The issue

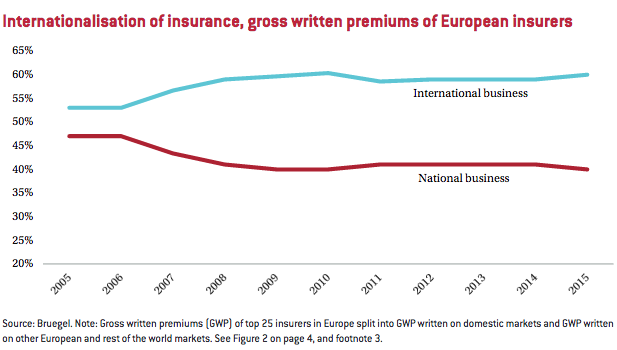

The full entry into force at the start of 2016 of the European Union’s Solvency II risk-based capital framework for insurance poses new challenges for supervisory cooperation in Europe. Supervisory challenges are present in terms of both management of systemic risk and day-to-day supervision. The common vulnerability of insurers to market risks, in particular the current low interest rate, is a source of systemic risk, and while supervisors might cooperate in day-to-day supervision, cooperation, such as exchange of information and coordinated action, can run less smoothly in times of crisis. Furthermore, risks are present in the context of a European insurance sector that is highly integrated, with a large and rising share of cross-border business.

The policy challenge

The European Insurance and Occupational Pensions Supervisory Authority ('EIOPA') currently plays a coordinating role in supervision, with final authority remaining with the national supervisors. A more centralised role for EIOPA in a European insurance union would overcome the fragmentation in supervision and ensure a joined-up view of the large cross-border insurance groups, enhancing the effectiveness of supervision. However, a staggered approach can be followed in a move towards insurance union. In the first stage, EIOPA can be given the authority to foster supervisory convergence. Ultimately, EIOPA would be given direct powers to supervise significant insurance groups, within a network of national insurance supervisors.

This post is based on a policy brief that can be found here.

Dirk Schoenmaker is Professor of Banking and Finance at the Rotterdam School of Management, Erasmus University Rotterdam, a Senior Fellow at the Brussels-based think tank Bruegel, a Research Fellow at the Centre for European Policy Research (CEPR), and a member of the Advisory Scientific Committee of the European Systemic Risk Board at the ECB.

OBLB categories:

OBLB types:

Share: