As Covid-19 spreads through all continents, its economic significance becomes undeniable. With a predicted global gross domestic product (GDP) plunge, governments rush to provide a quick response to bolster liquidity, give households and businesses hope and calm the markets. Yet, chances are that despite various governmental interventions, millions of jobs will be lost, and many small and medium enterprises will close their doors for good.

In these uncertain times, entrepreneurs are probably asking themselves: what are the consequences for start-up fundraising? Should I, by any means, adapt my strategy to approach an investor? Is it the best moment? How will VCs react? Can I even get funding in the foreseeable future? What should I expect?

Any attempt to anticipate how the VC industry will look like post Covid-19 is solely tentative, as we still face a lot of unpredictability. The following analysis, however, drawing on expertise shared by industry experts, will try to shed some light and provide guidance for start-ups for the upcoming months.

First, if founders are seeking financing, they need to be fully aware that the dynamics of doing a deal will be different from what they were just a few weeks ago. As theory and evidence show us, under conditions of rising skepticism, one could expect a shift in deal terms towards an allocation of control rights that is more VC-centered and thus less entrepreneur-friendly, diverting from what was becoming mainstream, notably with serial entrepreneurs.

Secondly, VCs will be more focused on spending time and effort with their portfolio companies and assist them to navigate these uncharted waters. This means that a lot of effort will be put into helping their start-ups with restructuring their business plans and budgets and dealing with burdensome personnel decisions. In many cases, portfolio companies might need fresh cash infusions and, especially if raising debt is not an available option (which is true for most early-stage start-ups), their investors might need to come up with internal, bridge rounds.

We believe less money will be deployed into new ventures, as VCs raise the bar to write term sheets. We expect them to still be moving with those that have been vetted and where investment rounds have been successful. However, all VCs will be more reluctant to take new ones, unless they offer a truly novel business model, human capital or solution that might trump all the risks. As uncertainty mounts, VCs will demand more visibility to invest and will be more selective about the business model, the execution team and understanding how (and if) the business is going to survive this challenging period—as one Silicon Valley VC put it, he will take into account the 'resilience and self-awareness' of the entrepreneur. New Enterprise Associates, one of the largest venture capital firms, has already urged the companies it backs to consider alternative funding strategies including lines of credit, according to the FT. The majority of VC firms will buckle down and attempt to wait out Covid-19 and its immediate aftermath.

Some might argue that it was time to shake the start-up industry, as there is a plenty of dry powder—somewhere around $2.4 trillion, as per Pitchbook’s most recent data. Limited Partners (LPs) seemingly lost value in a substantial amount of their investments, especially in public equity due to massive selloffs. Hence, they have a reduced total asset value and, consequently, despite maintaining their original private markets target allocation (in terms of %), they have a reduced dollar amount available to match capital calls (the 'denominator effect'). Thus, calling capital on LPs right now has a relevant impact, especially if they need to liquidate other positions at deep discounts to be able to meet those calls. We should note, however, that some analysts believe the risk of the denominator effect is mitigated because many LPs are currently under allocated to private markets, as well as there is a deeper and more developed secondaries market for those LPs that need liquidity, in contrast to what was the case for example in the post-global financial crisis. Therefore, they expect to be some pullback in fundraising but not a dramatic downturn.

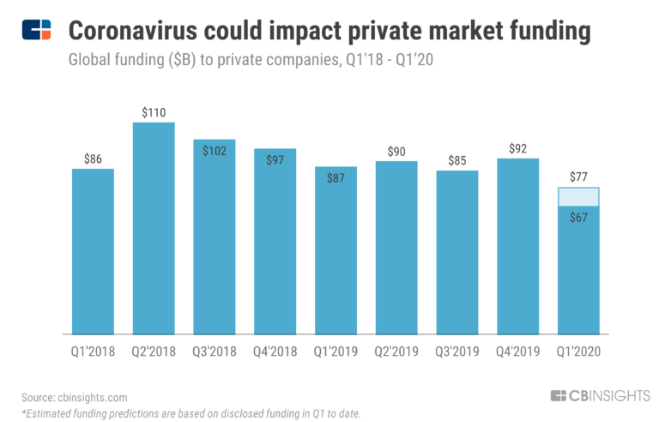

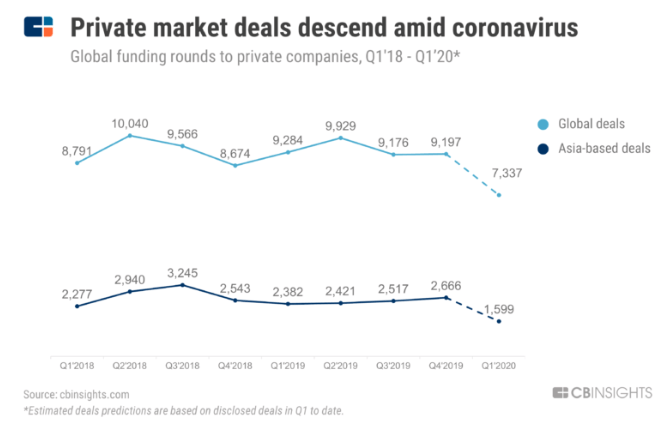

Our impression is supported by CB Insights data, projecting a decline in Q1 2020 that will be 'the second steepest quarterly decline in the past ten years', as well as an acute drop in deal flow:

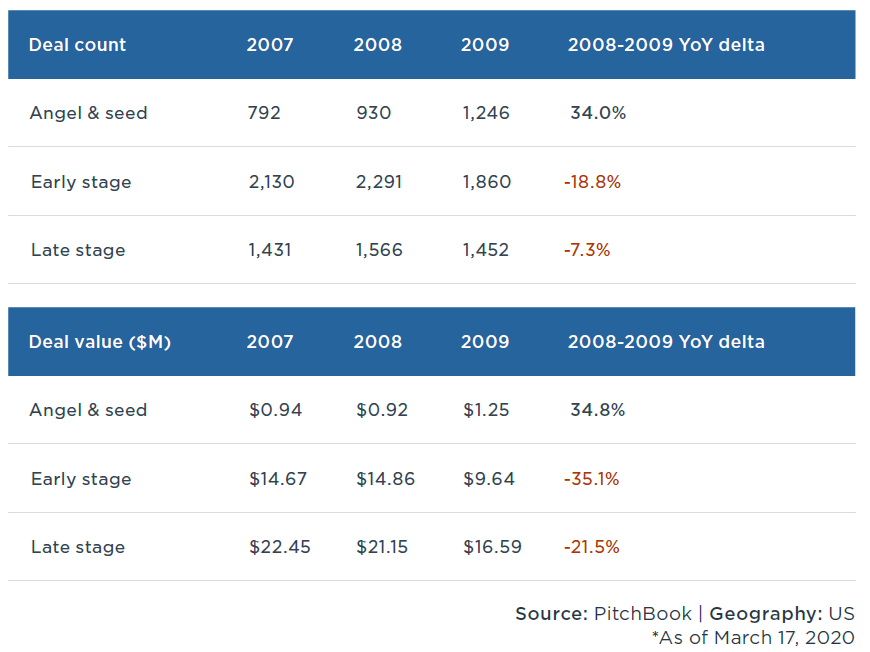

Pitchbook, on the other hand, expects Q1’20 deal flow to be largely unaffected, especially because deals that were announced ie in March were negotiated or consummated prior to the Covid-19 fallout. The next quarters of 2020, however, are set to exhibit a decline in total deal volume, in line with what we have seen in the aftermath of the global financial crisis of 2007-2009, the difference being that the angel and seed ecosystem is much more developed now, hence we should not expect a similarly significant uptick on those deals:

Another point worth noting is that exit volumes are likely to experience a dip, either because strategic M&A and secondary buyouts, especially leveraged ones, will be more scarce or because investors will be less welcoming to new initial public offerings. The latter would be an ominous thermometer to the overall VC industry activity. Another effect on the VC’s business practices is the prolongation of the time between vintages and extended holding periods, with investors hesitant to accept discounts and lower exit multiples. VC firms took an average of three years between raising new funds in 2019, according to Pitchbook data. However, with Covid-19, we can expect return to four or more years as it was before 2014.

So, what are the take-aways and the playbook for entrepreneurs that need to raise venture capital in the forthcoming term?

Considering the advices some VCs are reportedly giving their portfolio companies, entrepreneurs should preserve cash, stress test and adjust their balance sheets and business models to survive the Covid-19 threat, even if it means temporarily putting the aggressive growth playbook on the shelf. As revenue drops, many of them will face a decline in cash-flow profile that cannot be offset by cost reductions without fundamentally hurting the business. Once resources are not available through private or public banks or government-supported revolving credit lines, raising equity is the natural way to get through this. Yet, this equity might come at a very high price. Alternatively, we may see a new form of financing for early-stage start-ups. After the 2008-2009 crisis, crowdfunding emerged out of nowhere. There are already a few new initiatives that bring new short-term options to the table.

Early-stage start-ups should weigh the need for raising equity against the risks of a down round, bearing in mind the possible outcomes of antidilution provisions and reputational damage that might come along with it. As such, we figure venture debt will play an important role. Increased information asymmetry and uncertainty will cause later-stage valuations to see some haircuts as well, notably when compared to what happened in the past years, possibly creating a blind spot as parties will have more difficulty to agree on pricing and risk assessment. Emergent-country entrepreneurs face an additional problem, as most currencies are now severely undervalued against the dollar (the Brazilian Real, for instance, is down roughly 25% from early January 2020). Hence, 2019-dollar valuations will now probably make no sense, pushing for price adjustments in ongoing transactions and painful valuation discussions in new ones.

On the other hand, the journey of Covid-19, as it moves from one continent to another, might also be indicative for VC funding. In February 2020, despite Covid-19 causing severe damage to the Chinese market, we have seen various investments going through and new funds being raised in Europe and in the United States. This suggests that now, as the table is turning and the Chinese market aims to quickly revamp, some Asian VC firms will be looking into investing in start-ups in other continents. Based on confidential discussions with investment advisers, Chinese VCs and financial institutions are already preparing their capital for start-ups in aerospace, military, IT, healthcare as well as security. We should closely follow the battle for Reliance Jio and other investments into European and American unicorns.

In conclusion, it is still a blurry landscape as we are only scratching the surface of Covid-19’s implications for VC funding and overall economic activity, meaning it will only be possible to assess its impact on start-up fundraising over the coming quarters of 2020. This, however, should not prevent entrepreneurs from quickly adopting survival strategies, reflecting on their business models, questioning assumptions about their businesses, and, if they really need to raise equity in the shortcoming term, preparing for a 'new normal' in terms of deal dynamics or powerful Asian investors.

Alexandra Andhov is an Assistant Professor of Corporate Law in the Center for Private Governance at Faculty of Law, University of Copenhagen.

Raphael Andrade is a doctoral candidate in Corporate Law at the University of São Paulo. He is a Brazilian attorney and a founding partner at Andrade Chamas Advogados, heading the corporate practice.

OBLB types:

Share: