology may enhance domestic and cross-border cooperation between authorities. For instance, the drawing up of resolution plans for cross-border financial groups and the execution of coordinated resolution actions across jurisdictions could use algorithms that process information on the financial firms concerned and on the legal frameworks in which the global resolution strategy would be executed.

Notwithstanding the promising aspects of ResTech, its adoption by resolution authorities might not be a sufficient answer to all existing challenges. In a digitalised environment, resolution authorities would need to set up IT infrastructures and e-governance processes that prevent increased operational, cyber, reputational and legal risks. Further multidisciplinary research is necessary to assess the benefits of ResTech against its risks. One avenue to start addressing these challenges could be to gather the relevant actors and stakeholders together to work on a common taxonomy for ResTech. The next step could be to work on international standards on RegTech and SupTech, while at the same time shaping ResTech tools to reflect the specificities of financial firms’ crises resolution. In this regard, policy makers and resolution authorities are the best placed to foster innovation.

Giuseppe Loiacono is a bank resolution expert at the Single Resolution Board and Adjunct Professor in financial markets and regulation at SciencesPo Paris.

Alessandro Mazzullo is a senior data scientist at Eni Group.

Edoardo Rulli is a bank resolution expert at the Single Resolution Board.

The post is written in the authors' personal capacity and does not purport to represent the views of their respective employers.

OBLB categories:

OBLB types:

Share: