Regulating tail risks: When and how prudential regulation should apply to shadow banking

Posted:

Time to read:

Shadow banking – now labeled as non-bank financial intermediation (NBFI) by the Financial Stability Board (FSB) – maneuvers outside of the realm of prudential banking regulation. NBFI entities often refinance themselves through the wholesale market. Risks from leverage coupled with liquidity and maturity transformation are equally present in NBFI like in traditional banks. Therefore, NBFI also requires backstops, which frequently the regulated banking sector provides. These conjunctions allocate tail-risks–i.e. risks of very unlikely but severe events that cause decisively negative turns on the markets – at banks and, ultimately, their public safety nets. Yet, access to public backstops distorts investors’ incentives, dulls market discipline, and allows for risk-insensitive funding of shadow banking (Adrian and Ashcraft (2012)). Therefore, it is pivotal that financial intermediaries who benefit from (indirect) access to public safety nets are also subject to prudential regulation, which counterbalances these negative inventive effects. In our paper, we provide a promising route to regulating and supervising NBFI efficiently in this context.

Focusing on economic substance and risk structure

What should regulators do? They should analyze the allocation of tail-risks involved in the transactional structures of NBFI. For instance, banks pre-crisis carried the tail risks of securitization transactions, although these transactions provided relief from regulatory capital requirements, because the securitized loan portfolios were held by off-balance sheet vehicles and banks’ liquidity facilities were treated as low risk-weight exposures. Such a differential treatment of economically equivalent transactions based on formal discrepancies invites regulatory arbitrage. Therefore, we argue for a normatively charged approach to prudential banking supervision (Tröger (2016)) that focuses on the economic substance and the risk structure of NBFI transactions rather than on their specific legal form. It capitalizes on the fundamental insight that the overarching policy objectives that underpin prudential banking regulation are the same that drive the regulatory intervention in NBFIs. Shadow banks that ultimately unload tail-risks on to public backstops should be regulated like banks. This would automatically level regulatory cost structures of functionally equivalent transactions and would take away undue competitive advantages derived from a lighter regulatory burden. On the other hand, the approach would still permit more efficient forms of financial intermediation. Therefore, the approach would impede regulatory arbitrage and enable welfare enhancing innovation.

Multipolar regulatory dialogues

Yet, how can supervisors effectively analyze financial innovations and their risk-allocating characteristics? We argue, that supervisors have to determine the ultimate risk structure and scrutinize whether these structures imply tail-risks for public backstops. The burden of proof greatly facilitates the challenge for supervisors. In order to escape prudential regulation, market participants need to show that the risk structure of their transaction does not burden public backstops with tail-risks.

To understand the pivotal features of NBFI, i.e. the risk structure of financial innovation, we suggest multipolar regulatory dialogues (Thiemann and Lepoutre (2017)). These dialogues bring together regulators, semi-public gatekeepers like lawyers and auditors, and market participants. Efficient supervision of NBFI requires the monitoring of the production processes of financial innovations. Particularly, learning about the negotiations that the regulated conduct with semi-public gatekeepers in an effort to pre-determine the regulatory treatment of new products is central.

Regulators – who lack in-depth understanding of recent advances in transactional practices – and regulated institutions – who lack certainty about the pending decisions of the regulator’s treatment of financial innovations – have strong incentives to communicate candidly about product developments. To achieve the goal of overcoming mutual information asymmetries, successful discourses require trust and honesty from both sides, which should be present if such dialogues are based on a proper do ut des.

The important role of semi-public gatekeepers

Auditors, rating agencies, and lawyers play an important role. These gatekeepers are private but their services affect public interests directly as gatekeepers verify regulatory compliance. Moreover, they are involved in designing financial innovations that formally comply with the legal framework and achieve regulatory advantages at the same time. Therefore, regulators may achieve a deeper understanding of relevant innovations in communications with gatekeepers.

Obviously, incentives to ensure that regulated institutions and gatekeepers voluntarily provide relevant input are important. To create adequate motivations, supervisors have to help overcome the uncertainty in the regulatory treatment of specific forms of NBFI. Beyond this carrot, regulators have to hold the regulated and the gatekeepers accountable for their information sharing behavior. In the event of misconduct, regulated institutions and gatekeepers may be excluded from the interpretative community and therefore lose the benefit of reduced uncertainty.

Credit funds as an illustration

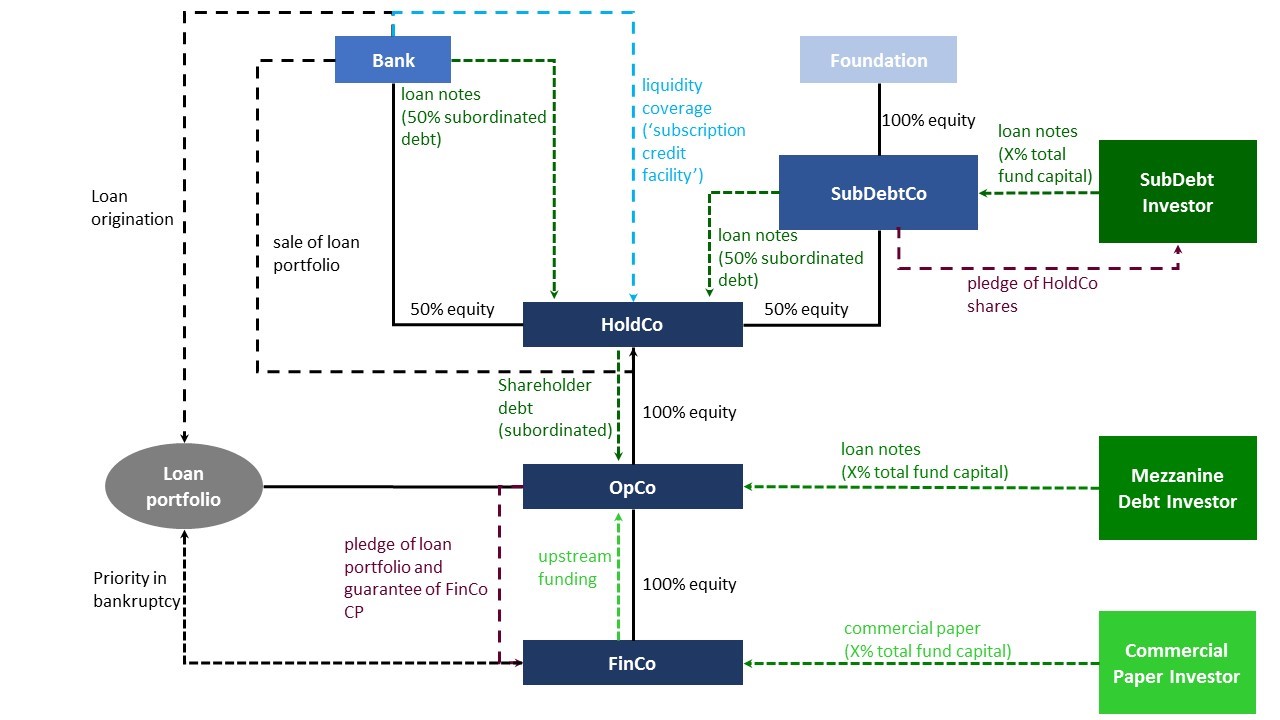

To illustrate the potential benefits from our approach, we use the recent contractual innovations at European credit funds. Supervisors in the EU embraced the basic structure of these funds as an alternative channel for credit that does not conjure up severe perils for financial stability (see Figure 1).

Figure 1: Basic transaction structure of European credit funds.

Over time, however, these funds have morphed to complex structures that use higher leverage ratios to increase the profitability of their business (see Figure 2). As a consequence, fewer assets are available to service more debt, which makes the sudden exit of investors more likely and thus, increases the run risks. To counter these fragilities, funds now establish relationships with banks that make it conceivable that public backstops assume the tail-risks investors are unwilling to bear.

Figure 2: Advanced transaction structure of European credit funds.

Supervisors should prevent structures that only become viable because they benefit from access to public safety nets without paying the price of complying with prudential regulation. From this perspective, supervisors should look deeper into the transactional design and contractual arrangements of credit funds. Only supervisors engaged in intense regulatory dialogues with the regulated and gatekeepers may be able to do so, in order to arrive at informed and socially beneficial decisions.

Matthias Thiemann is an Assistant Professor for European Public Policy at Sciences Po, Paris.

Tobias Troeger is a Professor of Civil Law, Commercial and Business Law, Legal Theory at the Goethe University Frankfurt/Main.

OBLB categories:

OBLB types:

Share: