Noncompete agreements, which prevent employees from going to work for competitors or starting competing businesses, have become pretty common: 38 percent of workers have at some point signed a noncompete agreement with an employer, according to University of Maryland’s Evan P. Starr and University of Michigan’s J. J. Prescott and Norman Bishara. The Huffington Post reports that even the sandwich maker Jimmy John’s requires employees to sign noncompetes.

But while noncompetes raise investment significantly, they also measurably hamper entrepreneurial activity, according to Chicago Booth’s Jessica S. Jeffers.

Jeffers surmised that noncompetes could shed light on the declining start-up rate of new businesses in the United States, including those in high-tech sectors. To investigate, she obtained de-identified data from LinkedIn on its users’ employment histories, which she mined to see when employees switched companies. Jeffers matched these data with state-level changes in the legal enforceability of noncompetes, specifically eight changes implemented between 2008 and 2014, six of which made it easier for companies to enforce these agreements.

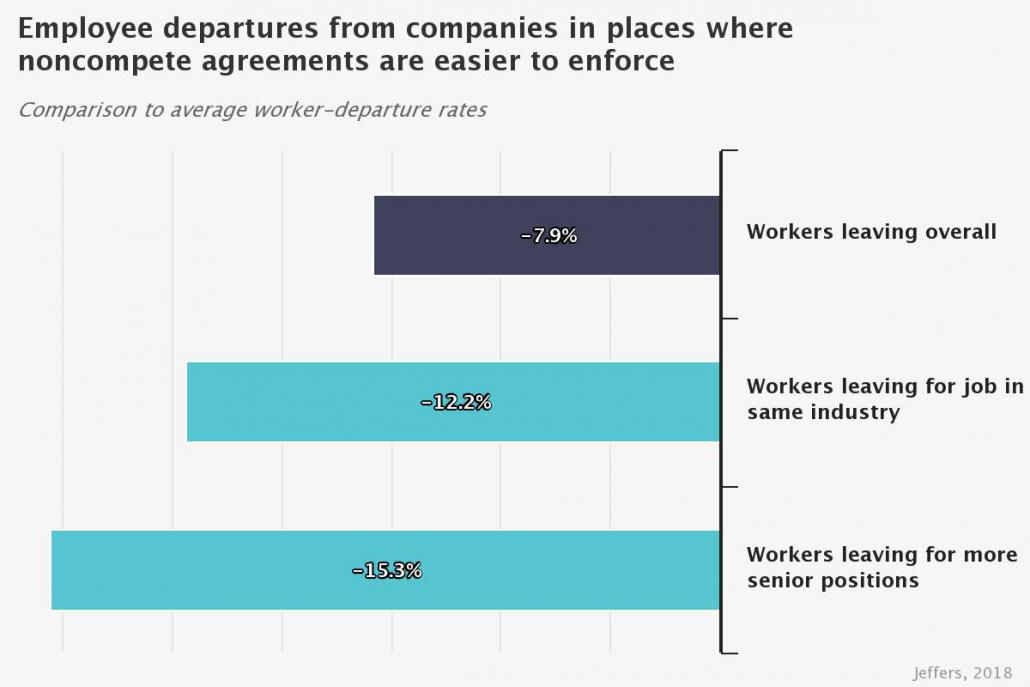

When noncompetes became easier to enforce, 12 percent fewer workers left their companies to take other jobs within the same industry, she finds.

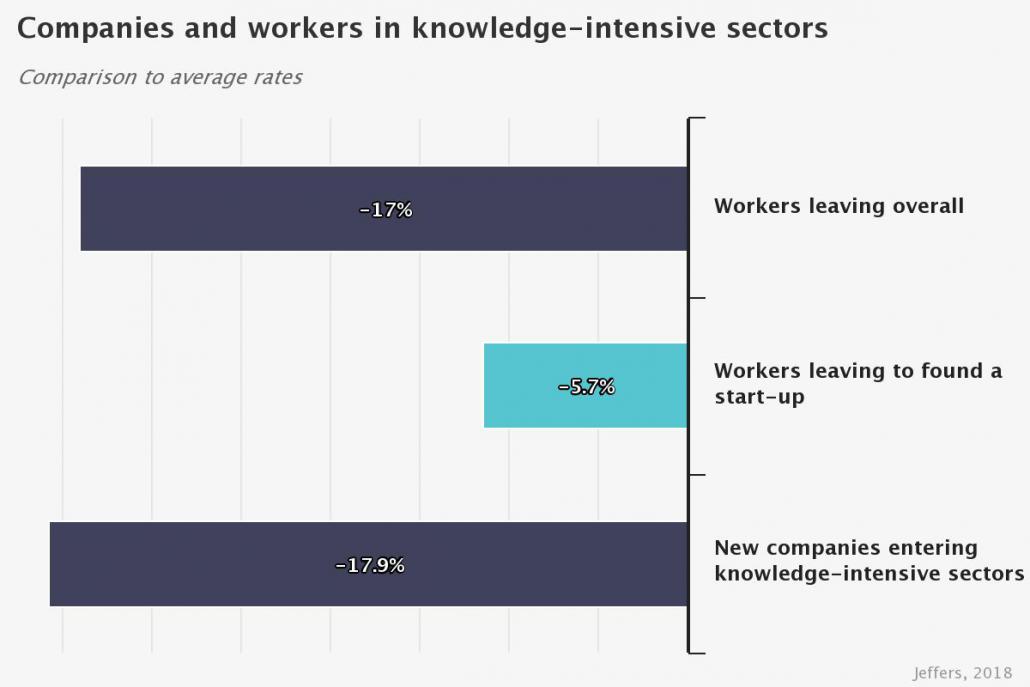

Increased noncompete enforceability also led to fewer employees leaving for more senior positions—a decline of 39 basis points, or 15 percent, relative to the average departure rate. Perhaps most importantly, the number of employees leaving for start-ups dropped as well, and in turn the number of companies entering knowledge-intensive sectors such as technology and professional services declined by an estimated 18 percent.

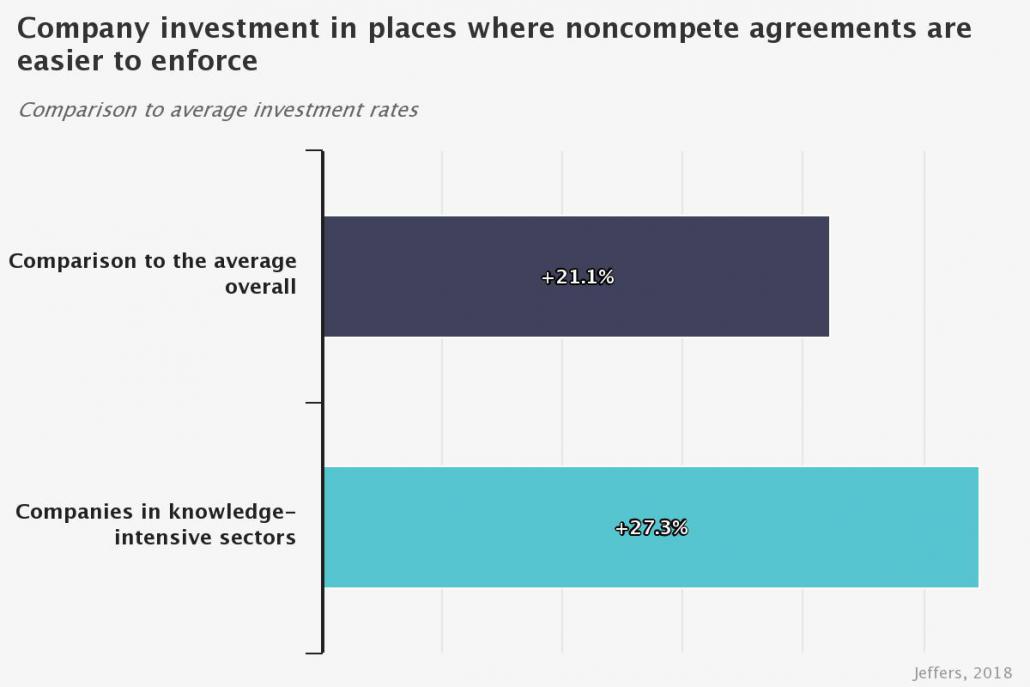

By contrast, noncompetes significantly boosted investment at large, existing companies. Jeffers finds that stronger court enforcement consistently led publicly held companies to make bigger capital investments. The companies in Jeffers’s sample increased investment by $6,000 for every $100,000 of net capital—while companies with a high proportion of skilled employees (those most often targeted by noncompetes) increased investment by $10,000 for every $100,000 of net capital.

‘These results point to an important trade-off between encouraging the entrance of new firms on the one hand and investment at existing firms on the other hand’, she notes.

Jeffers’ Stigler Center Working Paper is available here.

This article originally appeared in the Chicago Booth Review. Reprinted with permission on promarket.org – the blog of the Stigler Center at the University of Chicago Booth School of Business.

Share: