In a recent study, The Rise of Corporate Governance, we put forward and apply a quantitative metric for assessing the increase in the importance of and attention to corporate governance over the past two decades.

Prior work has attempted to quantify the increasing attention to corporate governance in public companies by investigating the use of governance terms by 'outsiders' —researchers, media reporters, and shareholders. By contrast, we study and quantify the attention to corporate governance by public companies themselves.

In particular, we study the universe of annual proxy statements issued by S&P 500 companies. The annual proxy statement is the critical document that public companies issue to report to shareholders on all matters that the SEC has deemed important for shareholders to know about when making voting decisions at the annual meeting. We begin our analysis in 1994 because this was the year in which the SEC Edgar website started to make all public filings available in an electronic form. Using a Python program, we were able to review the vast number of proxy statements issued by S&P 500 companies during this period.

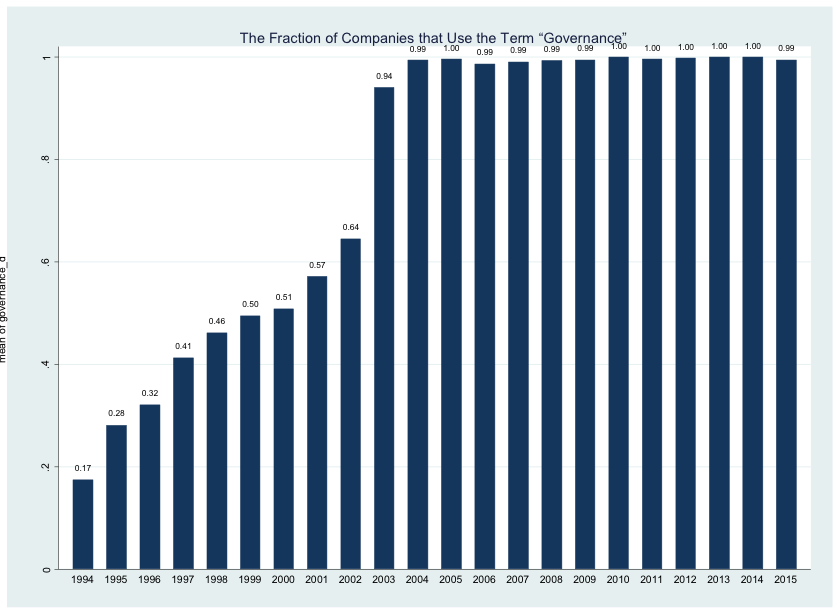

We document a dramatic increase in the use of the term governance. (We also obtain similar findings for the term corporate governance.) The percentage of companies that use the term governance increased from below 20% to close to 100%. Furthermore, among companies using the term, the average number of mentions per page increased eightfold—from 0.10 to 0.82. The dramatic increase that we document was concentrated during 1994–2004 – with especially steep increases in 2003 and 2004 after the 2002 passage of the Sarbanes-Oxley legislation following the Enron and Worldcom scandals – and the use of governance terms has remained at a high level since then.

We conclude by suggesting three alternative explanations for the documented rise in governance discourse by public companies. We discuss the different implications that each explanation has for the quality of corporate governance arrangements in place. We also identify testable predictions that would enable researchers using our metric to test and distinguish among these explanations.

Below we provide several figures that vividly illustrate the patterns that our study identifies. Figure 1 displays the change in the percentage of S&P companies that used the term governance in their proxy statement. In 1994, at the beginning of our period, only 17% of the companies used the term governance. By the end of the period, this term became ubiquitous, with practically all companies using it in the company’s proxy statement.

Figure 2 displays changes in the intensity of use of the term governance by S&P 500 companies that used this term in their proxy statement. For such companies, the bar graph in Figure 2 displays the evolution of the average number of mentions of the term governance. In 1994, at the beginning of the period, the average number of mentions was only 3. By the end of the period, however, the term governance was used an average of 68 times—an increase of over 2,200%.

The large increase that Figure 2 indicates might not wholly reflect an increase in the relative importance of corporate governance issues in the proxy statement. It might also be driven, at least partly, by an increase over time in the length of the proxy statement. Indeed, we document that the average length of the proxy statement more than doubled during the period we examine. To take this issue into account, we analyzed, for companies that used the term governance, the average number of mentions per page of the proxy statement. The bar graph in Figure 3 shows the evolution of this variable. From 1994 to 2015, the average per page number of mentions of governance went up from 0.10 to 0.82 (ie, from once every 10 pages to once every 1.2 pages). As in prior bar graphs, the steepest increase took place following the SOX legislation. Note that, once results are presented in terms of per page mentions, statements over time, the increase in the per page number of mentions had largely taken place by 2004, and this variable then largely plateaued with a slight upward trend.

Finally, Figure 4 shows that the patterns we identify are not driven by a few select industries. The Figure displays charts of the average per page number of mentions of governance plotted for each of the eight Standard Industry Classification (SIC) industry sectors that have significant representation among S&P 500 companies. We see a similar pattern for all eight groups: a dramatic increase in the average per page number of mentions during 1994–2004, with plateauing at a high level afterwards.

Alon Bebchuk is a Data Science intern at the Columbia Law School Data Lab, and Robert J. Jackson Jr. is Professor of Law and Director of the Program on Law and Policy at Columbia Law School.

OBLB categories:

OBLB types:

Share: